Funding Report for July 2022

What happened last month in the crowdfunding and marketplace lending markets? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last year? We look at numbers reported to P2PMarketData in July 2022 and dive deeper into this month’s focus: Direct Lending versus Indirect Lending.

About the monthly report

In the monthly funding report, we publish the funding amounts of online crowdfunding platforms. We track data from 71 participating platforms operating in 23 markets and 9 different currencies. Please note that:

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms' publicly available loan books and statistic pages.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

Explore the entire database with over 900 Platforms in the Platform Search Tool.

Key highlights: What happened last month with alternative investments?

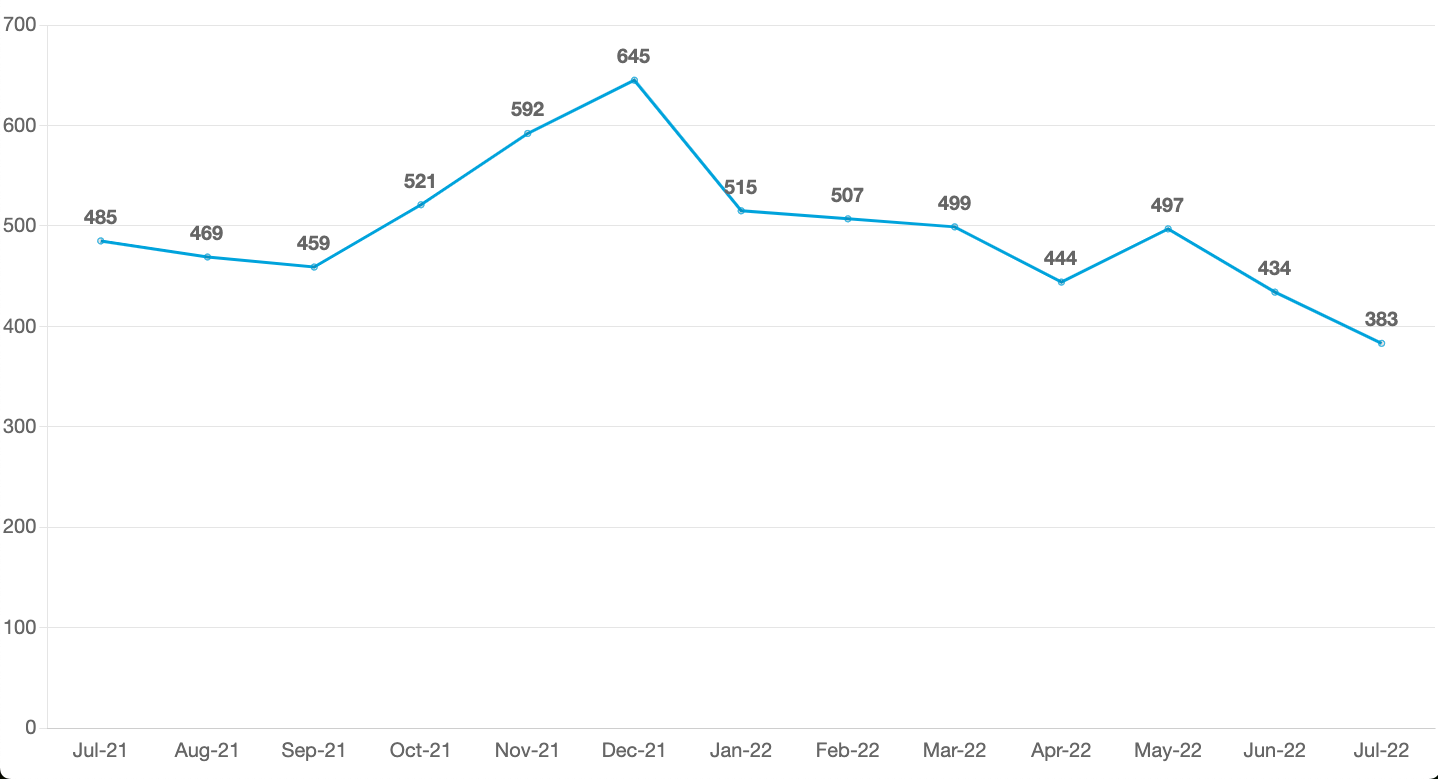

A slowdown in the alternative investment market continues as funding volumes have decreased for the second consecutive month. We recorded a total funding volume of €383m in July 2022 – a decrease of 12% compared to June 2022 (down from €434m).

