Funding Report for January 2023

What happened last month in the alternative investment markets? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last year? We look at numbers reported to P2PMarketData in January 2023 and dive deeper into this month’s focus: 2023 Market Outlook.

About the monthly report

In the monthly funding report, we publish the funding amounts of online alternative investment platforms. We track data from 34 participating platforms, operating in 15 markets and 4 different currencies. Please note that:

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms' publicly available loan books and statistic pages.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

You can check out the whole dataset at p2pmarketdata.com and explore even more alternative investment platforms using our platform inventory.

Key highlights: What happened last month in alternative investing?

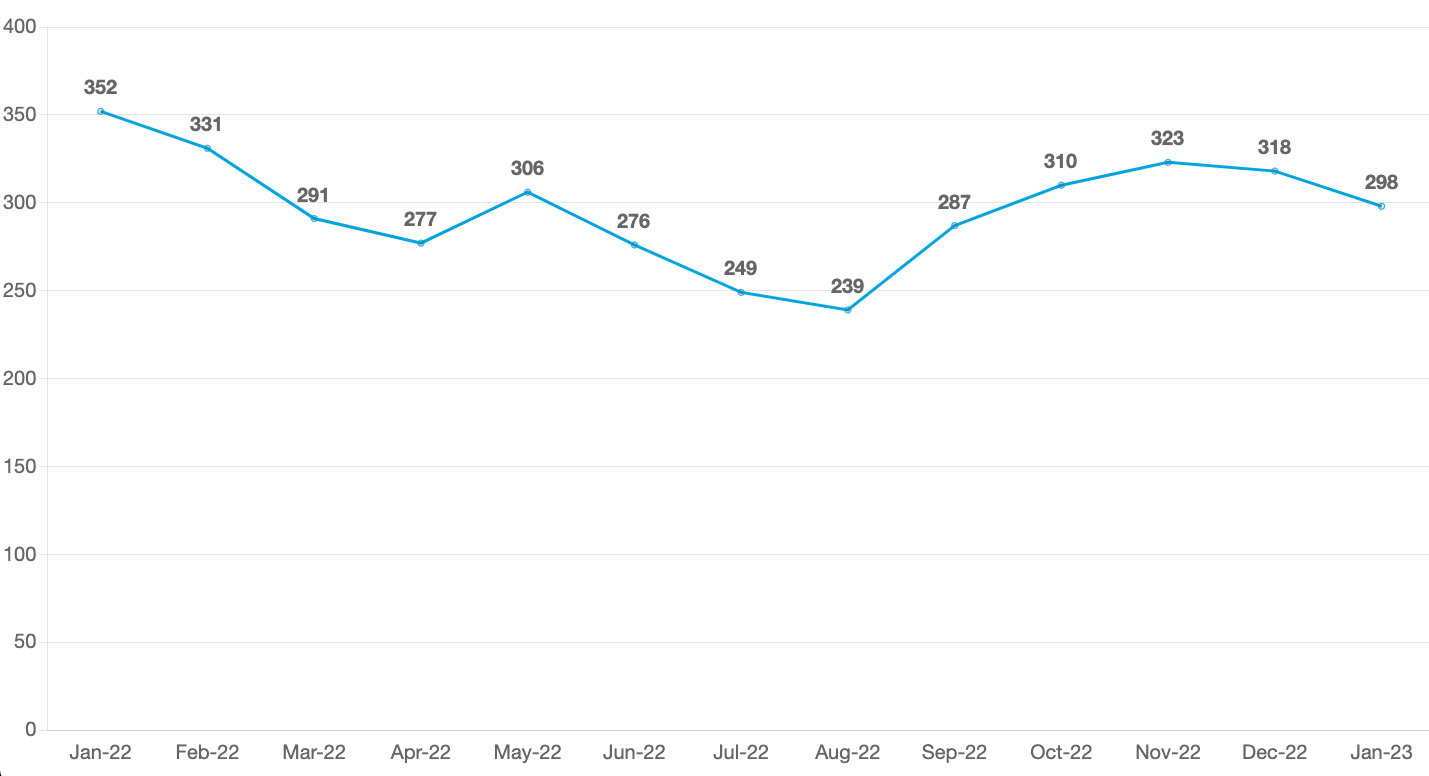

A slowdown in the alternative investment market continues as funding volumes have decreased for the 3rd consecutive month. We recorded a total funding volume of €298m in January 2023 – a decrease of 6% compared to December 2022 (down from €318m). The total monthly funding volume in January 2023 was lower by €54m compared to the same time in 2022.

