The Monthly Funding Report: July 2021

What happened last month in peer-to-peer lending and real estate crowdfunding? Which platforms are on the rise and which ones are falling behind? How has the sector performed over the last 12 months? We take a look at numbers reported to P2P Market Data in July 2021 and dive deeper into this month’s special focus: the exponential growth of peer-to-peer lending in Italy.

About the monthly report

In the Monthly Funding Report, we publish the funding amounts of real estate crowdfunding, peer-to-peer & online marketplace lending platforms. We currently track data from 69 participating platforms, including originators operating in 24 markets and with 9 different currencies. Please note that:

- The statistics exclude some prominent platforms such as Lending Club, Funding Circle, Credimi and Prosper, which do not accept retail investors and remain open only for institutional and corporate investors.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms’ publicly available loan books and statistic pages.

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

P2PMarketData’s broader strategy strives towards a more trustworthy and automated dataset and more integrated and high-quality service in close cooperation with the key European and global peer-to-peer platforms. That’s why, this month, we’ve continued a clean-up of our database, delisting further eight platforms that had been failing to comply with our requirements concerning timely and reliable data reporting. We’re also launching version 2.0 of the P2PMarketData’s website with more functionalities, detailed and reliable information about P2P lending sites and deeper integration with the platforms through API. We’ll continue to improve and expand the site’s new features and you will be able to check it out very soon!

Key highlights: What happened in P2P finance last month?

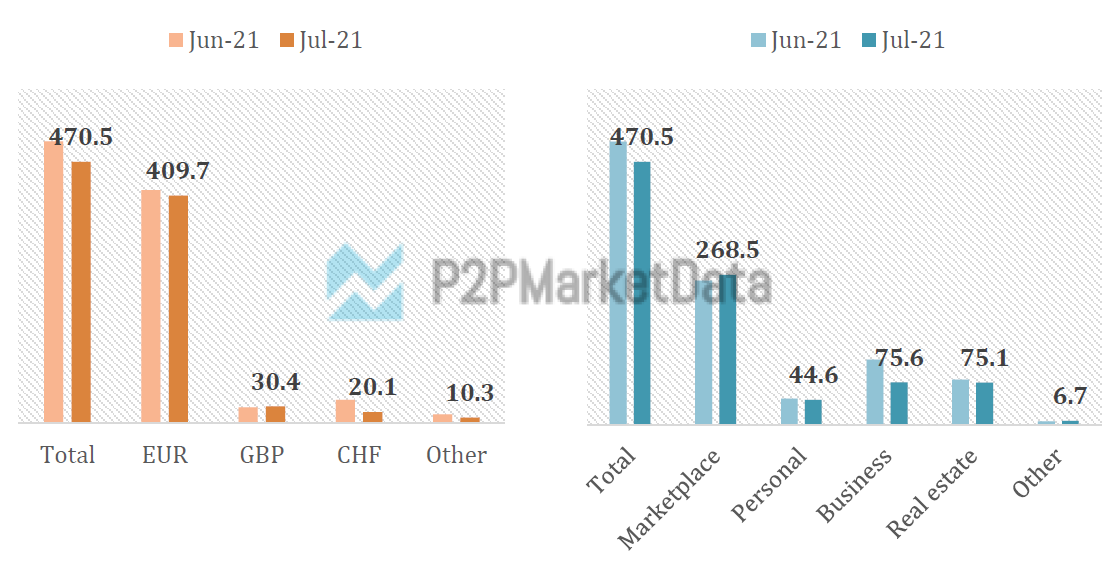

We recorded a total funding volume of €470.5m in July 2021. A slight decrease was recorded in the eurozone compared to June, while funding in British pounds increased a little. Funding denominated in the Swiss franc and other currencies dipped quite significantly – the former due to variance in CreditGate24 volumes – by far the largest Swiss platform; the other currencies mainly because of somewhat worse performance of the Nordic real estate and business platforms. Looking at investment types, business lending receded quite a bit after some fantastic gains last month, which we analysed in-depth in the June report. Real estate and personal lending both recorded marginal decreases too, while marketplace lending remained strong with a roughly 4% gain compared to last month.

We reported quite a few noteworthy milestones reached last month:

- Afranga – a Bulgarian marketplace launched just half a year ago, has funded over €5m worth of loans;

- Another relative newcomer – the Italian business lending site Criptalia has crossed the €10m total funding barrier; so did Reinvest24 – an Estonian real estate lending platform;

- The Irish Lendermarket has been one of the fastest-growing sites for months and has lately broken above the €100m mark; and

- Both CreditGate24 – the largest Swiss P2P site, and Fellow Finance – the Nordic leader in personal (and business) lending, have reached over €800m of total funded loans to date.

