The Monthly Funding Report: October 2021

What happened last month in peer-to-peer lending and real estate crowdfunding? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last 12 months? We look at numbers reported to P2P Market Data in October 2021 and dive deeper into this month’s focus: Mintos’ post-Covid recovery.

About the monthly report

In the monthly funding report, we publish the funding amounts of online crowdfunding platforms. We track data from 72 participating platforms, operating in 24 markets and 9 different currencies. Please note that:

- The statistics exclude some prominent platforms such as Lending Club, Funding Circle, and Prosper, which remain open only for institutional investors and do not share their data.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms’ publicly available loan books and statistic pages.

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

This month, we’ve welcomed one new platform into our database – Tribe Funding (a resale marketplace lending platform offering investments from various funding platforms). You can check out the whole dataset at p2pmarketdata.com!

Key highlights: What happened last month in crowdfunding?

We recorded a total funding volume of €550m in October 2021 – an increase of 13% compared to September 2021. After three consecutive months of decline, the total funding volume sprung up and reached the highest level in the last 12 months. Over the past year, the whole sector has grown by 38%, at a 4% monthly growth rate on average.

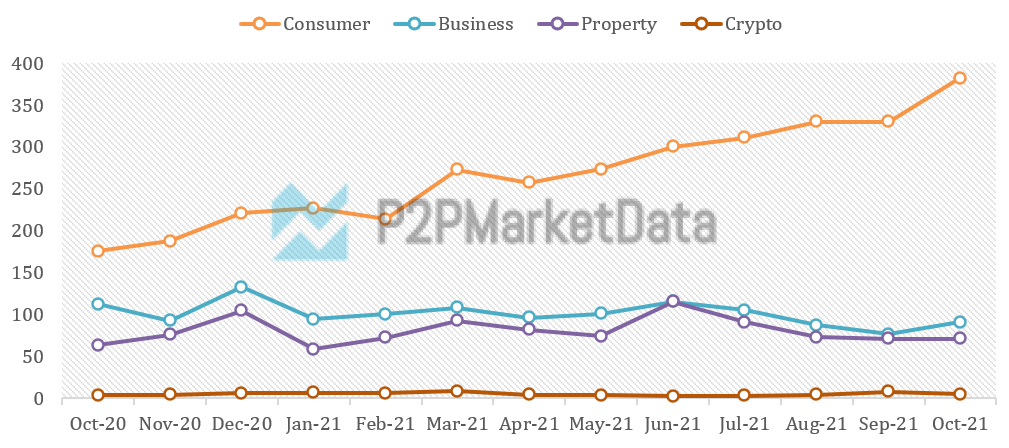

Looking at funding across the main investment types, consumer and business lending increased by 16% and 19%, respectively, crypto lending decreased by 38%, and property lending recorded no change compared to September 2021. Consumer lending remains by far the most common investment category in our dataset.

We reported several noteworthy milestones reached last month:

- Afranga and Klear – two Bulgarian platforms have funded more than €10m worth of loans since their inception.

- Bondora has crossed the €500m total funding threshold.

- Twino has reached over €900m of total funded loans to date. Congrats!

Platforms’ performance: How did the key players do in October 2021?

Mintos funded the most loans in October 2021, followed by PeerBerry and Opyn. Overall, the five largest platforms accounted for 62% of the total funding volume recorded in our database, while the ten largest platforms funded 75% of the total volume. The largest players were most likely to be direct marketplace lending platforms (6 out of 10), come from Latvia (3 out of 10), and offer consumer investments (6 out of 10).

EvenFi – an Italian business lending platform, has been the fastest-growing platform in the last 12 months, followed by Opyn and Lendermarket. The “rising stars” were most likely to be direct marketplace lending platforms (9 out of 10), come from Italy (3 out of 10), and offer property investments (4 out of 10).

Viventor, Housers, and Finansowo have grown at the slowest rate. Overall, the slowest-growing platforms were most likely to be direct marketplace lending platforms (7 out of 10), come from Latvia (3 out of 10), and offer consumer investments (4 out of 10).

