The Monthly Funding Report: March 2022

What happened last month in the crowdfunding and marketplace lending markets? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last year? We look at numbers reported to P2PMarketData in March 2022 and dive deeper into this month’s focus: an update on the impact of the Russian invasion of Ukraine on marketplace lending.

About the monthly report

In the monthly funding report, we publish the funding amounts of online crowdfunding platforms. We track data from 76 participating platforms, operating in 24 markets and 9 different currencies. Please note that:

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms' publicly available loan books and statistic pages.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

You can check out the whole dataset at p2pmarketdata.com, and explore even more alternative investment platforms using our platform inventory!

Key highlights: What happened last month in crowdfunding?

A slowdown in the crowdfunding market continues as funding volumes have decreased for the third consecutive month. We recorded a total funding volume of €526m in March 2022 – a decrease of 2% compared to February 2022 (down from €537m).

Looking at the longer term, the sector has grown by 42% over the past year, at a 2.1% average monthly growth rate. The total monthly funding volume in March 2022 was higher by €47m compared to the same time in 2021.

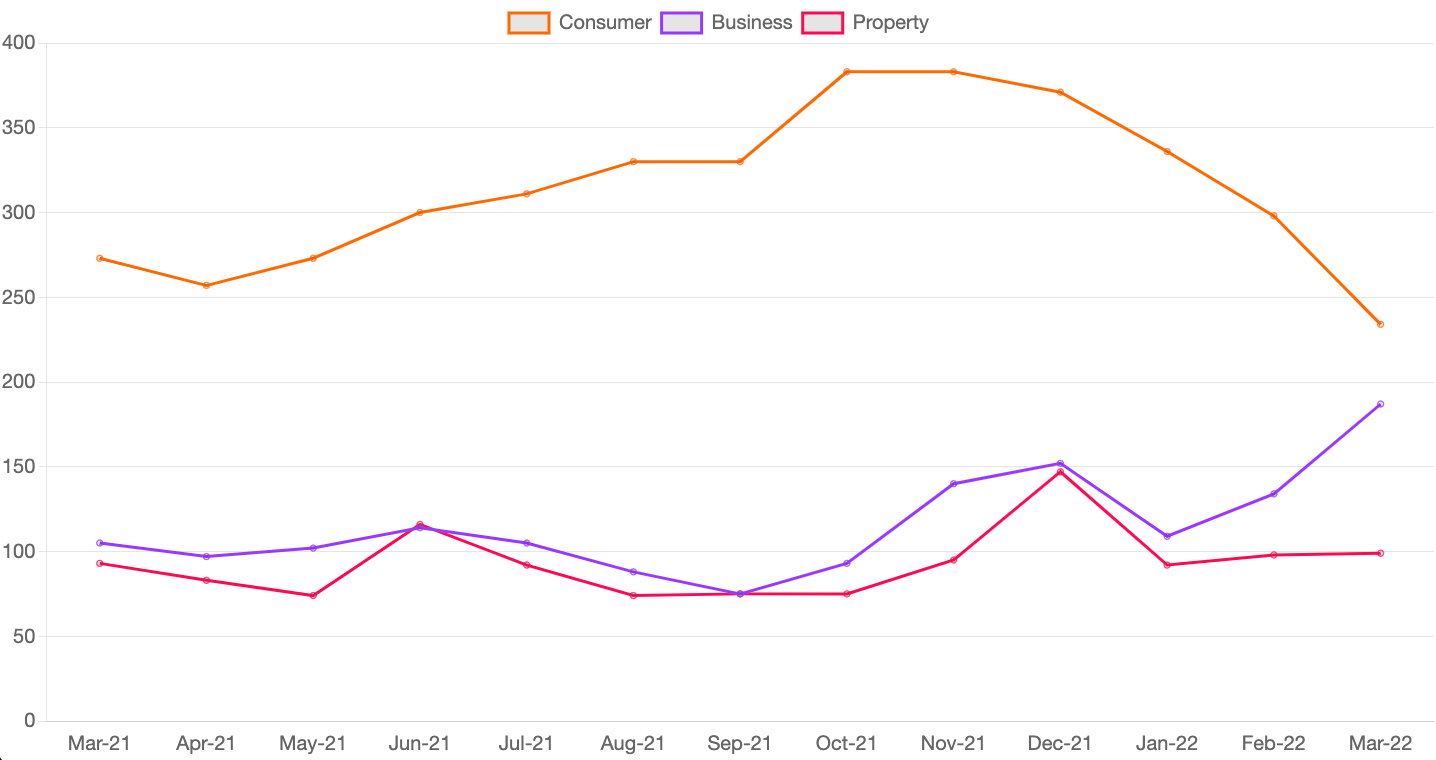

Looking at funding across the main investment categories, most funding in March 2022 went to platforms offering consumer investments (€234m), followed by business (€187m), and property investments (€99m). Business lending and property lending increased by 39% and 1% respectively, while consumer lending decreased by 22%, compared to February 2022.

