Crowdfunding Industry Market Update 2023 [Survey of 70 Platforms]

In this article, we explore the current state of the investment crowdfunding market, including up-to-date statistics and direct insights from industry leaders. What are the top investment and platforms in 2023? How has the sector evolved over the years? How resilient are the key players amidst changing macroeconomic conditions? Is new European regulation going to redraw the rules for crowdfunding platforms?

Investment Crowdfunding market in a nutshell

Global markets overview: Where are the investment crowds?

Almost half of all worldwide investment crowdfunding platforms in our database are based in Europe. Big and mature European economies tend to host most of them, including the UK (94), Italy (66), France (63), and Germany (46). However, if we correct for the market size, the Baltic states stand out. Estonia hosts the most platforms per capita – about 22 per 1 million people, followed by Latvia (4.7) and Lithuania (3.9). By comparison, in the UK, there are only 1.5 platforms per million people, in Italy – 1.1 and Germany – 0.6. Finally, countries in Central, Eastern, and South-Eastern Europe seem to lag in the crowdfunding craze. Some big markets like Poland, Hungary, and Romania have almost non-existent alternative investment markets.

However, by investment volume, the US still likely surpasses the entire old continent. According to the Cambridge Centre for Alternative Finance, the US was by far the largest market in the world in 2020, having funded $73.62 billion of total volume (corresponding to 65% of the global market share). Europe trailed far behind with $22.6 billion, over half of which came from the UK alone ($12.6 billion).

Number of platforms worldwide (n=914)

Sectoral breakdown: Many faces of investment crowdfunding

Globally, investment crowdfunding generally offers high-risk high-return opportunities. Looking at investment segments, equity platforms (including start-up and real estate equity) account for almost half of all platforms, while peer-to-peer lending trails at around one-third share of all platforms. The growth of the “other” segment, including mostly crypto and collectible investments is also notable.

Share of worldwide platforms by expected return and investment segment

However, investment products vary across markets. For example, Europe is the cradle of debt investments, while the US rocks the venture sector. Furthermore, the US is much more prone to purely digital investments: almost a third of all alternative investments there go to crypto and collectibles.

A look back: Investment crowdfunding growth

European market dynamics amidst global slowdown

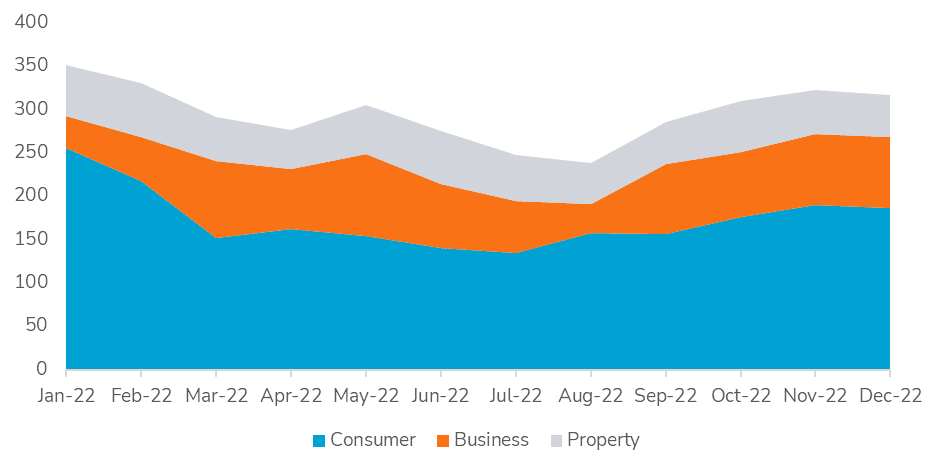

In 2022, monthly funding volumes reported to P2PmarketData decreased quite sharply in the first quarter, driven mostly by the invasion of Ukraine and the resulting declines in consumer lending in the resale lending platforms with exposure to the Russian and Ukrainian markets.

Funding volumes in the second quarter and throughout the summer were mostly dragged down by historically the largest lender – Mintos. Mintos went from funding almost €200 million worth of loans in October 2021 to just €35 million in July 2022. Business lending also entered a usual summer slowdown in July-August.

