What is Balance Sheet Lending? Meaning & versus P2P Lending

In balance sheet lending (also called portfolio lending), the platform entity provides a loan directly to a consumer or business borrower. The loan is on the platform’s books or balance sheet. That’s where the name comes from. The loan process is direct, like working with a bank. It’s one of the primary forms of alternative lending along with peer-to-peer lending.

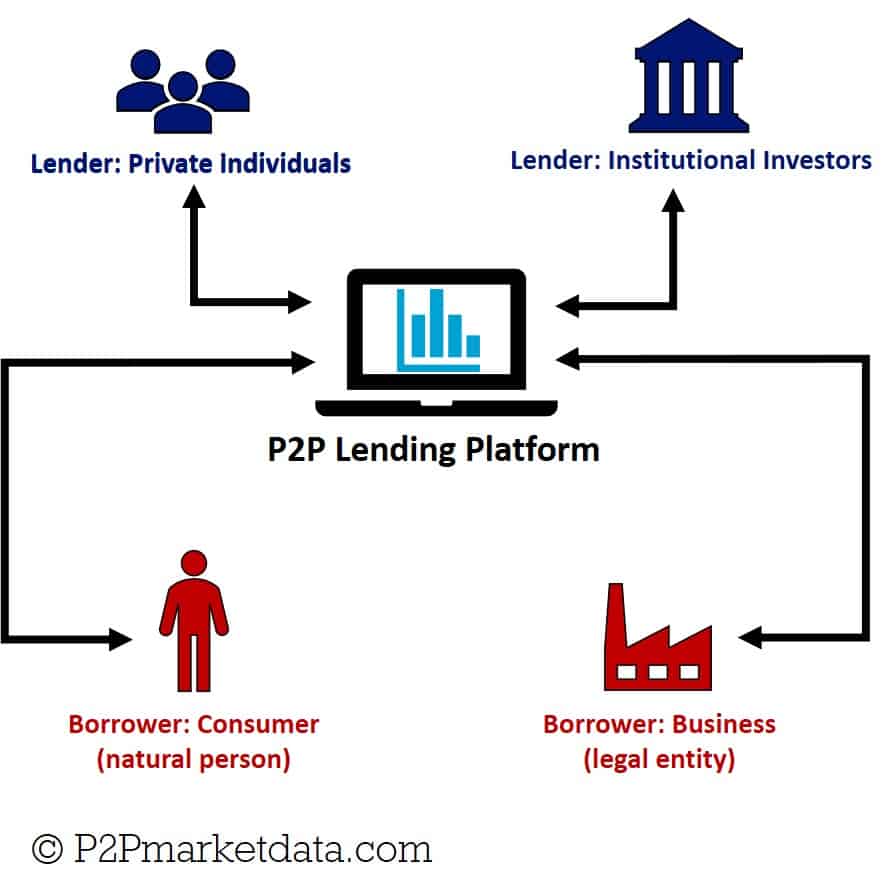

The main difference between standard P2P lending and balance sheet lending is who takes the risk.

What happens if a loan goes bad?

In peer-to-peer lending, the platform does not lend to the borrower. The platform utilize crowdfunding and links borrowers with investors directly who make the loan agreement themselves.

In balance sheet lending, the P2P platform (or another type of balance sheet lender) assumes the risk itself. The platform is directly liable for any losses. While balance sheet lending can take many different forms, the common trait of all balance sheet lenders is that they provide loans at their own risk.

This article will focus on balance sheet lending. We look at it from the perspective of peer-to-peer platforms and crowdinvesting, so let’s learn more as we dive into the details below.

Balance Sheet Lending Versus P2P Lending

Where does the money used for lending come from? This question is crucial if you want to understand which of the two main alternative lending models, P2P lending or balance sheet lending, the platform is using. The most useful question to ask is:

Does the money come from the marketplace (P2P lending is also known as marketplace lending) or the balance sheet of the P2P platform entity?

P2P Lenders

In standard P2P lending (also called lending-based crowdfunding), platforms play the matchmaker. They provide a service that makes it possible for investors to lend to companies and consumers. But they do NOT issue the loan themselves. A standard P2P lending platform is usually providing three services: Origination, Loan Servicing, and Recovery. These services are what you pay for (through fees) when you invest on such platforms.

- Origination- consists of locating borrowers that can be either consumers or businesses. Creditworthiness is part of the process to approve or reject those who are deemed too risky and classifying the approvals into risk categories

- Loan servicing- the task involved with handling payments and monitoring the loan performance

- Recovery- the work involved in debt recovery from defaults.