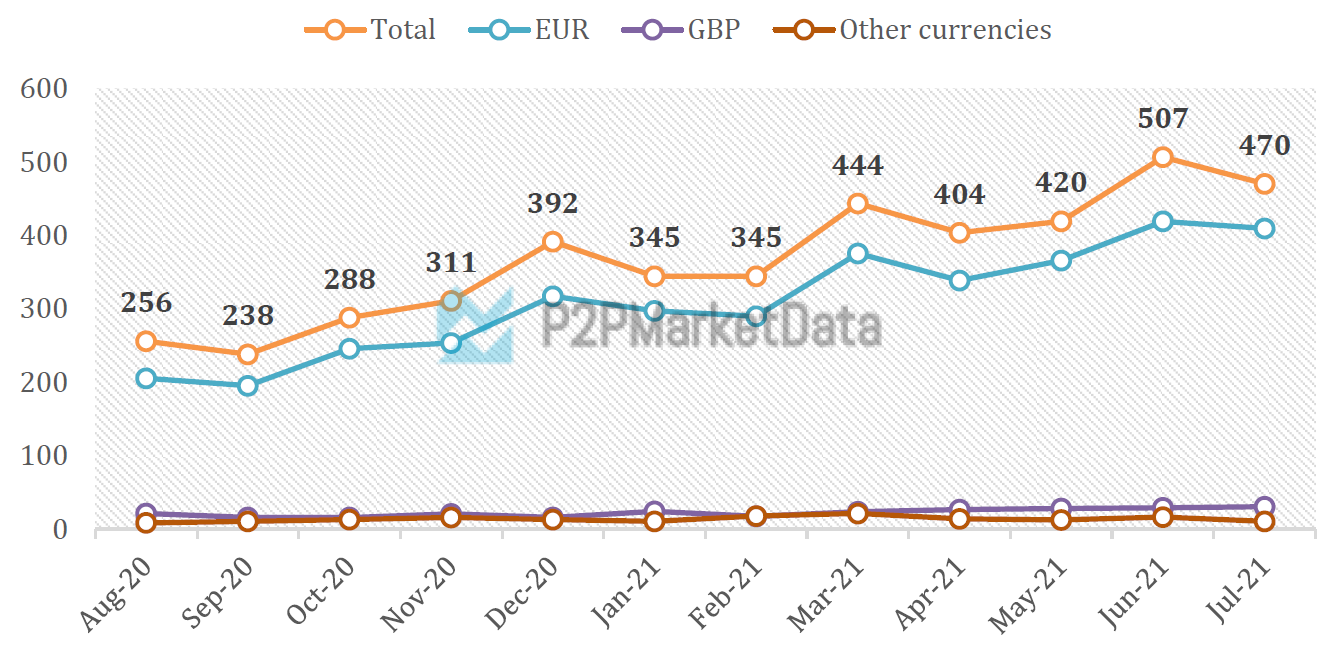

Even though the monthly funding volume in July dipped slightly (-7%), it’s unlikely to reverse the long-term upward trend towards full recovery from the Covid-induced crisis. Despite those periodical corrections, the progress has been strong – over the last 12 months, the peer-to-peer market has grown on at a 7% rate per month on average and is almost twice the size it was around this time last year.

