The Monthly Funding Report: February 2022

What happened last month in the crowdfunding and marketplace lending markets? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last year? We look at numbers reported to P2PMarketData in February 2022 and dive deeper into this month’s focus: the impact of the Russian invasion of Ukraine on marketplace lending.

About the monthly report

In the monthly funding report, we publish the funding amounts of online crowdfunding platforms. We track data from 76 participating platforms, operating in 24 markets and 9 different currencies. Please note that:

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms' publicly available loan books and statistic pages.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

Key highlights: What happened last month in crowdfunding?

A slowdown in the crowdfunding market continues as funding volumes have decreased for the second consecutive month. We recorded a total funding volume of €532m in February 2022 – a decrease of 2% compared to January 2022 (down from €546m).

Looking at the longer term, the sector has grown by 43% over the past year, at a 1.5% average monthly growth rate. The total monthly funding volume in February 2022 was higher by €134m compared to the same time in 2021.

Looking at funding across the main investment categories, most funding in February 2022 went to platforms offering consumer investments (€298m), followed by business (€135m), and property investments (€93m). Business lending and property lending increased by 21% and 2% respectively, while consumer lending decreased by 11%, compared to January 2022.

Platforms’ performance: How did the key players do in February 2022?

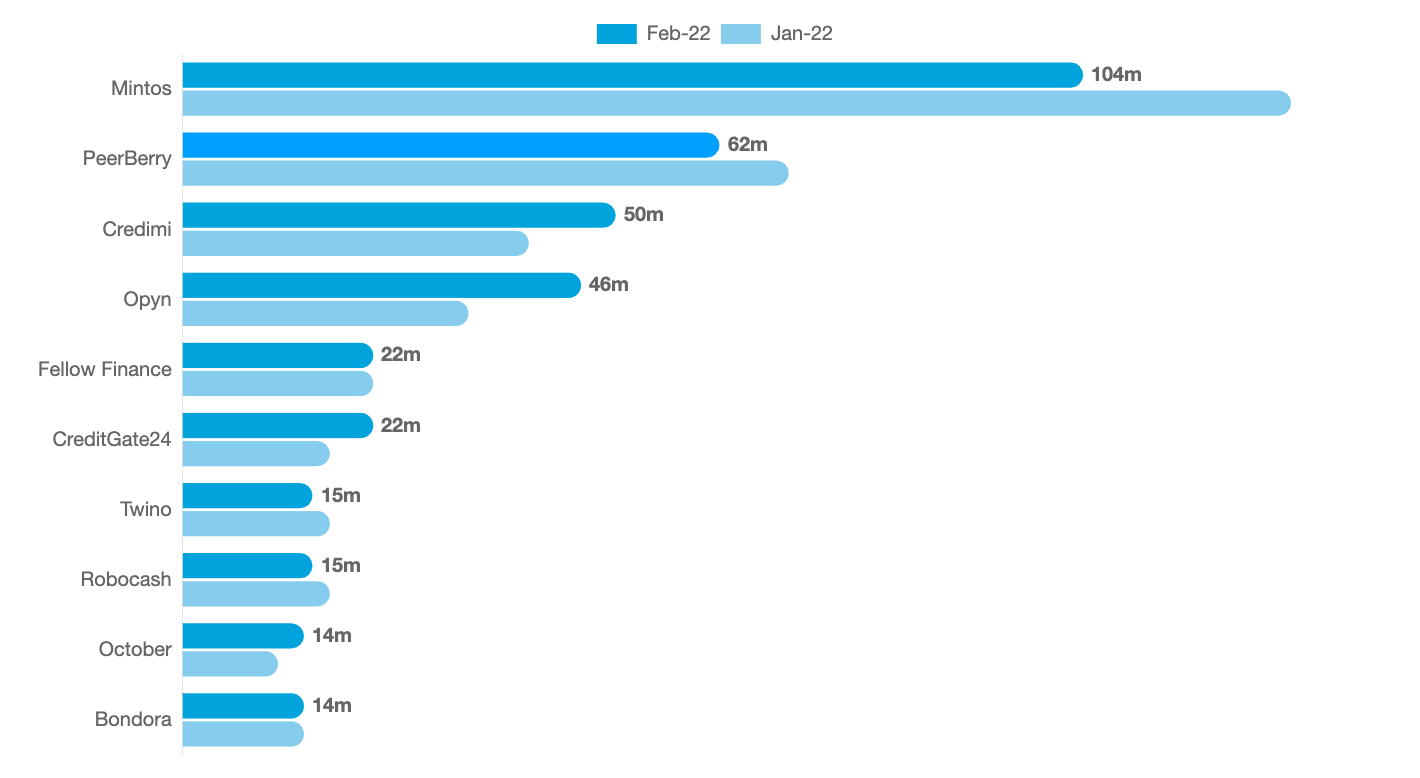

Mintos funded the most loans in February 2022, followed by PeerBerry and Credimi. Overall, the five largest platforms accounted for 53% of the total funding volume recorded in our database, while the ten largest platforms funded 68% of the total volume. The largest players were most likely to be direct marketplace lending platforms (6 out of 10) come from Latvia (3 out of 10) and offer consumer investments (6 out of 10).

Afranga – a resale marketplace lending platform from Bulgaria, offering consumer investments, has been the fastest growing platform in the last year, followed by Max Crowdfund and Kviku Finance. The “rising stars” were most likely to be direct marketplace lending platforms (6 out of 10), come from Italy (2 out of 10) and offer property investments (4 out of 10).

Viventor, Finansowo and Housers have grown at the slowest rate. Overall, the slowest-growing platforms were most likely to be direct marketplace lending platforms (7 out of 10), come from Latvia (2 out of 10) and offer business investments (4 out of 10).

*We only take into account platforms with total funding volumes higher than €10 million.

Finally, we reported several noteworthy milestones reached last month:

- Profitus, Supervest, and SAVY have all funded more than €50m worth of loans since their inception.