Platforms’ performance: How did the key players do in March 2022?

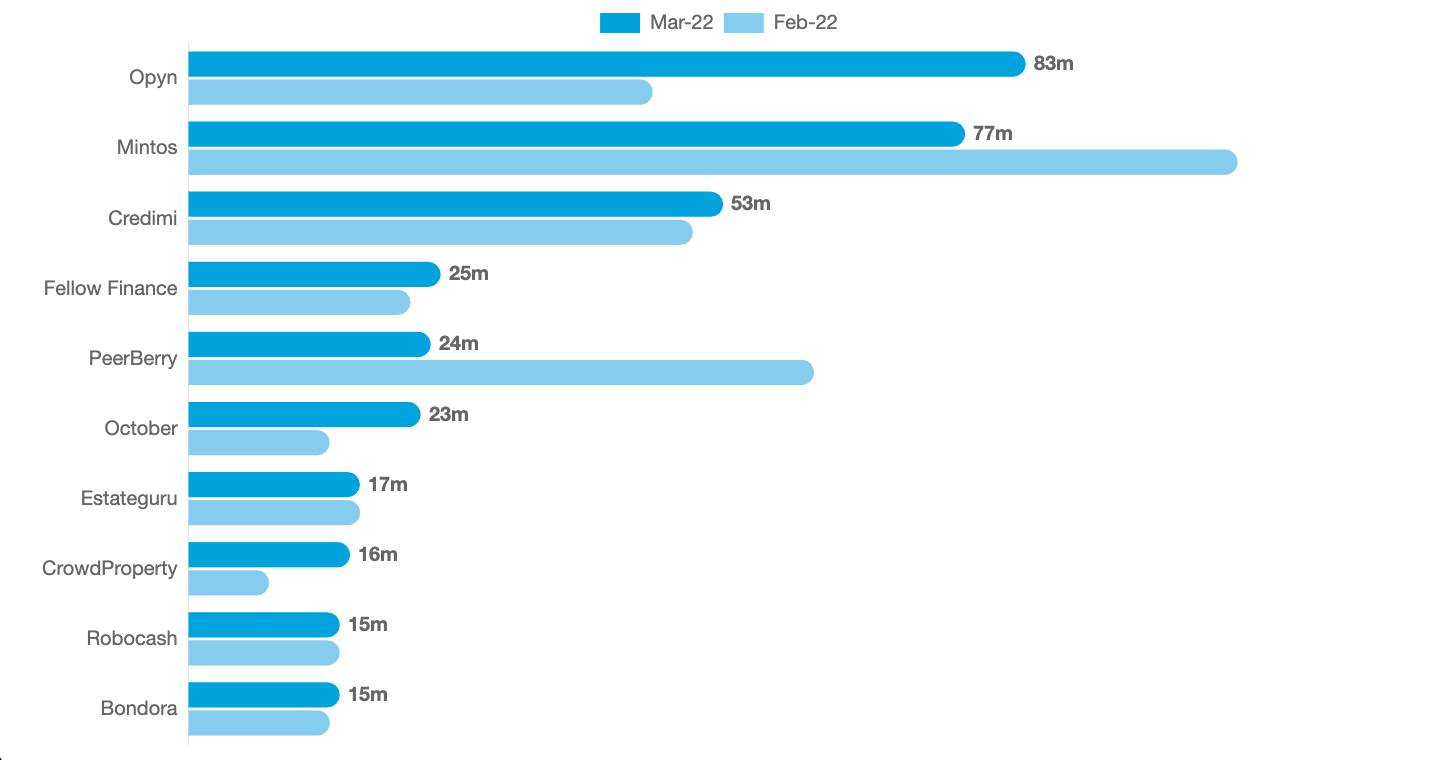

Opyn funded the most loans in March 2022, followed by Mintos and Credimi. Overall, the five largest platforms accounted for 50% of the total funding volume recorded in our database, while the ten largest platforms funded 66% of the total volume. The largest players were most likely to be direct marketplace lending platforms (7 out of 10) come from Italy (2 out of 10) and offer consumer investments (5 out of 10).

