Funding Report for September 2022

What happened last month in the alternative investment markets? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last year? We look at numbers reported to P2PMarketData in September 2022 and dive deeper into this month’s focus: the largest P2P markets in Europe.

About the monthly report

In the monthly funding report, we publish the funding amounts of online alternative investment platforms. We track data from 64 participating platforms, operating in 21 markets and 7 different currencies. Please note that:

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms' publicly available loan books and statistic pages.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

You can check out the whole dataset at p2pmarketdata.com, and explore alternative investment opportunities in the Investment Search Tool.

Key highlights: What happened last month in alternative investing?

After a period of decline, the market rebounded this month. We recorded a total funding volume of €403m in September 2022 – an increase of 21% compared to August 2022 (up from €332m). The total monthly funding volume in September 2022 was lower by €35m compared to the same time in 2021.

Looking at funding across the main investment categories, most funding in September 2022 went to platforms offering consumer investments (€199m), followed by business (€111m), and property investments (€86m). Business lending and property lending increased by 116% and 15% respectively, while consumer lending recorded no change compared to August 2022.

Platforms’ performance: How did the key players do in September 2022?

Opyn funded the most loans in September 2022, followed by Mintos and PeerBerry. Overall, the five largest platforms accounted for 54% of the total funding volume recorded in our database, while the ten largest platforms funded 70% of the total volume. The largest players were most likely to be direct marketplace lending platforms (5 out of 10) come from Latvia (2 out of 10) and offer consumer investments (6 out of 10).

