Henrijs Jansons: How Ventus Energy Is Powering Growth in Renewable Energy Investment

Ventus Energy has quickly established itself as one of the fastest-growing digital investment platforms for renewable energy in Europe. By combining renewable energy infrastructure projects with investor-friendly features like daily interest and early-exit options, the company has attracted thousands of lenders since launching in 2024. Now led by former Debitum Network CEO Henrijs Jansons, Ventus is entering a new phase with the launch of its regulated fund in Estonia. In this interview, Jansons shares how the platform works, what sets it apart, and where he sees Ventus Energy heading in the coming years.

For those new to Ventus Energy, could you briefly explain what the platform does and what makes it unique?

We are energy production company and our income comes from sales of heat to district heating operators and electricity sales in Nordpool exchange and Grid balancing. Ventus Energy uses online platform to attract Mezzanine capital that typically together with senior loans are used to acquire operational power plants and development projects. What makes us unique is that we have 100% focus on our own projects and we are also enabling retail with smaller tickets to invest in energy sector that previously was only accessible to institutional investors.

You previously led Debitum Network. What drew you to join Ventus Energy, and how has the company evolved since you took on the CEO role?

That is an interesting story - I met my Ventus co-shareholder Jānis while working at Debitum as we were reviewing potential investments in energy sector. Although I was keen to move ahead, the new shareholders opted to focus their efforts on the forestry business, where they have the strongest expertise.Since I was newbie at forestry, I opted to quit and since Jānis and I already were in touch, we decided to meet up in a small coffee shop and just one hour later agreed to work together on this common goal.