In other words, a peer-to-peer lender provides the infrastructure needed to make the funding arrangement between investors and businesses or consumers.

Balance Sheet Lenders

The model of balance sheet lending, in contrast, is closer to that of traditional bank lending. Balance sheet lending usually requires that the platform has a banking license. The structure of the loans provided in balance sheet lending is fundamentally different from the loans in peer-to-peer lending.

Why? Because the loans in balance sheet lending are the liability of the balance sheet lender.

If a borrower is not able to repay the money lent, the balance sheet lender (the platform) will end up losing their own money. This is a major difference from P2P lending where the lender is a peer-to-peer investor funding a loan facilitated by the platform and not the platform itself.

Cost Structure and Funding Process

This is Lending Club’s Balance Sheet from when they were a peer-to-peer lender. If they were a balance sheet lender (they were not - now they are a bank), the loan would be a liability, and the payments would be an asset called Accounts Receivable to balance the books. Previously, Lending Club financed loans from retail investors, but now they only work with institutional investors.

In balance sheet lending, the P2P platform originates the loan. They keep the money used for lending on their balance sheet. Thus, the platform will earn revenue from both its fee structure and the interest payments accruing from loans.

The downside for the platform is that it also assumes credit risk. This also has consequences for the cost structure and the funding process.

In balance sheet lending, one of the main costs is the cost of capital, which can be explained as the price of obtaining the funds needed to provide loans. Most platforms have outside credit lines they must pay for to provide loans. Since the balance sheet lender assumes the risk of the loans itself, another substantial cost to manage is the cost associated with covering losses on bad loans. Like a bank, the difference between the cost of capital and the interest rate charged to borrowers, known as Net Interest Margin, is how the platform makes its money.

In peer-to-peer lending, unlike with a balance sheet lender, investors assume both the risk and the return (in the form of interest payments). This makes the cost structure significantly different between balance sheet lending and P2P lending. The capital base comes from the investors. The platform could set aside funds to cover loan defaults, but the risk is to the investors and not the platform itself. This is also why many P2P platforms with loan originators use buyback guarantees. A standard P2P lending business model does not have to acquire capital to finance loans. Instead, they must attract investors. In the same way, a P2P lending platform does not have to set aside funds to cover loan defaults. Some will. Others won’t.

When comparing the cost structure of balance sheet lending and peer-to-peer lending, we find that the cost structure of standard P2P lending platforms is more transparent for the investor. P2P lending often creates more value, especially if the investor is able to manage his/her risk by diversifying across currency, geography, platform type, loan type, and repayment type.

In terms of speed, the funding process between P2P lending and balance sheet lending also differs, which has consequences for both investors and borrowers.

The advantage of balance sheet lending is that the money is available and ready to fund the moment the borrowing application is approved.

On the other hand, P2P lending platforms are in a constant struggle to balance the capital demanded by borrowers (consumers or businesses) and the capital supplied by lenders (investors). As an investor, this can lead to a shortage of loans to invest in, and as a borrower, it can lead to a prolonged funding period.

The Future of Balance Sheet Lending and P2P Lending

The business models described above are how balance sheet lending and peer-to-peer lending generally work. In reality, many platforms are hybrids trying to enjoy the benefits of both types of alternative lending. The market of both balance sheet lending and P2P lending as alternative lending sources are young and in rapid development with the largest growing segment being in real estate crowdfunding. Predictions of the development of the market are speculative at best.

Balance sheet lending is becoming more common, especially in the United States and the Americas Region. In response, we expect that peer-to-peer lending could move more in the direction of bank lending. That means more sophisticated interfaces available to borrowers or traditional P2P lending platforms only serving specific niche markets. Many P2P platforms like Prosper in the US have funding agreements with investment funds to assure funding liquidity is available on the platform.[1] In return, they get their choice of whole and partial loans to buy. We expect to see this trend continue with more banks and investment funds working with P2P platforms or running their own lending platforms.[2]

P2PMarketData is the world's largest discovery tool for online alternative investment websites. Compare over 500 alternative investment websites from all over the world in the Alternative Investment Search Tool.

Article Sources

- The Wall Street Journal: “Prosper Inks $5 Billion Loan-Buying Deal With Investors Including Soros, Jefferies”

- Wolfgang Pointner & Burkhard Raunig, Oesterreichische Nationalbank: “A primer on peer-to-peer lending: immediate financial intermediation in practice”