The end of the year ended on an optimistic note with funding volumes finally climbing back to roughly the levels of late 2021, fuelled by both Mintos’ rebound and the renewed activity in the business sector.

Monthly funding volumes (€ millions) based on data reported to P2PMarketData (n=34)

Overall, 2022 was a relatively ‘slow’ year for the investment crowdfunding sector compared to its average (even if extremely rapid) historic growth. However, given the circumstances, and compared to other asset classes, investment crowdfunding performed “rather well” as one industry player put it:

The war in Ukraine, the rise of inflation and interest rates, and the pessimistic economic forecasts were big challenges for the sector. However, it went rather well, and for sure better than other asset classes like stocks or crypto.

Klear

Long-term growth

Looking over the longer time horizon, we notice two major trends. First, the sector is dynamic and prone to shocks. Investments slumped during the first Covid wave between February and April 2020, and the market contracted in 2020 by about 23%, compared to 2019. 2022 was another, albeit milder depression in response to unfavourable global macroeconomic situation. These shocks, however, ‘mould’ and strengthen the emerging sector:

Overall, the sector is healthier than it was a few years ago. The COVID period has shown the resilience of some platforms, (…) and has pushed others to improve the quality of their assets.

Klear

Second, despite the recent turmoil, the sector has been growing exponentially, more than doubling the funding volumes between 2018 and 2022, according to data platforms have reported to us:

Historically, the sector has weathered environmental factors relatively well. The global pandemic, supply chain difficulties and political instabilities have not stopped the progress of the crowdfunding sector.

Max Crowdfund

Monthly and annual funding volumes (€ millions) reported to P2PMarketData (n=34) and gathered via the online survey (n=27)

Hot topics

Tough macroeconomics

Respondents to the P2PMarketData survey – leading investment crowdfunding platforms, put fiscal and monetary macroeconomic conditions at the top of the main challenges the sector is facing in early 2023:

The combination of higher rates, higher inflation, and fear amongst investors caused several casualties among P2P firms that had not planned sufficiently for potential changes in economic conditions.

LandlordInvest

However, platforms also point out the ‘cleansing’ effect of tough market conditions and their role in strengthening the market by pressuring platforms to improve risk assessment practices and de-incentivise high-risk investments. Finally, in some segments, the unfavourable macro conditions may even be stimulating:

Interest rate hikes can actually be beneficial for P2P industry (especially for real estate), as the money becomes more expensive and not so easily accessible, it will bring higher quality projects to P2P, as the money from the bank is not that much cheaper.

Reinvest24

Key challenges of 2022/2023: percentage of respondents (n=70)

Invasion of Ukraine

In spring 2023, the impressions on the impact of the invasion of Ukraine on investment crowdfunding and its severity vary.

Key challenges of 2022/2023: percentage of respondents (n=70)

The invasion of Ukraine had the most profound impact on platforms with exposure to the Ukrainian and Russian markets. In March, these platforms saw their funding volumes plunge by, on average, 24% month-to-month.

Impact of the invasion of Ukraine on funding volumes: Monthly growth of funding volumes by platform category

*These are resale marketplace lending platforms: IUVO, Mintos, PeerBerry, Robocash, and Twino.

In the short term, we saw a similar market reaction as previously described in the aftermath of the Covid crisis and other shocks – the fleeing of capital to lower risk and predominantly business- or property-focused national (Western European) platforms:

Once it was clear that the war was picking up momentum, many international investors began to shy away from not only the public markets in the Baltic region but also from funding Baltic marketplace lenders and focused on supporting Western Europe, UK and the UK lenders.

NEO Finance

Going into 2023, we can also see the war’s medium-term effect on the wider market by disrupting supply chains (hurting many real estate development projects) and further deteriorating macroeconomic and financial stability:

Due to the economic situation and Russia’s war against Ukraine, there was a lot of uncertainty, challenges, and unanticipated changes in the market. A lot of real estate projects slowed down or went into stagnation because of broken construction material supply chains and newly arisen logistical issues.

