Funding Report for March 2023

What happened last month in the alternative investment markets? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last year? We look at numbers reported to P2PMarketData in March 2023 and dive deeper into this month’s focus: European markets for alternative investments.

About the monthly report

In the monthly funding report, we publish the funding amounts of online alternative investment platforms. We track data from 36 participating platforms, operating in 15 markets and 4 different currencies. Please note that:

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms' publicly available loan books and statistic pages.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

We've welcomed 2 new platforms into our database this month – TWINO (a resale marketplace lending platform based in Latvia that offers payday loans, real estate loans, business loans, and personal loans), and Rebuildingsociety (a direct marketplace lending platform based in the United Kingdom which offers business loans). You can check out the whole dataset at p2pmarketdata.com, and explore even more alternative investment platforms using our platform inventory.

Key highlights: What happened last month in alternative investing?

After a period of decline, the market rebounded this month. We recorded a total funding volume of €360m in March 2023 – an increase of 28% compared to February 2023 (up from €280m). The total monthly funding volume in March 2023 was higher by €53m compared to the same time in 2022 and reached its highest level over the last year.

Looking at funding across the main investment categories, most funding in March 2023 went to platforms offering consumer investments (€230m), followed by business (€87m), and property investments (€43m). Consumer lending, business lending, and property lending increased by 21%, 38%, and 59% respectively, compared to February 2023.

Platforms’ performance: How did the key players do in March 2023?

Mintos funded the most loans in March 2023, followed by Opyn and PeerBerry. Overall, the five largest platforms accounted for 75% of the total funding volume recorded in our database, while the ten largest platforms funded 85% of the total volume. The largest players were most likely to be resale marketplace lending platforms (6 out of 10) come from Croatia (2 out of 10) and offer consumer investments (6 out of 10).

Crowd with Us, Letsinvest, and Esketit has been the fastest-growing platform in the last year. The “rising stars” were most likely to be direct marketplace lending platforms (5 out of 10), come from the United Kingdom (2 out of 10), and offer consumer investments (4 out of 10).

Bulkestate, LandlordInvest, and TWINO performed the worst during the previous year. Overall, the declining or slow-growing platforms were most likely to be direct marketplace lending platforms (8 out of 10), come from Estonia (2 out of 10), and offer property investments (7 out of 10).

*We only take into account platforms with a total funding volume higher than €1 million.

Finally, we reported several noteworthy milestones reached last month:

- Max Crowdfund has funded more than €50m worth of loans since its inception.

- Profitus has crossed the €100m total funding threshold.

- Esketit has broken above the €200m mark.

- Robocash has funded more than €600m worth of loans since its inception.

- Estateguru has reached over €700m of total funded loans to date. Congrats!

Deep dive: European markets for alternative investments

The new Regulation on European Crowdfunding Service Providers (ECSP) will likely improve the conditions for cross-border investments on (some) crowdfunding platforms. It could even lay the foundations for a single EU market for alternative investments. This month, we look into the national level – which European countries lead the way and which lag behind?

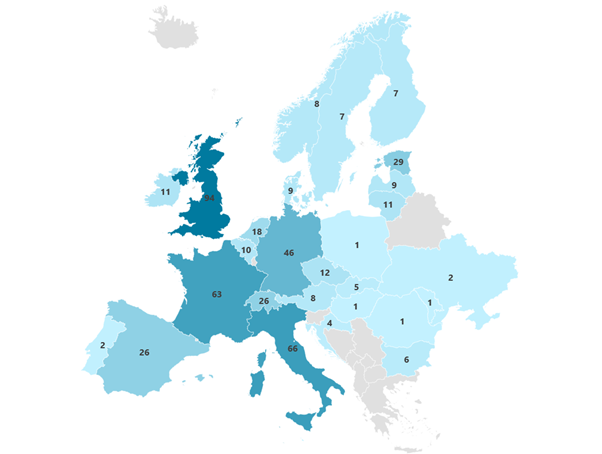

First of all, as the analysis from Robocash also notes, big and mature economies tend to host relatively many platforms, including the UK (94), Italy (66), France (63), and Germany (46). Most platforms there target predominantly domestic investors and favour the direct lending model.

However, if we correct for the market size, the Baltic states stand out – maybe unsurprisingly. Estonia hosts the most platform per capita – about 22 per 1 million people, followed by Latvia (4.7) and Lithuania (3.9). By comparison, in the UK, there are only 1.5 platforms per million people, in Italy – 1.1 and Germany – 0.6.

The Baltic platforms are also disproportionately big – we wrote in September last year that Latvia accounted for almost half of the total volume recorded at the time on P2PMarketData (mostly because it’s home to the giant Mintos). The Baltics are also more likely to be the favourite base for platforms targeting international audiences and representing the indirect – or resale lending model.

Finally, countries in Central, Eastern, and South-Eastern Europe seem to lag in the crowdfunding craze. Some big markets like Poland, Hungary, and Romania have almost non-existent alternative investment markets. Our map in the Western Balkans also remains almost empty – if you notice any platforms we’ve missed from that region, let us know!

Overall, Europe is diverse in terms of progress and approaches toward alternative investments. In our analysis of the ups and downs (but mostly downs) of the Polish platforms back in 2021, we noted that unfriendly regulation for digital lending might have been one reason for a low take-up. It’s curious to see if the new ECSP will only impact current players (if at all), or maybe also spur developments in new markets by leveling the regulatory playing field. One way or another, we hope to see more platforms from all European markets in our database!