*We only take into account platforms with total funding volumes higher than €10 million.

A deep dive: ups and downs of Europe’s largest marketplace lending platform

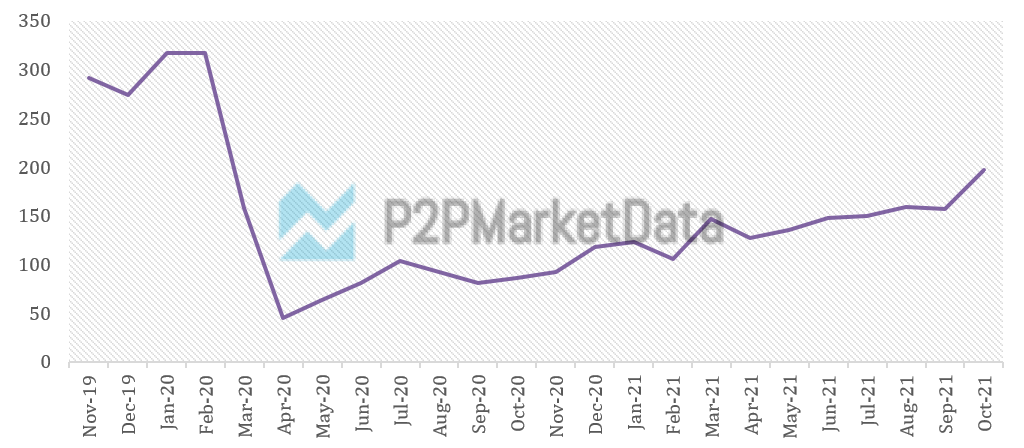

Mintos’ monthly funding volume shot up from €157m in September to €197m in October 2021 – an impressive 25% increase. Although the current funding level still doesn’t match those Mintos used to attract pre-Covid, we can see its stable recovery from the troubled times.

And troubled times they were – Mintos was arguably among the platforms worst hit by the Covid crisis. Between February and April 2020, its monthly funding plummeted from over €300m to less than €50m. The economic turmoil hit investors’ profits too, as many borrowers were unable to make loan repayments. In the whole of 2020, annual returns fell below 1%, from 11-12% in previous years. The company also laid off several employees – the number of staff went down from 177 in 2019 to 161 in 2020. Finally, the company’s financial results were hurt – Mintos recorded a loss of almost €2m in 2020.

By the way – such a performance is not exactly a surprise. Our data suggests that platforms that operated nationally, offered low-risk low-return investments, and focused on real estate or business sectors went through the crisis most smoothly. Mintos checks none of these three boxes.

So, how did Mintos get from that low point to last month’s record funding volume? Soon after things started going south, the management reacted. Already in 2020, they hired a Chief Risk Officer and formed a new team dedicated exclusively to working with recoveries. They also improved communication with investors, introducing regular reporting about funds in recovery and live video sessions with the CEO and recovery team (Ask Mintos Anything). Finally, they launched new product features based on investor feedback (Mintos Strategies).

Lately, Mintos has introduced new breakthroughs. In August, it received an investment firm license from the Latvian regulator. In September, it announced a transition from investments in single loans to financial instruments called “notes”, which collate 6-20 underlying loans in a single product. Check out our interview with Mintos Head of Product – Marcis Gogis to learn more about this and other Mintos’ plans for the future.

What’s the bottom line here? Hopefully, Mintos showcases the crowdfunding industry’s learning process. Business models that proved vulnerable in times of economic shock are reforming. Platforms across the board increasingly emphasize investor trust through a mass drive toward (a) obtaining licenses and (b) improving transparency and communication. P2PMarketData is here to facilitate the latter – check out our refreshed website with more functionalities and plenty of new data!

P2PMarketData is the world's largest discovery tool for online alternative investment websites. Compare over 500 alternative investment websites from all over the world in the Alternative Investment Search Tool.