Crypto Lending: How to Earn Interest on your Cryptocurrency

If you are comfortable lending in Euros, British Pounds, or Dollars, then why would you bother lending cryptocurrencies too? Crypto P2P lending is about more choices for both borrowers and lenders. You are taking advantage of the P2P matchmaking that platforms like Mintos or VIAInvest do but with one major difference. You get the added benefits of digital, programmable money that are cryptocurrencies like Bitcoin or Ethereum, too.

With crypto lending, investors have more options and more ways to earn interest. You can lend USD and get Bitcoin, or you can lend Tether (USDT) and earn Ethereum. Or you can lend Ethereum and get paid in Ethereum if you want.

More options are good, but why bother?

Imagine that you find a P2P platform where you want to invest. You like the loan offerings, potential returns, and you even like the platform itself. But you can’t. Common reasons why you might not be able to invest include:

- You aren’t a citizen or resident of the right countries.

- You don’t have the right currency in your bank account.

- You live in a country that’s currently under global sanctions.

- The country where the platform is doesn’t like the leaders of your country.

- Other reasons that have nothing to do with you or your money.

- Banking and investing laws are country-specific. What you do in Country A is against the laws in Country B.

And you don’t have to be in a place like Iran or Venezuela to have this problem. American P2P lenders can invest on Prosper but not on Zopa. European lenders can lend on Twino but not on Lending Club (before the Radius Bank acquisition – now no one can lend on Lending Club).

What if you want access to non-EU resident borrowers?

You can lend to a borrower wherever they are as long as you agree on an interest rate with crypto peer-to-peer lending. Your borrower is transnational. Where they live doesn’t matter. What currency is in their bank account doesn’t matter. Exchange rates don’t matter. Because they will be paying you in cryptocurrency, not Pesos or Naira or Rubles. They agree to pay you in crypto, which you can keep or exchange out for home currency.

Diversification out of your home market and out of your home currency; these are just two reasons why you should loan part of your money as cryptocurrency. Now let’s look at how.

Brief Introduction to Blockchain Technology

Blockchain technology empowers cryptocurrencies and crypto lending. It’s a distributed database spread out over many computers in locations all over the world. The use of cryptography protects the database. And it’s not just a database, it’s also a ledger.

Blockchain is a digital redesign of the ledger. Since ancient times, ledgers store commercial transactions. Yet, they have always been prone to errors because they have relied on human inputs. A public blockchain like Bitcoin does not rely on humans or trust. It’s known as a ‘trustless’ system. Nodes of the network confirm transactions. Nodes verify the sender has the cryptocurrency to send to the receiver. The information of each transaction goes into a block, and each block forms a part of the chain. It is almost impossible to change the data inside a block once it becomes part of the chain. This quality of immutability is one of blockchain’s best features. The data stays well preserved for historical records, governments, or criminal/legal proceedings forever.

The universal problem of online money without an intermediary like a bank is how to solve the double-spending problem. The problem is based on the idea that if you have $1 online, how do we prevent you from sending that $1 to two different people and spending that one dollar twice. Confirmation of transactions by the network in the same way that Visa or Mastercard approves a card transaction is how. The network, maintained by independent 3rd parties (the node operators), is how Bitcoin solves this problem. An extra protection is that the nodes keep a copy of the entire transaction log of its blockchain. People can go back and look at the history of transactions on this online ledger through a system called Proof of Work.

Think about what this means for a second. You don’t have to wait to see if Visa or Paypal or your bank approves the transaction because you have the available cash or credit (or does not approve it). No one can prohibit you from transacting with another person with cryptocurrencies as long as you have the money in your balance. Blockchain is decentralized (no central entity like a bank). It’s censorship resistant, too (when you are declined even when you have the money because the bank does not like something in the transaction).

How Is P2P Lending with Crypto Different?

Powered by blockchain technology and some of its benefits, like being trustless, makes crypto lending different from lending dollars or Euros. Let’s examine the main differences.

Data Transparency

Part of the ethos of cryptocurrencies is transparency. Anyone can go in and look at any transaction at any time that’s on the blockchain. We talk here often about the transparency at platforms and how important it is. ANY crypto platform will have lots of statistics from their platform and information to share with you as a potential lender.

Many crypto platforms get regular audits to show proof of their reserves and overall financial health.

The Cryptocurrencies You Lend Are Different than Fiat Money

For something to be money, it has to be a unit of account, store of value, and a medium of exchange. All the cryptocurrencies available to borrow or lend on these platforms are mediums of exchange, but they are not all money like USD, EUR or GBP.