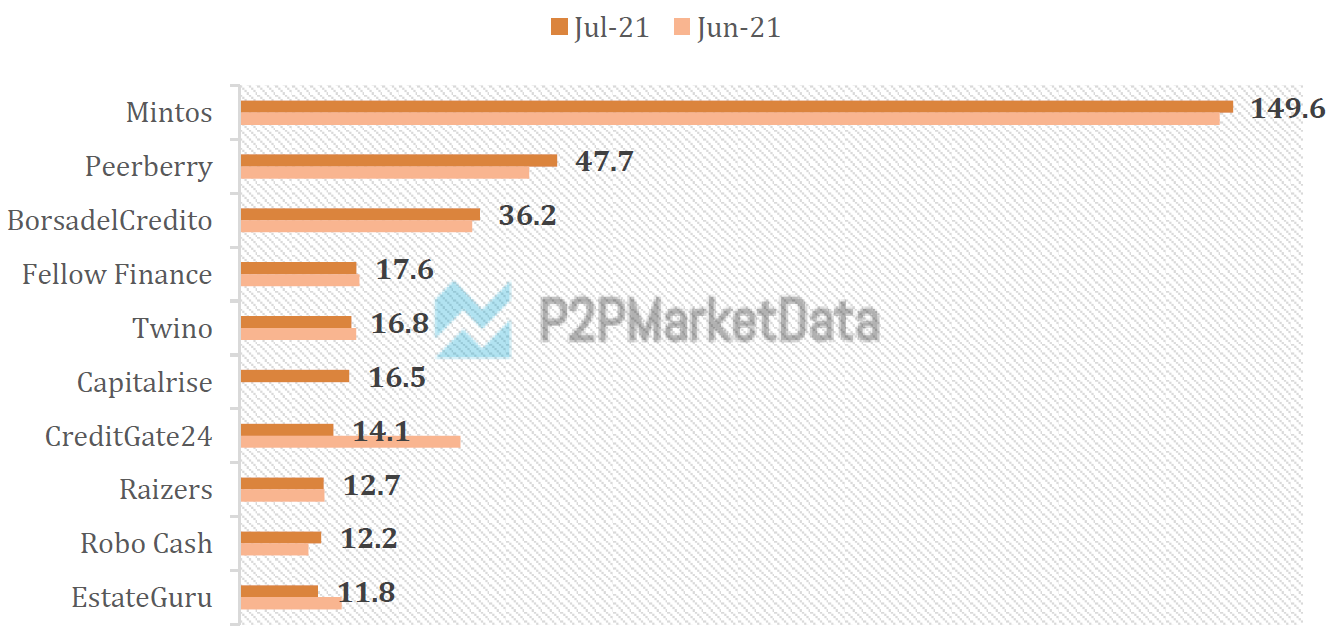

Big player ranking

Capitalrise stands out in this month’s big player ranking. They made it into the 10 highest-funding platforms for the first time, having recorded by far the highest monthly loan amount in their history. Other than that, the ranking has remained stable with the largest platforms, especially Mintos and Peerberry, continuing to gain ground.

Rising star ranking

Here, you can see 10 platforms that have grown the most over the past 12 months. MyConstant’s volumes have been further decreasing, causing it to drop from first to second place in June and sixth place in July. But by far the strongest blow came from the Italian business lending site Criptalia. It has just crossed the €10m total funding threshold, which made it eligible for our rising star ranking. Even though Criptalia’s sky-high growth rate is in part attributable to the very low base 12 months ago (just above €0.5m), it’s certainly a player worth looking at more closely (read the deep dive section below!).

* We only take into account platforms with total funding volumes higher than €10 million.

Slow-mover ranking

Below, we show the reverse of the rising star ranking – the 10 platforms that have noted the slowest growth in the last year. We’ve recorded slow-growing sites across countries, currencies and investment types, and no clear trends or abnormalities seem to emerge.

* We only take into account platforms with total funding volumes higher than €10 million.

A deep dive: Italy is going alternative!

Criptalia has been by far the fastest-growing platform we track with an astounding 1821% growth over the last year. Even more thought-provoking is the fact that 4 out of 10 “rising stars” are Italian – two business lending platforms (Criptalia and Borsa del Credito, the market leader and one of the largest European platforms), one real estate-focused site (Trusters) and one for personal lending (Soisy). Looking at country-level data, I suspected that Italy would be a faster-than-average-growing market, mirroring the performance of its booming platforms. But the gap between Italy and the rest of Europe is enormous! To give you some numbers: the total funding volume in our database increased by a factor of less than two (1.84) over the last year – Italian platforms grew almost six times (5.68); the total volumes grew on average at 7% monthly – Italian volumes at 22%. There is no other outlier as such. As is shown in the graph below, all major markets tend to grow at a similar pace – all but Italy.

Can our data be biased or incomplete in a way that exacerbates Italy’s growth and underestimates growth in other markets? Unlikely. Here’s what Cambridge Centre’s for Alternative Finance Second Global Alternative Finance Market Benchmarking Report has to say about Italy’s performance:

- Italian alternative finance market grew almost fourfold between 2018 and 2020, outperforming all other European markets by a vast margin.

- This growth has lifted Italy from roughly the middle of the league to the largest national market in continental Europe.

- Italy was one of the few European markets that sustained a positive growth trend in 2020 amidst the Covid crisis. It grew from $1.55 billion in 2019 to $1.86 billion in 2020, while the total European market declined from $12.2 to $9.9 billion.

- Italy excels particularly in business lending, equity-based crowdfunding and invoice trading (in the last category surpassing even the UK, which leads in almost all categories).

- Italy has the highest rate of institutionalization (93%), compared to the rest of Europe, where it varies between 8% in the Baltics to 75% in Ireland.

All in all, Italy has emerged as the largest, fastest-growing and most mature market for peer-to-peer lending and crowdfunding in continental Europe. Even though it’s dominated by institutional investors, you can still find good ways to tap into this potential and add some of the fast-growing Italian platforms to your portfolio.

P2PMarketData is the world's largest discovery tool of online alternative investment websites. Compare over 500 alternative investment websites from all over the world in the Alternative Investment Search Tool.