The total monthly funding volume in July 2022 was lower by €102m compared to the same month in 2021 and reached its lowest level over the last year.

Looking at funding across the main investment categories, most funding in July 2022 went to platforms offering consumer investments (€175m), followed by business (€102m) and property investments (€100m). Consumer, business, and property lending volumes all decreased by 3%, 23%, and 12%, respectively, compared to June 2022.

Platforms’ performance: How did the key players do in July 2022?

Opyn funded the most loans in July 2022, followed by PeerBerry and Mintos. Overall, the five largest platforms accounted for 43% of the total funding volume recorded in our database, while the ten largest platforms funded 60% of the total volume. The largest players were most likely to be direct marketplace lending platforms (5 out of 10), come from Croatia (2 out of 10), and offer consumer investments (6 out of 10).

Income Marketplace – a resale marketplace lending platform from Estonia offering consumer investments, has been the fastest growing platform in the last year, followed by LandlordInvest and Blend Network. The “rising stars” were most likely to be direct marketplace lending platforms (6 out of 10), come from the United Kingdom (3 out of 10), and offer consumer investments (4 out of 10).

Ablrate, Lendwise and Bulkestate have performed the worst compared to the previous year. Overall, the declining or slow-growing platforms were most likely to be direct marketplace lending platforms (6 out of 10), come from Latvia (3 out of 10), and offer consumer investments (5 out of 10).

*We only take into account platforms with a total funding volume higher than €1 million.

Finally, we reported several noteworthy milestones reached last month:

- Estateguru has funded more than €600m worth of loans since its inception.

- CreditGate24 has reached over €1b of total funded loans to date. Congrats!

Deep dive: Direct vs Indirect Lending

We compared direct marketplace lending and resale marketplace lending in the November 2021 report. Among five key differences that showed up in our data, we concluded that the direct lending model seems more shockproof. We reflect on those conclusions today as the European “Resale Giants” have been having a harder time over the last few months.

While at the end of last year, funding volumes were similar in both categories, in July 2022, Direct Marketplace Lending is far ahead of Resale Marketplace Lending (€236 million vs €140 million funded loans). A big part of the puzzle is the decline of Mintos’ volumes, which we covered extensively in the April 2022 report (also June 2022 one). But most of the big Resale Lending platforms got a severe hit in the first half of 2022, including the seemingly better-performing PeerBerry. Overall, the top five Resale Marketplace Lending platforms’ volumes have declined by 45% in the last six months, while the largest Direct Marketplace Lending platforms have noted a substantially better performance growing 33% in the same period.

| PeerBerry | -38% | Opyn | 72% |

| Mintos | -60% | Estateguru | -7% |

| Robocash | -1% | Bondora | -6% |

| Lendermarket | 12% | October | 11% |

| Esketit | 136% | CrowdProperty | 61% |

| Resale Top 5 | -45% | Direct Top 5 | 33% |

Although we can’t say for sure what all the reasons for this divergence are, the recent uncertainty in the financial and non-financial markets might have contributed: Direct Lending generally seems safer and more predictable, while Resale Lending involves substantial geopolitical risks (due to lending in foreign markets and currencies). So, when crises loom – such as Covid, war, or fears of recession – capital might flee to the more secure, usually regulated and bound to a national market, Direct Marketplace Lending platforms. We’ll keep an eye out for how the situation unravels – for example, will the rampaging inflation draw more investors back to Resale Marketplace Lending platforms, which tend to offer higher returns?