Letsinvest

ECSP

The new EU Regulation on European Crowdfunding Service Providers (ECSP) might be the hottest topic of 2023. It lays down uniform rules across the EU for the provision of investment-based and lending-based crowdfunding services related to business financing.

Overall, the market impression of ECSP impact is positive insofar as it is expected to provide more certainty for cross-border investments:

It is an important facilitator to cross-border crowdfunding, which has been thus far hindering the growth of the European sector. (…) ECSP adoption will likely transform the industry by providing a homogenised, cross-border European framework for the first time.

Max Crowdfund

Expected impact of the ECSP: percentage of respondents (n=51)

However, several industry players also emphasised its bureaucratic burden on, particularly new and small, platforms:

The ECSP license has increased the entry barrier significantly for new market participants. For the long-term P2P industry success, it is required, to eliminate all fraudulent activities and to have high standards regarding platforms procedures. But in the short-term, it will slow down the innovation (…).

Reinvest24

The progress toward the actual certification of platforms remains slow, although most industry players in the EU/EEA have either applied for the license or are planning to do so. Among those not interested in the ECSP license, the main reasons include the platform activity not falling under the ECSP provisions, no interest in operating across EU borders, or having already another (national) license.

ECSP applications: Percentage of respondents (n=53)

Future outlook: Key trends reshaping the sector

Investment crowdfunding penetrating the world of finance

All industry players have agreed that investment crowdfunding will be gaining popularity. Regarding its role in an investment portfolio, although most see it as an intrinsic element of any ‘standard’ future portfolio, views are more diverse.

Investment crowdfunding's long-term role: percentage of respondents (n=49)

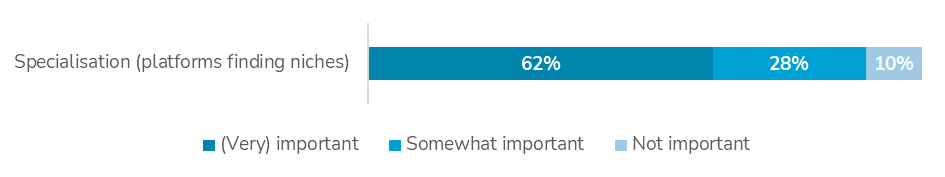

At the same time, most industry players agree that finding niches where platforms can specialise and fill in gaps created by the ‘traditional’ financial institutions will be an important future challenge.

Key future trends: percentage of respondents (n=70)

Many platforms emphasised the potential of investment crowdfunding to thrive in adverse macroeconomic conditions – from the ‘cleansing’ effect to the increased demand for good risk-return ratios:

Record high inflation made the question “where to invest?” more relevant than ever and dissatisfying stock and bond market performances made investors look for alternative investment options.

Letsinvest

The demand side (borrowers) is also increasingly drawn to alternative funding sources where traditional financing is either unavailable or inefficient, especially for SMEs and developers:

Real estate developers are starting to appreciate the flexibility, time-efficiency, relative simplicity of receiving funding through crowdfunding platforms. The process of receiving a bank loan is extremely long, expensive and (…) often unsuccessful. Crowdfunding platforms fix this market failure (…).

Letsinvest

Bankisation

While competition for both borrowers and investors is developing between crowdfunding platforms and financial institutions, the cooperation with banks is another long-discussed modus operandi in the industry. However, it is generally assessed with caution by industry leaders:

I think that many of us in the industry were expecting more cooperation between platforms and banks. We’ll see if it’s just a delay in time or if there is a structural incompatibility or simply fierce competition…

Klear

Another aspect is the cooperation amongst platforms and fintechs. Although also progressing slowly, it holds much more potential for the future, according to most respondents:

This area has a lot of room for development and it's likely that we see some new setups and collaborations in the near future.

