Sergejs Viskovskis: Indemo Redefines NPL Investing with “1 Debt : 1 Note”

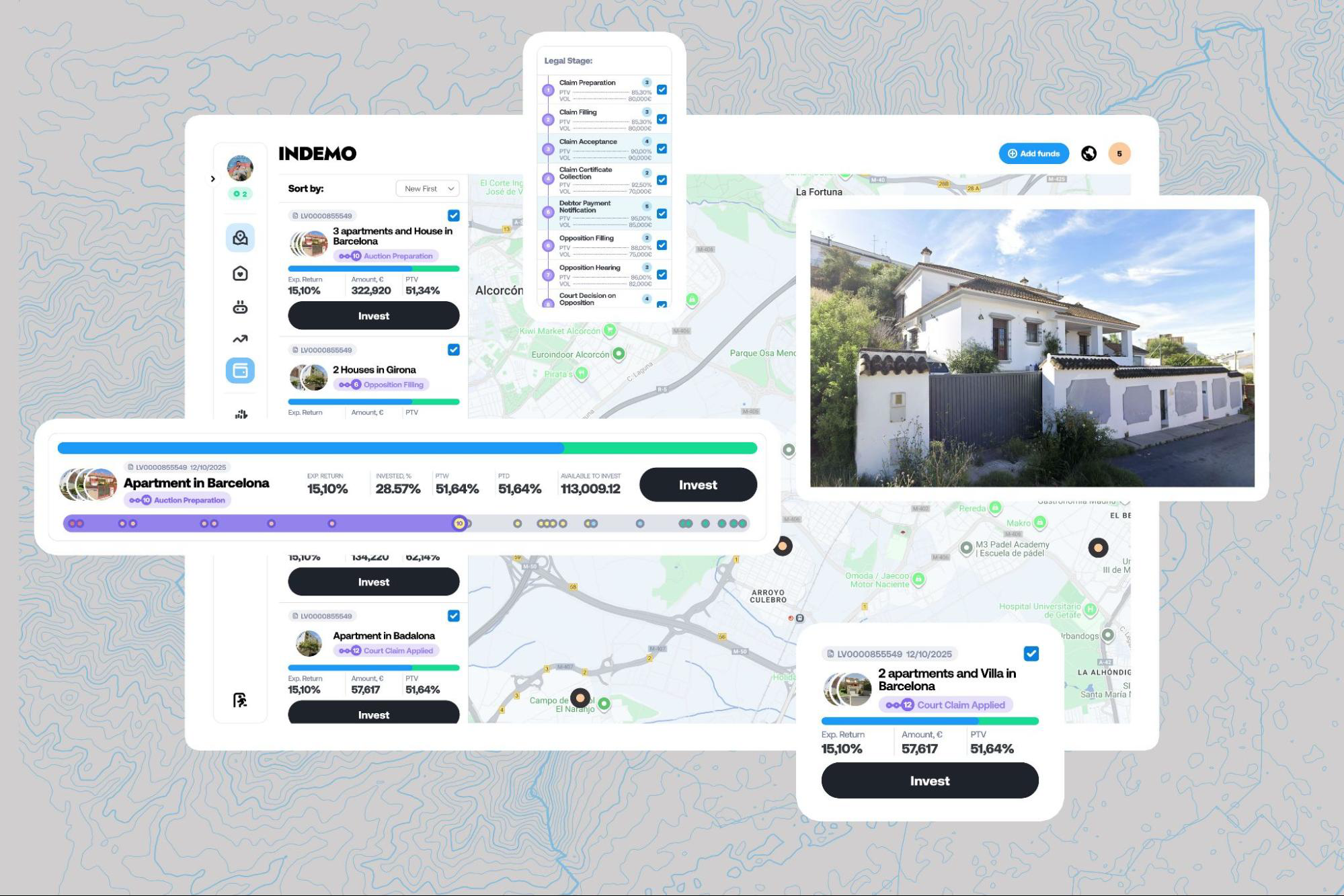

In this interview, we speak with Sergejs Viskovskis, CEO of Indemo, about how the platform is reshaping non-performing loan (NPL) investing through its new 1 Debt : 1 Note structure. He explains how the update enhances transparency, simplifies portfolio tracking, and gives investors direct exposure to individual real-estate-backed debts. The conversation also touches on investor returns, risk management, and how the new structure lays the groundwork for Indemo’s upcoming Secondary Market features.

For those who are new to Indemo, could you briefly explain what the platform does and what makes it unique in the European real-estate investment space?

