The Monthly Funding Report: April 2021

What happened last month in P2P finance and crowdfunding? Which platforms are on the rise and which ones are falling behind? How has the sector performed over the last 12 months? We take a look at numbers reported to P2P Market Data in April 2021 and dive deeper into this month’s special focus: the recent crypto craze.

About the monthly report

In the Monthly Funding Report, we track the funding amounts of real estate crowdfunding, peer-to-peer & online marketplace lending platforms. Please note that:

- The statistics exclude some prominent platforms such as Lending Club, Funding Circle, Credimi and Prosper, which do not accept individual investors and remain open only for institutional and corporate investors.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms’ publicly available loan books and statistic pages.

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

We currently track data from 84 participating platforms, including originations operating in 27 markets and with 12 different currencies. In April 2021, we welcomed a promising, Lithuania-based real estate lending platform Profitus (you can read the latest Profitus analysis here) and a newly-launched Irish marketplace Esketit. We had to delist FinBee as they stopped sharing funding volumes publicly and didn’t follow our minimum requirements for reliability and accuracy of the data reported to us directly.

Key highlights: What happened in P2P finance last month?

We recorded a total funding volume of €463.5m in April 2021. Looking at the main currencies, funding in EUR remained strong, accounting for almost three-fourths of the total amount. Marketplace lending was the most popular investment type – close to half of all the investments were made on loan-aggregating platforms. Funding across all currencies and investment types has decreased since last month.

We also reported several noteworthy milestones reached last month:

- British real estate lending platform Blend Network has crossed the £25m total funding barrier (roughly €30m);

- The leading Swiss business lending platform CreditGate24 has funded over CHF 800m worth of loans (over €733m);

- Peerberry has broken above the €500m threshold; and

- Another large marketplace lending platform Twino has funded over €800m since their launch.

Considering the broader picture, funding volumes in April decreased slightly after a sharp increase in March. This slow-down happened across the board, including all currencies and investment types, unlike the divergence between EUR and GBP funding volumes that we wrote about in last month’s report.