Reinvest24

Finally, platforms turning into banks is the ultimate sign of integration of investment crowdfunding with the mainstream financial markets. It started in the UK with the ‘big three’ of P2P lending (Zopa, RateSetter, and Funding Circle) all acquiring banking licences and ceasing P2P operations. Through 2022 and 2023, we’re seeing a continuation of this trend, most notably with the Finnish P2P giant Fellow Finance shutting down its lending operations in April 2022. Although bankisation is not generally seen as a major future trend by industry leaders (likely because it only concerns a minor share of active platforms), it does impact the shape of the sector:

On one hand, it is very positive as it shows that new lenders can become very successful and reach an “established” position. On the other hand, it is a bit sad to see these companies simply bailing out the crowd who was essential in their early stages, just for the reason of cost efficiency… (…) Here is the key question: will we see one day a very big lender funding its operations mainly with the crowd, without becoming a bank?

Klear

Key future trends: percentage of respondents (n=70)

Institutionalisation

Closely related to bankisation, while also bringing investment crowdfunding into the realm of mainstream financial markets, is the progressing institutionalisation of the sector. The penetration of the European markets by institutional investors varies a lot, from about 8% in the Baltics to 93% in Italy. However, there is a consensus that institutionalisation of investments is on the rise and will steer how the sector evolves.

Key future trends: percentage of respondents (n=70)

Institutionalisation surely fuels the growth of the sector and provides larger funding volumes to the investment pool. But many platforms also recognise the impact of institutionalisation on the stability and sustainability of the market:

The institutionalisation of the sector is very important for a number of reasons: (1) it creates more detailed analysis of the investment opportunities, (2) it increases the information requirement for potential investments, (3) it increases investment capacity and transparency for the sector thus increasing investment volumes, and (4) it creates a framework for reporting and asset management, thereby creating increased confidence for retail investors (…).

NEO Finance

Regulation

With the talks about the ECSP on the front pages, how policymakers will shape the sector is one of the most significant factors expected to shape the sector in the near future.

Key future trends: percentage of respondents (n=70)

Furthermore, even though some concerns are being raised about the short-term effect of the ECSP, overall, there is a clear and profound preference within the industry for regulation.

The need for regulation: percentage of respondents (n=61)

Finally, although the ECSP is the main theme in 2023, it is essential to look at other examples. For example, the UK market, where regulators have historically been more proactive in establishing a playing field for alternative investments, can serve as a benchmark for Europe:

We’ve noted that firms regulated by the UK’s Financial Conduct Authority (FCA) have to date been required to adhere to higher standards in terms of advertising messaging, risk warnings and the like.

LandlordInvest

Conclusions

In summary, one horizontal issue surfaces a lot when looking at the investment crowdfunding sector today, and that’s balance. The market is trying to find its equilibrium, with the economic and political crises threatening its stability but also clearing the field from (often irresponsibly) high-risk players. Market players are looking forward to regulation that would provide more security and a level playing field while not stifling the fast-growing industry. And finally, investment crowdfunding is still trying to find its place in the broader financial market, navigating between institutionalisation and bankisation and (still quite extreme) deregulation.

Acknowledgments

We would like to extend our gratitude to the employees and owners of the 70 participating alternative financing platforms from all over the world. Not only did they respond to our survey, but they also graciously allowed us to acknowledge their participation publicly. We truly appreciate their cooperation and transparency.

Angels Den, Debitum, easyMoney, Scramble, Inversa, InRento, DomaCom, microLEAP, WiSEED, Common Owner, Opyn, Neighborhood Ventures, CITESIA, P2Vest, FinClub, The Money Platform, StockCrowd IN, Occollo, Fundkiss, Axiafunder, Strataprop, Secure Living, Lande, Crowdlender, Tribe Funding, ITS Lending, goPeer, Hive5, Bildap, Mainvest, Perx, 3circlefunding, Genervest, Bondster, Look&Fin, Finbee, FarmAField, Ener2Crowd, ViaInvest, Capitalia, Flex Funding, CG24 Group, HeavyFinance, Africa GreenTec, Crowmie, Žltý melón, Groundfloor, Robo Cash, Lendermarket, Twino, Rendity, Savy, Klear, Kirsan Invest, Profitus, PeerBerry, Loanpad, CapitalRise, Raizers, Colectual, Kuflink, Esketit, Lendwise, FinoMark, LandlordInvest, Evenfi.