Esketit – a resale marketplace lending platform from Ireland, offering consumer investments, has been the fastest growing platform in the last year, followed by Afranga and Max Crowdfund. The “rising stars” were most likely to be direct marketplace lending platforms (6 out of 10), come from Ireland (2 out of 10) and offer consumer investments (4 out of 10).

Viventor, Housers and Finansowo have grown at the slowest rate. Overall, the slowest-growing platforms were most likely to be direct marketplace lending platforms (7 out of 10), come from Latvia (2 out of 10) and offer business investments (4 out of 10).

*We only take into account platforms with total funding volumes higher than €10 million.

Finally, we reported several noteworthy milestones reached last month:

- Kuflink has funded more than €200m worth of loans since its inception.

- Robocash has crossed the €400m total funding threshold.

- Opyn has broken above the €700m mark.

- Credimi has reached over €2b of total funded loans to date. Congrats!

Deep dive: The impact of the war on marketplace lending – Part 2

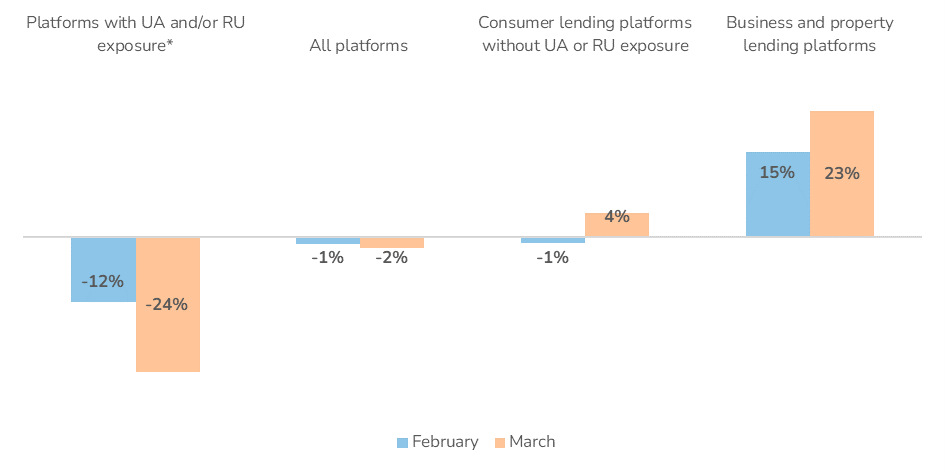

In the last monthly report, we drew the first conclusions stemming from our data on how the Russian invasion of Ukraine might change the European marketplace lending scene. We pointed to decreases in consumer lending volumes, particularly for platforms exposed to Russian or Ukrainian markets. In March, this trend has only accelerated. Platforms exposed to war-affected markets saw their funding volumes plunge by, on average, 24% month-to-month. At the same time, business (and, to some extent – property) lending platforms are enjoying robust growth, and even consumer lending (excluding war-affected platforms) has picked up. It is tempting to speculate that investors are simply redirecting their P2P investments away from the troubled platforms to those they consider safer, particularly EU-focused business loans.

*These are: IUVO, Mintos, PeerBerry, Robocash, and Twino.

Although we cannot be sure of its long-term impact, the war can potentially redraw the map of the EU marketplace lending scene. Two of the largest European platforms – Mintos and PeerBerry have been hit most severely. For the first time in our monthly report series – since July 2020 – Mintos lost its position as the largest marketplace loan funder in Europe as its monthly funding volumes dropped from €124m in January to €77m in March. PeerBerry recorded an even greater outflow of investments this month, despite its strong commitment to repay the war-affected loans within 24 months, using the Group’s reserves and profits from other “healthy” loan companies.

| February | March | |

|---|---|---|

| Peerberry | -11% | -61% |

| Mintos | -19% | -26% |

| IUVO Group | -6% | -20% |

| Twino | -8% | -17% |

We have said several times, including in our recent State of the European marketplace lending after Covid article, that business and real estate would likely become the leading marketplace lending segments. We have not anticipated that Opyn would take over Mintos as the largest loan originator as soon as the first quarter of 2022 though! Is this just a one-time anomaly or a marking point in the P2P landscape? We will continue to follow the market dynamics with our up-to-date statistics, which, we believe, are proving more valuable than ever in times of change and uncertainty like now.