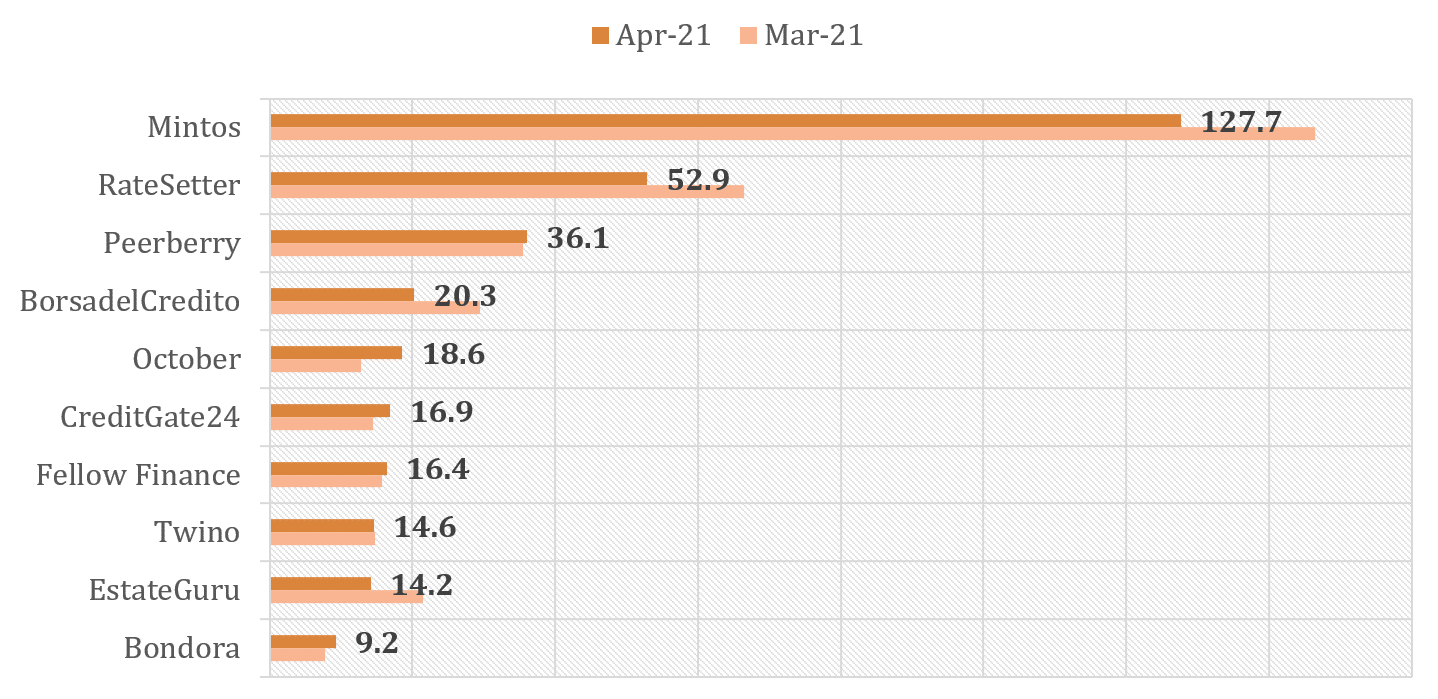

Big player ranking

The top of the peer-to-peer lending league performed worse this month, even considering the overall volume decreases. Their share in funding amounts decreased from roughly 60% to 55% of all investments. Two leaders – European Mintos and British RateSetter noted substantial declines. In the top 10, only October, CreditGate24 and Bondora managed to fund considerably more loans compared to March.

Rising star ranking

Here, you can see the 10 platforms that have grown the most over the past 12 months. US-based crypto lending platform MyConstant and Irish marketplace Lendermarket stay at the top of the list. Our newly added platform – Profitus has also joined the ranking.

* We only take into account platforms with total funding volumes higher than €10 million.

Slow-mover ranking

Below, we show the reverse of the rising star ranking – the 10 platforms that have noted the slowest growth in the last year. There haven’t been any significant reshuffles in this area, with marketplace and personal lending platforms accounting for the majority of slow-growing platforms (6 out of 10), unlike the rising stars, which tend to include more real estate lending sites.

* We only take into account platforms with total funding volumes higher than €10 million.