With crypto, we and those we lend to get a common unit of account. Having a common unit of account is an essential feature as it enables transactions between people living anywhere in the world without the hassle (and fees) involved in exchanging fiat currencies.

When you are lending cryptocurrencies, you are lending one of three options:

- Bitcoin, Ethereum or Litecoin, which are known as Layer 1 Networks. The native token of BTC, ETH, or LTC (there are others) is the token powered by their respective blockchain. This is the option most similar to how people think about money created by a Central Bank. In these cases, the production comes not from a Central Bank but from the blockchains. These tokens are the most like money and many believe BTC and ETH are money.

- Stablecoins like USDC, DAI or USDT. These coins focus on price stability. Lending or borrowing these would be like operating in Singapore Dollars, Hong Kong Dollars or Belize Dollars. These are three currencies who are NOT US Dollars but keep their currencies pegged to the US Dollar to keep their currencies consistent in price.

- Other (mostly Ethereum based) tokens. Ethereum has a standard for tokens called ERC-20. Most tokens are ERC-20 based and compatible, making them easy to lend and borrow. Wrapped BTC (WBTC) and Binance Exchange Token (BNB) are two examples available to lend or borrow. Lending these tokens is like lending or borrowing in assets with a commonly known value like artwork, wine, or stamps. There is a known market for these assets, and they have value, but they are not directly money themselves. They are not a unit of account or a medium of exchange.

The point is that other assets that have value but are not money are lendable as cryptocurrencies, where only fiat money is lendable in the traditional economic system. This means more flexibility for you as a lender.

Collateralized Lending

The idea behind crypto lending is that any crypto lender can lend to any crypto borrower they want. And how do platforms make this happen? Two ways: Cryptocurrency and Collateral. The cryptocurrency part we’ve discussed already as these are the assets we borrow and repay. But lending to a transnational borrower who could be in England, Denmark, the US, Argentina or China is a challenge. The only way to protect lenders coming from economic and credit systems as different as these is through the collateral.

Every loan on a crypto lending platform is overcollateralized. This means that for every $100 you borrow, you must post and secure collateral on the platform of $120, $150 or even $200. Now why would someone borrow money in this way? Some reasons include:

- Personal Needs or lack of personal liquidity.

- Tax implications in many countries are different for borrowing than selling.

- A temporary cash need.

- You don’t want to sell your crypto for cash because you want to hold it for the long term. You believe its value will continue to grow.

Use of Smart Contracts

Starting on Ethereum and dominant on their network, smart contracts are key in protecting lenders. A smart contract is a self-executing contract where the terms are preprogrammed into the contract. The technology monitors the contract AND enforces it for you. If the terms are not satisfied, the algorithm in the contract notices. The algorithm automatically enforces the terms returning your collateral to you and taking the collateral from the borrower.

The amazing thing about this technology is that you, as a lender, are not reliant on people or the platform for enforcement. It’s automatic. We discussed earlier how blockchain is a trustless system where trust in another centralized entity like a bank is not required. The use of a smart contract is trustless, too. You are not trusting the platform to enforce your lending terms. The contract itself does it.

Crypto Lending Liquidity Pools

Another big difference when lending crypto compared to fiat money is that it provides you with an option aside from p2p matching. Maybe you just want to earn your interest rate of 4-9% and not go through the p2p lending process to scan for matches and agree on funding that could be delayed.

You can bypass the whole process of p2p lending if you want. You can invest your crypto into a liquidity pool that lends your money out at a fixed rate to any borrower who puts up the required collateral. This method is easy, fast, and your money is working right away. There’s no waiting to see if the loan you like and invest in gets fully funded or not.

This method is popular. Compound Finance, one of the new generation of DeFi (decentralized finance) platforms, lends only through liquidity pools and currently has $3.86 billion dollars in collateral locked up for borrowers. Compound is not the largest of the DeFi crypto lenders, yet they would be in the top 10 in funding volume if we put them on our front page. They would rank higher than well-known platforms like Twino and Bondora. All the largest DeFi platforms have more than $USD 32 billion of collateral in use on their platforms.

It’s no fad. Crypto lending is here to stay. Now we will look at some of the platforms themselves.

Best Crypto Lending Platforms

The peer-to-peer lending and liquidity pool options in crypto p2p lending make for two good passive income opportunities for lenders. You can see how with factors like:

- openness and transparency of data and

- use of money that is outside the existing financial system

that legacy financial institutions would see this as disruptive and threatening. And you would be right.

