Nadezhda Vlasenko: How Robocash Is Redesigning for Transparency & Scale

Founded in 2017, Robocash has established itself as a fully automated investment platform offering access to consumer and business loans issued by UnaFinancial across several emerging markets. With a strong focus on automation and buyback-backed investments, the platform has attracted thousands of investors seeking returns. In this interview we hear from Nadezhda Vlasenko, Product Owner of Robocash, about the ongoing redesign of the platform, what’s changing behind the scenes, and how the company is navigating today’s investment landscape.

For readers new to Robocash, could you briefly describe the platform and how it fits into the wider UnaFinancial structure?

Robocash offers an automated solution for quick access to investments, which requires minimal effort from investors to manage portfolios while historically providing stable passive income. The platform is owned by UnaFinancial, and all loan originators represented on it are companies belonging to the holding. It allows us to minimise risks of investment default - this is why our investors have always got their money back with no delays.

Robocash is currently undergoing a platform redesign. Beyond visual updates, what are the main goals behind this transformation?

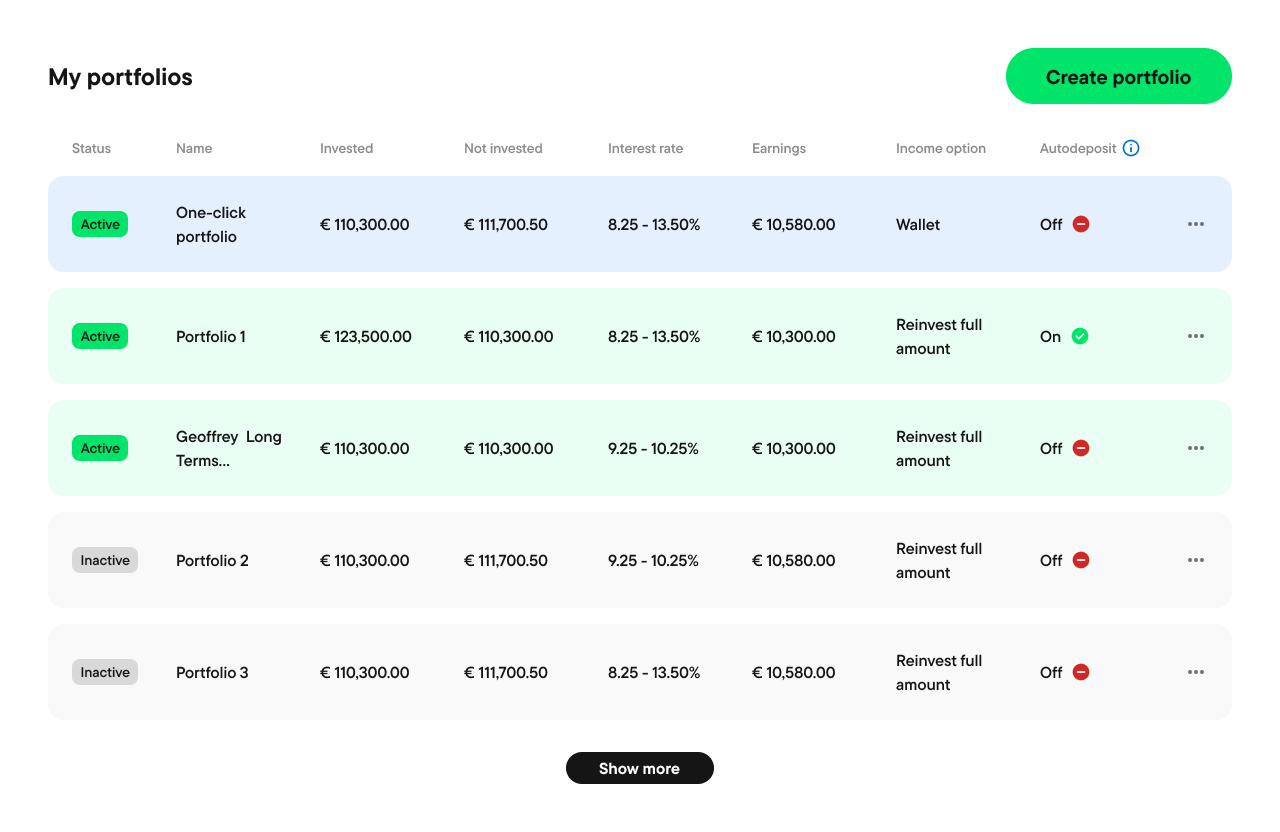

Beyond improving its visual appeal, this transformation aims to streamline navigation through clearer information presentation and optimize the onboarding process for new investors. Ultimately, the new design will further enhance the platform’s transparency and credibility, encouraging both existing and prospective investors to interact more confidently with it.