Looking at funding across the main investment categories, most funding in January 2023 went to platforms offering consumer investments (€195m), followed by business (€58m), and property investments (€46m). Consumer lending increased by 4%, while business lending and property lending decreased by 30%, and 6% respectively, compared to December 2022.

Platforms’ performance: How did the key players do in January 2023?

Mintos funded the most loans in January 2023, followed by Opyn and PeerBerry. Overall, the five largest platforms accounted for 73% of the total funding volume recorded in our database, while the ten largest platforms funded 88% of the total volume. The largest players were most likely to be resale marketplace lending platforms (6 out of 10) come from Croatia (2 out of 10) and offer consumer investments (6 out of 10).

Lande – a direct marketplace lending platform from Latvia, offering business investments, has been the fastest-growing platform in the last year, followed by Esketit and AxiaFunder. The “rising stars” were most likely to be direct marketplace lending platforms (6 out of 10), come from the United Kingdom (2 out of 10), and offer property investments (4 out of 10).

Bulkestate, Klear, and Bergfürst have performed the worst compared to the previous year. Overall, the declining or slow-growing platforms were most likely to be direct marketplace lending platforms (8 out of 10), come from Estonia (1 out of 10), and offer property investments (6 out of 10).

*We only take into account platforms with a total funding volume higher than €1 million.

Finally, we reported several noteworthy milestones reached last month:

- CapitalRise has funded more than €200m worth of loans since its inception.

- Lendermarket has reached over €300m of total funded loans to date. Congrats!

Deep Dive: 2023 Market Outlook

2022 was a year of macroeconomic and geopolitical shocks for the economies and financial markets and a particularly adventurous time for (European) P2P lending. In the last monthly report, we looked at how the sector performed amidst this uncertainty and turmoil. It’s time now to turn into the future and consider what might await in 2023.

First, commentators largely expect most macro risks to persist in 2023. The fight against inflation is not yet won, and the monetary policy tightening drag is building, limiting borrowing for consumer spending, capital investments, and real estate development. Warnings of a recession or slowdown surface in both the US and the EU, driven by energy prices and tightening monetary conditions. Even though main stock indexes in America and Europe rebounded in January, investor sentiment remains fragile, and volatility in stock markets will likely remain elevated. However, there are also positives – Asia (read: China) is reopening to trade, Europe is emerging from a much-feared low-in-gas winter, and the UK – another important market – seems to have stabilized its leadership after the Truss incident.

At the same time, in the investing world, with the underperformance of stocks and increased uncertainty, more and more investors are looking toward alternative assets. According to one of the UK’s property lenders – Shojin, a third of UK retail investors are more inclined to invest in alternative assets amid “concerns over the government's economic policy”. This appetite is driven by recessionary fears and volatility of traditional investments, but also the great performance of alternatives. SS&C – a US-based hedge fund, notes that 86% of surveyed investors reported that alternative asset performance met or exceeded their expectations, and 70% said they expect to increase their investments. Curiously, Shojin’s results signal that, despite the demand for alternatives, there might be accessibility issues – 60% of retail investors said it was “hard to determine the best way to gain access to alternative investments”. Tools such as our investment search tool can help you navigate the alternative scene.

Finally, zooming in to the P2P lending sector, we can see several trends gaining pace in 2023 based on our analysis and talks with major European platforms:

- A boom in EU cross-border lending: The rollout of the European Crowdfunding Service Provider Regulation (ECSPR) will play a key role in the development of the sector in Europe, providing a homogenized framework for international investments.

- Expansion to new segments: There are niches and products where online lending can further develop its potential, including bridge financing for large real estate developers, buy-to-let property lending, or green investments.

- Risk management and transparency: Several key platforms have suffered some heavy blows. Mintos’ funding volumes significantly declined, PeerBerry failed on its buyback obligation in the face of the collapse of the Ukrainian and Russian markets, while EstateGuru saw mounting defaults due to (perhaps too rapid) expansion. On the flip side, all platforms have responded with strong, open communication and have put mitigation measures in place startlingly fast. Mintos rebounded, PeerBerry set up a repayment scheme and maintained investor trust, and EstateGuru is acting toward loan recovery.

We facilitate platforms’ transparency pledges by publishing their reported funding volumes and investment statistics. We now offer to verify the statistics, which adds another validation layer - you’ll see green badges next to platforms’ names - so far, we have verified statistics of EstateGuru, Rendity, Heavy Finance, and Income Marketplace. You can check it out now on our statistics page.