- Bondster has crossed the €100m total funding threshold.

- Raizers has broken above the €200m mark.

- Opyn has funded more than €600m worth of loans since its inception.

- October has reached over €700m of total funded loans to date. Congrats!

Deep dive: Ukraine invasion and marketplace lending

It’s difficult to draw any robust conclusions about the impact of war in Ukraine on the online lending and crowdfunding sector in Europe. First, it’s worth noting that business and property lending, which are usually confined to national markets, actually grew in February, suggesting good investor sentiment in Western markets. On the other hand, we did see a notable decrease in consumer lending, including on platforms with exposure to Ukraine and Russia such as Mintos (-19%), Robocash (-14%), PeerBerry (-11%), Twino (-8%), and IUVO (-8%). However, this trend of decreasing consumer loans’ volumes has continued for four months now and concerns pretty much all consumer lending platforms.

*These are: IUVO, Mintos, PeerBerry, Robocash, and Twino

Nonetheless, it’s curious to look at the platforms’ responses to the invasion – we can see two main lines of actions:

- Platforms exposed to Russian or Ukrainian markets reacted promptly and paused or terminated all lending activity from the two countries. For example, already on the day of Russian aggression (February 24th), Mintos, PeerBerry, and IUVO Group excluded all loans from Russia and Ukraine from their primary markets. All platforms seem to prioritise communication, posting frequent updates on recent developments.

- Some platforms stepped up to help. For example, HeavyFinance launched a campaign where they donate an equivalent of 2% of all investments made via their platform from their own account. Crowdfunding has also become a popular way to financially support Ukrainians. Media reports suggest that as much as $59 million have been sent to Ukraine in crypto assets alone. The Ukrainian government itself has announced the plan to issue NFTs to support Ukrainian Armed Forces.

Despite the rather positive reaction of most platforms and users, significant risks remain for investors with P2P investments in both Ukraine and Russia. Hryvnia and rouble plunged, causing potential losses on exchange rates, while several platforms temporarily halted exchange or withdrawal of RUB. Although repayment rates reportedly have not suffered much so far, banning most Russian banks from SWIFT might prevent Russia-based originators from transferring funds to foreign investors. Finally, the likely economic collapse in both countries (especially in sanction-struck Russia) might eventually lead to (much) increased default rates. We will continue to follow the latest developments and report on market responses, so stay tuned!

P2PMarketData is the world's largest discovery tool of online alternative investment websites. Compare over 500 alternative investment websites from all over the world in the Platform Search Tool.