Because the technology is so new, the opportunities are excellent and will be for a while. This is nowhere near an efficient, competitive market like the market for oil, sugar, or Eurodollars. Instead, because it is new, you can earn outsized returns without the outsized risks while the rest of the world discovers what crypto is about.

Below, we will explain how these platforms are using the cryptoeconomy to their advantage along with a brief guide on how to get started as an investor or borrower.

In most cases, you cannot invest and earn interest directly using fiat money like USD, EUR, or GBP. You will need to convert your home currency to crypto on an exchange. One example of an exchange where you can easily convert GBP or EUR to crypto is Coinbase. If you want to borrow on a crypto lending platform, you must own an accepted cryptocurrency to use as collateral for the loan. You will need an approved asset to borrow or lend on these platforms.

MyConstant

MyConstant started as a stablecoin (CONST) project in January 2019, launching a digital currency backed by the US Dollar at the CES 2019, a big tech event in Las Vegas. In May 2019, MyConstant launched its crypto lending platform. Their goal is to tackle some of the central challenges with the traditional economic system discussed earlier in this article. To solve these problems, the Constant team wants to deliver on two central areas:

- Give investors control over amounts, rates, and terms.

- Secure all lending with collateral to protect investors’ funds. This avoids human errors in credit checks and risk evaluation.

How does the MyConstant crypto lending platform work?

To sum it up, as an investor on the MyConstant platform, you have two options: Flex and Crypto P2P Lending. Your best option depends on whether you want to control who you lend to or earn more interest in certain cryptocurrencies.

The Flex option takes advantage of the liquidity pools we mentioned. Your money goes into a pool and is lent right away with no waiting and matching. There are three great benefits with this option:

- You can withdraw anytime you like

- There are no fees (except possibly from your wallet or exchange)

- Interest is compounded constantly. No waiting to start to earn interest

The crypto p2p program works the same way as other peer-to-peer matching programs in fiat currencies. If you own cryptocurrency already, you can lend it and earn up to 11 % APY, depending on which crypto you receive as payment. All loans are fully backed by collateral, which is sold if a borrower defaults on payments. The forced sale on default is written into the smart contract. MyConstant lets you set your own loan term, giving you the option to choose between terms of 1 month, 3 months, and 6 months.

If you want to know more about how crypto lending on MyConstant works, read our detailed review of MyConstant.

CoinLoan

CoinLoan was founded in 2017 by Alex Faliushin and Max Sapelov to tackle one specific problem. Many investors in crypto assets believe in HODLing long term. What they don’t want to do is sell their cryptocurrency just to get some cash. Thus, CoinLoan was born as a platform for loans secured by digital assets as it went live in July 2018. In March 2020, CoinLoan started offering fiat-to-crypto loans with the possibility of using both fiat and stablecoins as collateral.

The CoinLoan Interest Account

CoinLoan’s investment product is the CoinLoan Interest Account and promises an interest income of up to 12.3% APY. Interest accrues daily in the currency of your deposit starting from the moment you deposit funds and you can withdraw anytime you like. You pay no fees for either deposits or withdrawals in Euro and stablecoins.