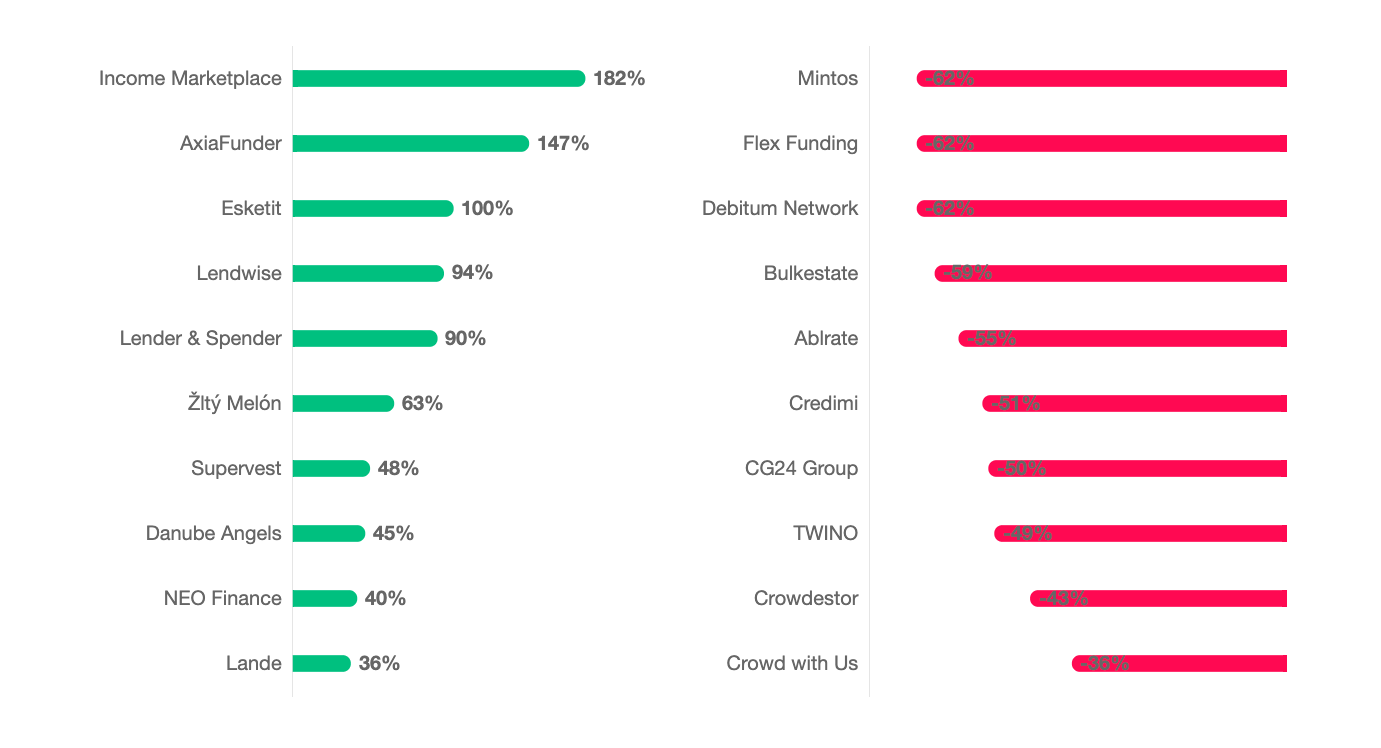

Income Marketplace – a resale marketplace lending platform from Estonia, offering consumer investments, has been the fastest growing platform in the last year, followed by AxiaFunder and Esketit. The “rising stars” were most likely to be direct marketplace lending platforms (5 out of 10), come from United Kingdom (2 out of 10) and offer consumer investments (6 out of 10).

Debitum Network, Flex Funding and Mintos have performed the worst compared to the previous year. Overall, the declining or slow-growing platforms were most likely to be direct marketplace lending platforms (6 out of 10), come from Latvia (3 out of 10) and offer business investments (5 out of 10).

*We only take into account platforms with a total funding volume higher than €1 million.

Finally, we reported several noteworthy milestones reached last month:

- Lender & Spender has funded more than €100m worth of loans since its inception.

- October has reached over €800m of total funded loans to date. Congrats!

Deep dive: Largest P2P markets in Europe

At P2PMarketData, we started publishing a series of investment guides for some of the world’s attractive markets. So far, you can read about investing in the UK, Switzerland, Canada, France, the Netherlands, Spain, and Australia. But what about P2P lending? How do different European markets compare in terms of volumes and growth? Which are the most prominent and dynamic markets in Europe for alternative investments? They’re not easy questions, given the inherent scarcity of data in the sector.

When we look at historical funding volumes in our database (i.e., all loans funded up to date), Latvia takes credit for almost half of the originated loan volume. However, a vast majority comes from a single P2P lending giant – Mintos (€8.3 billion out of €9.4 billion funded in Latvia). Other countries home to international resale platforms (Estonia and Croatia) also score high in our dataset. At the same time, we might underestimate the size of the more “traditional” markets with more “national” lending platforms. For example, according to Cambridge Centre’s for Alternative Finance Second Global Alternative Finance Market Benchmarking Report, Italy, France, and Germany were the largest markets in continental Europe.

With the recent decline of Mintos, the Latvian share in the European lending scene drastically decreased. In contrast, the Italian lending market continues booming, taking over as the largest loan originator in the first three quarters of 2022. This hardly comes as a surprise, though. Already back in July 2021, we wrote about the exponential growth of lending in Italy, and in March 2022, we saw Opyn overtaking Mintos as the largest platform in our dataset. The remaining countries in the top five show much less variation.

Interestingly, it also seems that the growth of P2P lending is not limited to several large markets but is broadly distributed, with some smaller markets quickly catching up. The fastest-growing markets (comparing 2022 and 2021) include Denmark (+214% year-on-year), Ireland (+125%), and the Netherlands (+120%). At the same time, however, we’ve noted significant declines in several big EU countries such as Germany (-32%) and Poland (-19%). We wrote about the underperformance of the Polish P2P lending sector back in January 2021.

As the database becomes more diverse, our statistics will become more representative to be able to make more rigid cross-country comparisons. Stay tuned for more insights, and don’t forget to check out our new investment educational content!