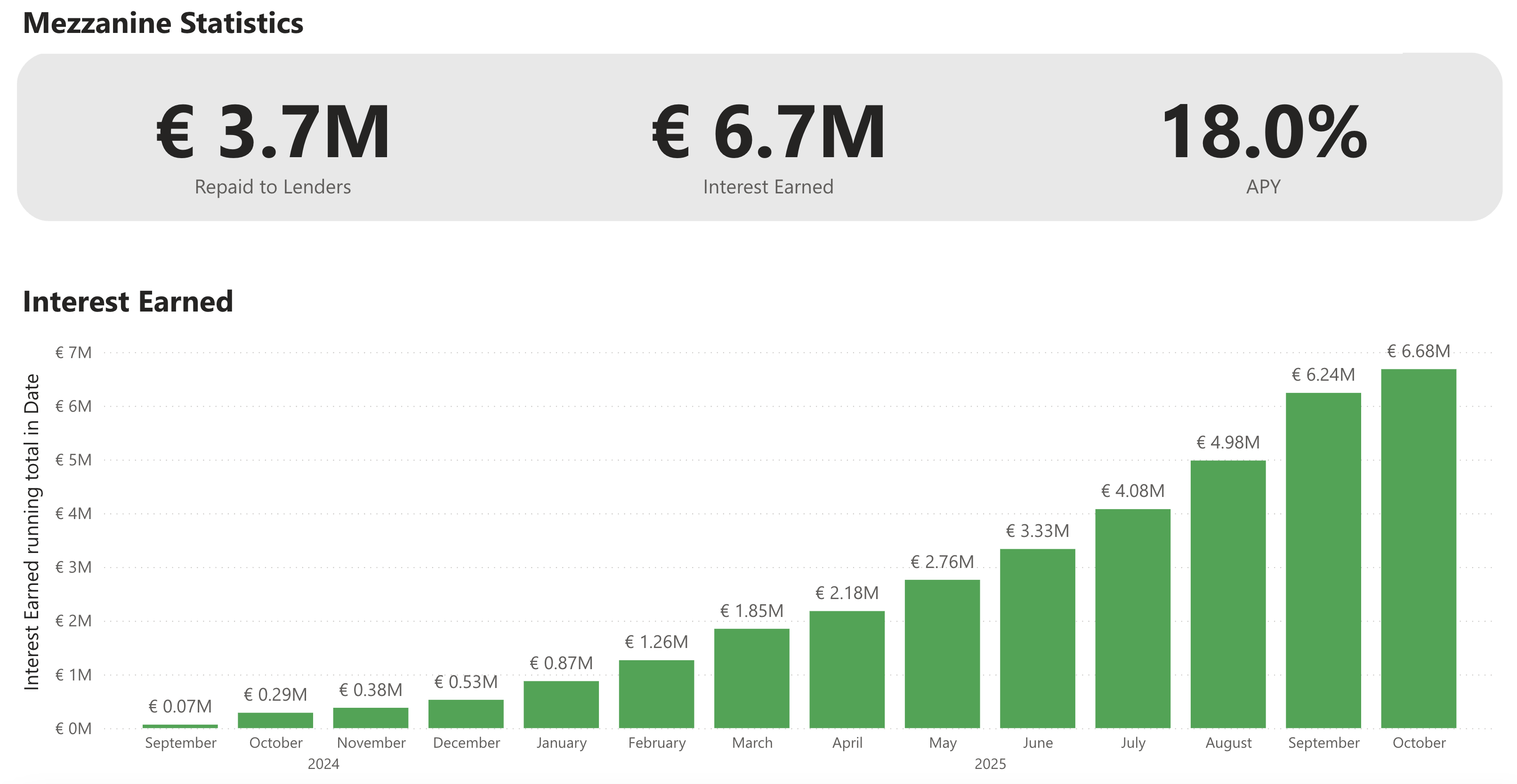

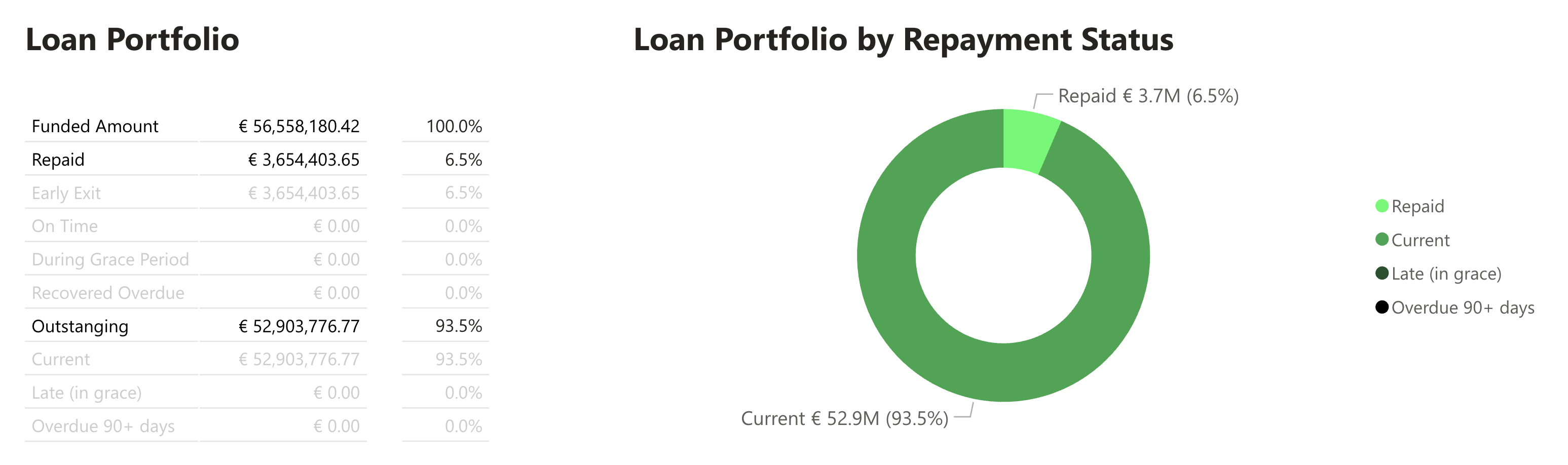

In its first year, Ventus has achieved exceptional growth - building a €50M outstanding mezzanine loan portfolio, acquiring multiple operational plants across three countries, and commissioning its first BESS park. With two more parks set to launch by the end of the year, making Ventus the largest private heat provider in Latvia’s capital.

Ventus Energy has grown rapidly since launching. How do you identify and evaluate the projects that appear on the platform, and what does your due-diligence process look like?

My partner Jānis is expert in the heating industry as he has also been chairman of cogeneration power plant association for more than 10 years. Igors is expert in Solar and BESS parks with also 10 years of development experience and recently we have entered in a cooperation with Sergejs who is a Wind park expert in Lithuania.