How will the new design and dashboard improve transparency and help investors better understand their portfolio performance and risk exposure?

The new design simplifies the user experience and is presented in a clearer format. It will also feature tooltips with helpful explanations on how to build a portfolio and track its performance. For example, our Statistics page will be optimized to align with the new layout, making it easier for investors to see how their portfolios are functioning and to understand the breakdown of loans by status. Any investment carries risks, but when investors have transparent tools to manage their money, it greatly helps them to make more informed decisions.

Have investor preferences or behaviors changed in recent years?

We have observed changes in the distribution of investors by age group. Over the past year, the proportion of platform users aged 45-60 has increased, indicating growing experience among investors. The share of women investors is also rising and now accounts for 14% of the active user base. Regarding inventors’ preferences, larger portfolios (over €30,000) are gradually growing, confirming that investors' confidence in P2P investments is increasing. Also, the users lean towards longer-term (and more profitable) loans. As they gain experience, European investors are willing to deposit large sums for longer periods than before, especially given that the market continues to grow steadily and while investors previously chose a larger number of P2P platforms, they now prefer a few companies that have proven their reliability and stability over time.

Since launching in 2017, how has Robocash performed through different market cycles and financial ups and downs?

Since launching in 2017, Robocash has navigated through several turbulent market events and economic fluctuations. Thanks to the coordinated efforts of our team, we have maintained a stable environment for our investors. Throughout these years, our investors have never experienced a payment delay or a default on any loan. In August 2025, the investors’ total earnings crossed the 35 M euros mark, and now the user base is approaching 42,000 members, reflecting stable market demand. Of course, in response to external factors and market changes, we have adapted our offerings to ensure the continued stability of our business model. Our primary goal has always been to uphold our commitments to investors while maintaining operational efficiency.

Risk management and buyback reliability are key factors for investors. How do you ensure the ongoing stability of loan originators within UnaFinancial?

The UnaFinancial Group stands behind all its loan originators and actively manages risk and liquidity across the entire structure. This balanced oversight allows us to offer a stable return to our investors. The Group possesses full direct ownership of each Loan originator, giving us vested interest in their financial resilience. The Group actively oversees liquidity and reserves, ensuring all investor commitments are met without delay. Every Loan originator on Robo.cash is backed by a direct Buyback guarantee, which obligates the loan originator to repurchase a claim if a payment is overdue by 30 days, adding an essential layer of immediate protection. The Group’s combined financial strength and comprehensive control are designed to safeguard investors’ interests by ensuring the ongoing stability and liquidity of its loan originators.

With rising global interest rates, how has Robocash adjusted its investment offerings or pricing?

Currently, we see a very strong demand on the platform, which exceeds the available supply. To maintain a balanced environment, we moderate the interest rates accordingly. This approach helps us ensure the overall platform's stability. We closely monitor the global environment, but our main focus remains on aligning our offerings with the needs of the whole business. In any case, our priority on the platform has been and remains providing reliable investments with a stable income above all else.

Many European platforms are now regulated under ECSPR. How do you view the evolving regulatory environment, and what does it mean for Robocash and your investors?

Regulation is definitely a concern for many investors, and we believe that regulatory frameworks will continue to be developed in the future. The ESCPR license is a mandatory requirement for crowdfunding platforms to operate within Europe. Robocash is an investment platform on which you can invest in existing asset classes (existing consumer and business loans), not a crowdfunding platform. The essential difference between our platform and crowdfunding is that we do not give away any equity or gather funds from the public for some specific projects, but rather pay interest on the money you invest when buying the claim rights of existing loans that are placed on the Robocash platform. We strictly adhere to all applicable laws and regulations in the Republic of Croatia. If a regulatory framework specific to our activities be introduced in the future, we will fully comply with it.

Finally, what can investors expect from Robocash in 2026?

Robocash is part of UnaFinancial, and its strategy is closely aligned with the overall development plans of the Group. In 2026, UnaFinancial will continue strengthening existing projects, developing new ones and exploring new markets. The platform will be actively working towards achieving these goals, supporting growth and innovation across Group’s initiatives. As for more specific plans, next year, investors can look forward to the complete launch of our redesigned platform, which will offer an improved user experience and new features.