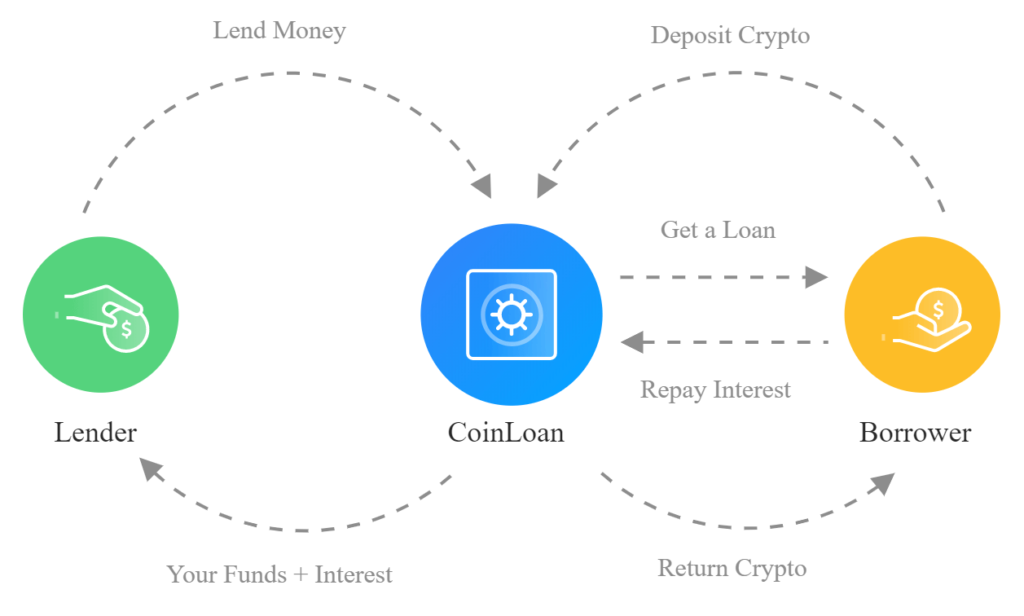

The lending process and the role of CoinLoan can be illustrated this way:

As we see from the illustration above, the lending operation on CoinLoan works similarly to a bank. They use part of your deposit to create loan offers, here just in the form of crypto-backed lending. The entry barrier is also relatively low on CoinLoan, with a minimum deposit of approximately $100 (varies depending on the asset).

You can earn the highest returns with staking CLT, the CoinLoan utility token. Staking is important for the cryptoeconomy but not important if all you want to do is lend and make money. We will be looking at staking crypto as an investment in a future article.

Below you see a list of the available assets with the annual percentage yield with and without the staking of CLT.

BlockFi

BlockFi was founded in 2017 with the aim to enable holders of cryptocurrency to do more with their digital assets. Unlike many other crypto lending businesses, all BlockFi’s financing came from institutional investors and not from an ICO (initial coin offering). BlockFi is based in New York.

At the moment, BlockFi offers two financial products to holders of cryptocurrencies:

- An interest account where you lend your crypto to earn compound interest.

- Crypto loans where you can raise funds using your cryptocurrency as collateral.

The BlockFi Interest Account

With the BlockFi interest account, you can lend your Bitcoin, Ether, or GUSD to earn compound interest in the cryptocurrency of your choice. All you have to do is store your cryptocurrencies at BlockFi, which uses your crypto assets to generate interest. The interest pays out monthly, and you can expect to earn up to 6% interest annually.

To generate interest, BlockFi lends the assets held in interest accounts to corporate and trusted institutional borrowers. These loans are typically in the form of overcollateralized crypto-backed loans in a structure common to other crypto lending platforms. The difference is BlockFi is running a very centralized lending business model as they do not directly match borrowers and lenders but act as the lender themselves. They are a crypto version of a balance sheet lender.

A nice thing to highlight is that BlockFi puts client funds at the top of the capital stack, meaning that BlockFi will take a loss before any client will in the case of defaults. This creates a healthy incentive structure where it is always in the interest of both BlockFi and its clients to control the risk of the loans issued.

To earn interest on BlockFi, you must have a minimum balance of 0.5 BTC or 25 ETH, so the entry barrier is quite high. However, for investors with large cryptocurrency holdings the BlockFi, interest account could be an interesting option to earn interest while HODLing.

Crypto-backed Loans with BlockFi

BlockFi is offering crypto-backed loans to holders of Bitcoin, Ether, and Litecoin, which allow crypto holders to access liquidity in USD without selling their cryptocurrencies. This can be an interesting option for cryptocurrency investors with some of the needs we’ve discussed already (like taxes) for borrowing instead of selling.

In a traditional bank, you would normally have to provide some sort of collateral to obtain a loan. This could be in the form of, e.g. a business or real estate. To obtain a crypto loan at BlockFi, you must stack either Bitcoin, Ether, or Litecoin as collateral. The amount of collateral you need to provide depends on the loans LTV (loan-to-value). BlockFi offers loans with an LTV of up to 50%. This means that if you stake 1 BTC, BlockFi will allow you to take out a USD loan with a value of 0.5 BTC.

When using crypto lending, you need to be aware of margin calls, which will be activated if your crypto assets decrease in value. At BlockFi, the first margin call occurs at 70% LTV, which means that the crypto asset used as collateral has dropped by 50% since your loan was issued. To avoid liquidation of a portion of your collateral, you will need to bring down the LTV to a healthy range, which you do by either adding more collateral in the form of crypto or paying down the loan balance. If no action is taken, BlockFi will lower the LTV back into the safe zone by liquidating some of your collateral. You will receive notification emails if your LTV is approaching 70%.

Applying for a loan at BlockFi is easy, and you will receive a loan offer within a business day. There is no prepayment penalty if you decide to repay your loan early.