Indemo offers a new way of investing in Spanish real estate - an asset class that has long been an attractive opportunity for European investors. We are the first licensed platform in the EU to offer discounted debt investments for the retail market: by acquiring non-performing mortgage loans at a discount from Spanish banks and selling the properties at market value, Indemo delivers high investment returns backed by real estate collateral. So, what sets us apart from traditional real estate investment platforms is that instead of relying on property value appreciation over time, whether through rental income or eventual sale, our approach is to debts a significant discount with the aim to sell the associated assets at their current market value. This strategy has long been employed by funds and financial institutions, we are the first ones to offer this type of investments for the retail market.

You’ve just launched the “1 Debt : 1 Note” structure. What problem does this change solve for investors, and how does it differ from the previous investment model on Indemo?

Previously, we offered discounted debt investments in the form of investment notes, each including eight collateral assets. Investors would always purchase a bundle of notes, which included a mix of properties. Since November, we’ve launched a “1 Note: 1 Debt” product, which allows investors to select each asset individually. This change makes our platform feel more like a traditional investment platform, where you can choose projects based on personal preference or detailed data such as appraisals, property type, location, PTV, and LTV ratios. We feel that by offering our community a way to invest in each asset individually, we give investors opportunity to more tailored diversification according to one’s personal preferences. Also, it’s important note that of the keygoals of the release is to prepare the platform for future Secondary Market functionality planned for the first half of 2026.

What are the main advantages and trade-offs of this approach in terms of diversification, transparency, and risk management?

The golden rule of diversification remains just as relevant with Indemo’s new approach to investing as it has always been. Since we now offer debts tied to specific assets rather than diversified property baskets, this principle is more important than ever. Investors can individually decide which assets seem most attractive based on the provided data and metrics. With the introduction of our 1 Note : 1 Debt concept, we provide the same level of transparency but with greater engagement. Each note is linked to a single property, making it easier to review, analyze, and make investment decisions. This approach encourages investors to dedicate more attention to each asset’s analysis and to track returns with greater clarity over time.

What are the potential earnings for an investor under the new 1 Debt : 1 Note model, and how do returns typically compare to Indemo’s previous structure?

The expected annual income remains at around 15.1%, which hasn’t changed much since we continue to operate under the same business model and within the same asset class. What has evolved, however, is the investor’s ability to approach investing in new ways. For example, investors can now choose between different strategies — focusing on early-stage debts with higher return potential and a greater likelihood of fast, out-of-court settlements, or opting for later-stage debts that offer more predictability in terms of timing. Previously, it was more difficult for investors to control their exposure to specific assets. The current setup allows them to decide precisely how much capital to allocate to each individual note, providing a clearer and more customizable investment experience.

You’ve mentioned that 1 Debt : 1 Note lays the foundation for a future Secondary Market. Could you share how these upcoming features will build on this release?

Yes, I’ll be happy to share that we’re very excited about the upcoming changes! First of all, the release of the Secondary Market functionality is one of our major goals for next year, as we want to bring long-awaited liquidity to our discounted debt product. Our investment notes already offer a high expected annual return, but since they currently can’t be sold immediately, adding liquidity will make them one of the most attractive products on the market: combining strong, stable real estate collateral on one hand with double-digit returns on the other. As for AutoInvest, yes, it’s also being updated soon to align with the new product structure and will include additional settings requested by our community.

How do these new updates improve the investor experience and decision-making process on the platform?

We’re gradually rolling out new features with the Secondary Market functionality in mind, as we want the most important product metrics to be visually accessible and easy to use for our investors. While key metrics, such as price-to-value, property type, and region, have always been available, our focus now is on making them easily identifiable with just one click. Our goal is to make the investor journey as smooth and intuitive as possible, and these updates are an important step toward that.

How does Indemo ensure proper valuation and recovery management for each individual non-performing loan (NPL) investments?

Debt recovery and management are key factors in the success of our business model. Our local partners in Spain bring over 15 years of experience in this field, along with strong market knowledge and a wide professional network necessary for handling all aspects of debtor communication and overseeing legal and judicial procedures. We are in constant daily communication with them and can confidently say that, in Spain, we have one of the most capable debt management teams in the Iberian region today. Their combined experience in managing tens of thousands of assets, coupled with Indemo’s sharp focus on our core product, residential properties, typically secondary residences, allows us to ensure that each debt placed on the platform is managed as effectively as possible.

Finally, looking ahead - are there new geographies, asset types, or partnerships you’re preparing to introduce?

As mentioned earlier, one of Indemo’s key goals for next year is the introduction of the long-awaited Secondary Market functionality. Over the next few months, our core product development efforts will be fully aligned with this priority. In addition, we have other exciting plans and products currently in testing and preparation for launch. One of these is a more traditional “fix & flip” investment model, where we acquire properties in the later stages of debt flow, take possession, make necessary enhancements, and sell at a higher price. Investors will enjoy full transparency, with access to photos, videos, property valuations, and detailed updates at every stage of the refurbishment process. In short, we have some exciting news coming next year. Stay tuned and follow us closely on our website, social media, and Telegram channels!