The History of Crowdfunding

Crowdfunding as we know is a recent innovation. Supporting your favourite artists, funding charitable activities in your neighbourhood, lending money to real estate companies or investing in start-ups has never been so easy and so widespread. All you have to do is go online, pick the cause you care about and several clicks later, it’s all done.

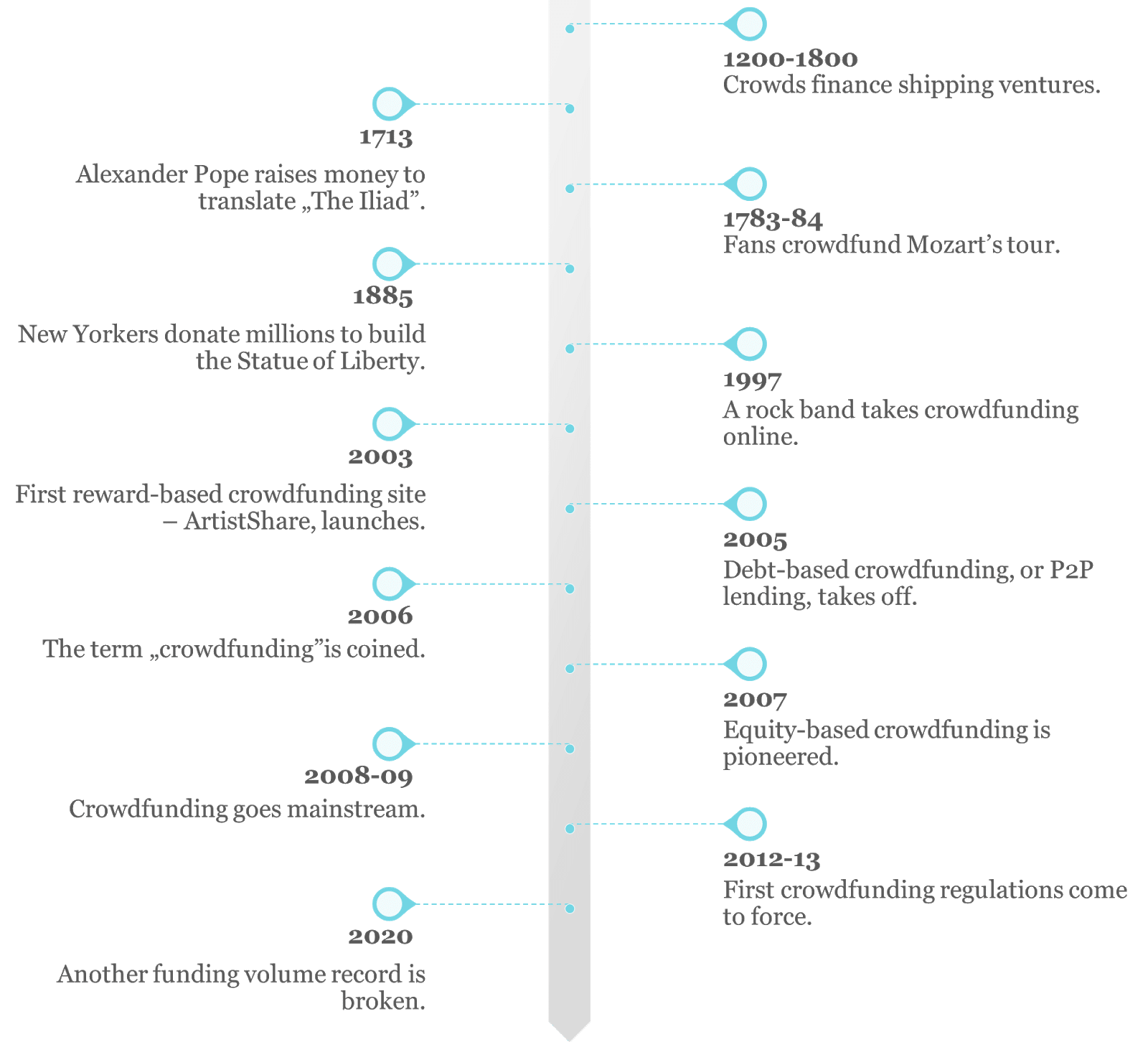

It doesn’t mean though that the core idea of mobilising “the crowd” to fund ventures is a new invention – it is not. So, when did crowdfunding start? The history of crowdfunding as a form of financing reaches centuries back. Of course, it has changed a lot ever since, but you’ll be surprised how familiar some of the “ancient” crowdfunding projects look. Here’s a quick summary:

1200-1800: Traders crowdfund shipping expeditions in exchange for profits.

As early as the 13th century, city traders were jointly providing the necessary financing for very risky, expensive and timely, yet exceptionally profitable, shipping expeditions. They then received a proportional share of the profits or bore a part of the loss. This approach provided shipping companies with a sensible risk management strategy, offered investors potentially high returns and gave the world an idea of how equity-based crowdfunding might work.

1713: Alexander Pope invents reward-based crowdfunding.