A deep dive: The crypto lending craze

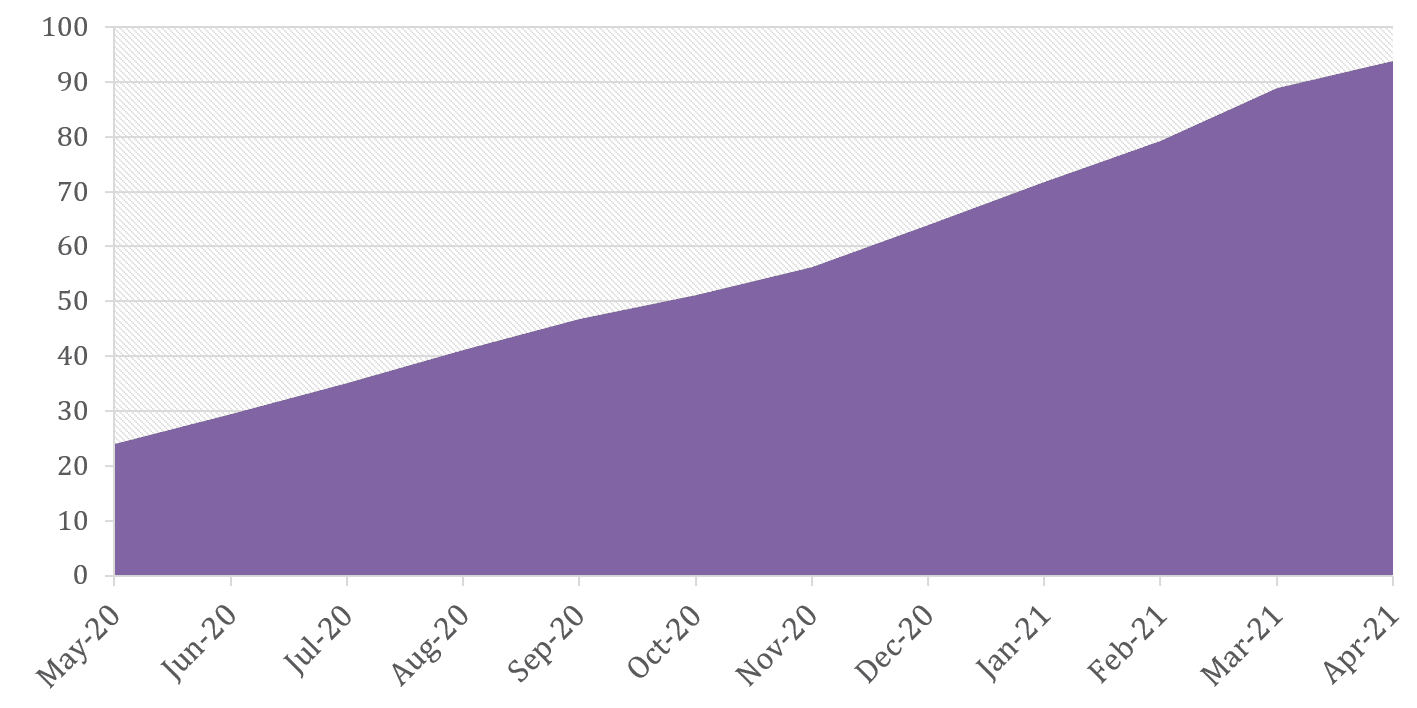

Crypto lending platform MyConstant has been at the top of our rising star ranking for months now, swapping the first and second place with Lendermarket. It’s no coincidence – cryptocurrencies have been booming during the COVID-19 pandemic. The volumes have surged and the prices of main cryptocurrencies have skyrocketed. Not only adventurous investors and hedge funds have driven this crypto hype – respectable, well-established institutions, including Goldman Sachs and Citigroup, are also tapping into it.

No surprise that the world of crypto has also reached the peer-to-peer lending sector. Total value locked in DeFi lending has risen over seventy-fold over the last year, from $0.6 to $43 billion, according to DeFi Pulse. The steady growth of MyConstant in our monthly reports at around 400% annually seems to reflect this broader trend well.

So, should you also be investing in crypto lending? Proponents say that blockchain is the future of financial services as it provides a cheaper, more efficient and accessible way for lenders and borrowers to access and offer credit. Open-source codes with algorithms that set rates in real-time based on supply and demand can further diminish the role of the middlemen – which is the essence of P2P lending.

Critics argue that such sites are untested, unregulated and prone to coding bugs and hacks. Many analysts see the crypto craze as nothing more than the next overblown bubble that is inevitably going to burst, leaving many investors with huge losses. Relatively high returns on crypto P2P loans are a warning in themselves – remember, a high interest rate almost always means high risk. Inexperienced investors can be particularly vulnerable to promises of crypto. The FCA – the British financial regulator, has recently addressed the uptake in high-risk investments, acknowledging that “too often consumers are investing in high-risk investments they don’t understand”, which can lead to “significant and unexpected losses”, and announcing they will try to “reduce the risk of people taking on inappropriate, high-risk investments that don’t meet their needs”.

So, what’s the bottom line? The simple moral would be to always be aware of the risks associated with financial instruments you’re getting into. If you want to know more, stay tuned with the P2PMarketData blog for more insights, news and guides for crypto-based P2P lending.

P2PMarketData is the world's largest discovery tool of online alternative investment websites. Compare over 500 alternative investment websites from all over the world in the Alternative Investment Search Tool.