Criteria for new projects are one of the following:

- Sale price considerably lower than real value generated

- We see potential for upgrades that will translate in higher output and valuation

- Distressed assets that can be bought at significant discount and re-deployed in another location for value maximization

Who are the key members of your leadership team, and what expertise has enabled you to scale so quickly?

Jānis, Igors and Sergejs are our core technical experts, while Toms (CMO), Arvis (COO) and myself are experts in the p2p segment. Our legal and compliance team of Gvido of Anna brings 20 years of banking and fintech legal know how. Put all this together with unique Energy product and you have a recipe for success.

You recently registered the Ventus Energy Fund under the Estonian Financial Supervisory Authority. What does this step mean for your investors, and will the fund be open to retail investors or only institutions?

Fund is mainly made for long-term institutional investors willing to commit at least 100 000 EUR. Interest rate here is expected to be between senior and mezzanine rate so we can have various funding sources and lower average capital cost. But if any retail investor is looking forward to join we will individually look at each case and once compliance and source of funds is passed they are very welcome to join.

Looking at your performance so far, what kind of returns have investors achieved, and how do you see returns evolving as you add new projects?

Average return with loyalty bonuses and campaigns is ~18% but of course as our group acquires and develops more and more operational power plants and refinances projects with senior/institutional lenders, the interest rate will decrease for mezzanine capital as the monthly EBITDAs increases hence, or cash flow becomes stable and predictable. Even now, monthly return of the power plants is enough to cover interest rate expenses.

Ventus Energy offers features like daily interest payments and early-exit options. How do these work in practice, and what should investors know about liquidity?

For me it was important to create a platform I would like to use, so now that I am co-shareholder I have ability to influence and shape the user experience for end user. Of course, we also took a look at best practices and it is no secret that Bondora Go&Grow daily interest is well regarded. So simple answer – taking the best from the market and adding some cherry on top from ourselves – like, for example, compounding feature that allows to reinvest and gain maximum return within the same project. Energy Projects are not comparable to consumer loans and they are long projects (typically 3-5 years) therefore we added early exit option that based on liquidity allows investors to step out of the project prematurely. So far liquidity has been excellent with fastest early exit being less than 2 seconds since requests while on average the requests are processed within 3-5 days.

What are the main risks of investing in Ventus Energy, and how do you mitigate them?

As in each industry there are multiple risks and I will name a few:

- Regulatory risk – Energy sector is a regulated business, therefore changes in law can affect the revenue. We mitigate the risk by having our co-shareholder in cogeneration power plant association with direct opportunity to lobby and contest such changes.

- Product risk – If electricity prices would significantly decrease some of power plants would earn less. We mitigate it by having multiple products for sale like Heat, electricity and grid balancing so we can either switch to more profitable one (Nordpool electricity exchange vs Grid balancing).

- Resource cost risk – Again here we are mitigating by having several options, For example, we can produce heat by using wood chips, Gas engines and early next year also waste burning (which is subsidized).

- Refinancing risk – As every business we want to have as low the cost of capital as possible. However, if for some reason we would fail to refinance mezzanine part in the fund or bank, then we have distributed project repayments over time in such a way we should be able to just repay them using our free cashflow generated by power plant operations.

After such fast growth, what key milestones are you aiming for in the coming year?

To be honest it is not our aim to be very large mezzanine platform – our core business and focus lies with stable revenue from operational power plants via sales of heat and electricity. Therefore, the key milestones are:

- Refinancing of mezzanine capital with senior loan of at least one project

- Reach and surpass stable 1 Million EUR Monthly EBITDA

- Strengthen our position as leading Heat provider in capital city of Latvia

- Expand in the heating market within region of Latvia

- Enter new markets

Finally, how do you see Ventus Energy’s role in Europe’s transition to renewable energy over the next five years?

Too much renewable energy is not good for society, because it is impossible to control wind and sun therefore the grid needs to balanced and that is were we see opportunity with Ventus as we actively upgrade our wind and solar parks with BESS (Battery storage systems) that allows it to perform balancing in a way that the green energy does not turn into a disaster and shutdown of cities (like it recently happened in Spain for couple of hours). All in all, Ventus aims to provide stable and predictable energy to Europe!