In the early 18th century, a young poet, Alexander Pope, was quite keen on translating Homer’s epic poem, “The Iliad”, into English. He lacked the necessary resources to publish the work though. What did he do? He turned to the people, asking donors to pledge two gold guineas to support his work in exchange for having their names published in the book. Alexander Pope probably ran the first-ever reward-based crowdfunding campaign and successfully completed the first creative project financed by the fans.

1783-84: Mozart crowdfunds his Vienna tour.

Even the great Mozart sometimes struggled to gather funding to “go on tour”. Setting out to perform three piano concertos in the Viennese concert hall, he sent an invitation to prospective backers offering concerto manuscripts to those who agreed to help finance the events. A total of 176 backers donated enough funds to make his tour happen.

1885: Fundraisers build the Statue of Liberty.

The erection of the Statue of Liberty might be the most famous and the most often cited historical case study of crowdfunding campaigning. As the Statue – a diplomatic gift from the French people to the US was being shipped from France, the efforts to raise funds for its pedestal stalled. Just when it seemed all means had failed, Joseph Pulitzer decided to launch a fundraising campaign in his newspaper The New York World. More than 160,000 New Yorkers chipped in to raise over $100,000 (just over $2.3 million in today’s dollars) in about five months.

1996-97: Crowdfunding goes digital.

Online crowdfunding gained the first momentum in the arts and music communities and the British rock band Marillion is widely credited for the inception of modern-day crowdfunding. Between 1996 and 1997, Marillion’s fans raised $60,000 through an Internet campaign to sponsor their tour in the US.

2003: The first crowdfunding platform – ArtistShare, launches.

Most likely drawing on the experience of Marillion and other artists that followed suit, the first “fan-funding” website – as it was then called, was established. ArtistShare is a platform where artists could seek funding from their supporters to cover their production costs in exchange for free, early access to the artist’s album, song or another piece of art. ArtistShare can be credited with developing the format that most modern crowdfunding platforms follow to this day.

2005: Debt-based crowdfunding takes off with the launch of Zopa

The first peer-to-peer lending platform – Zopa, kicked off in 2005 in the UK, followed by the launch of Lending Club and Prosper in the US in 2006. The P2P lending frenzy accelerated after the 2008-09 crisis to become, by far, the largest and fastest-growing crowdfunding branch. See our article on the history of Zopa and P2P lending if you’re interested!

2006: The word “crowdfunding” is born.

Seemingly unimportant, and yet what a deeply ground-breaking development this was! A young entrepreneur, Michael Sullivan, was running a support platform for video bloggers – fundavlog. Keen on spreading the word, he started a blog explaining the idea behind fundavlog as well as exploring the broader topic of online fundraising. Although his project ultimately failed, he came up with the term “crowdfunding”, which forever changed the face of the industry.

2007: Equity-based crowdfunding is pioneered down under.

The Australian Small Scale Offerings Board (ASSOB), launched in 2007 in Australia, is probably the world’s first known equity-based crowdfunding platform. It channels funding from both accredited and unaccredited investors to small businesses. Equity-based crowdfunding came relatively late to the Northern Hemisphere, with the launch of CrowdCube in the UK in 2011.

2008-09: IndieGoGo and Kickstarter launch; reward-based crowdfunding goes mainstream

The financial crisis of 2008-09 seems to have been a game-changer for the crowdfunding sector. Amidst the perceived collapse of the financial markets, many people turned to the Internet, and to each other, to seek funding. This period also marks the launch of two modern crowdfunding giants – IndieGoGo (2008) and Kickstarter (2009) as well as the proliferation of many other, niche crowdfunding sites. In just five years, crowdfunding has grown by 1,000% and the number of platforms globally has surpassed 450.

2012-13: First crowdfunding regulations are introduced.

In 2012, President Barack Obama signed the Jumpstart Our Business Start-ups (JOBS) Act, sometimes called the “Crowdfund Act”, into law. It legalized equity-based crowdfunding, i.e. allowed businesses to seek funding in exchange for shares in their company. It also put crowdfunding under a legal framework for the first time.

The British policymakers soon followed suit – in 2013, a set of rules was proposed regulating investment-based crowdfunding activities for the first time. In 2019, the UK went a step further and included top debt-based crowdfunding platforms in the Coronavirus Business Interruption Loan Scheme, recognizing the crucial role they play in channeling funds to British businesses.

2020: The highest-funded reward-based crowdfunding campaign to date is run.

Cloud Imperium Games has raised over $317 million for the development of their video game Star Citizen, breaking a record funding volume for a single project. They have been crowdfunding since 2012, both through crowdfunding platforms such as Kickstarter and their own website. They are unlikely to stay on top for a long time though – the record gets beaten rather frequently, which just shows how dynamic the sector is.

What’s next for crowdfunding?

It’s good to remember that some social phenomena that we often see as products of the internet era have in fact been with us for centuries. The great difference between Mozart’s times and ours is that thanks to the technology we have at hand, we can make things like crowdfunding widespread, if not universal. This ability to bring people together is an immense power – let’s hope that the future story of crowdfunding will be one about harvesting that power for good causes.