The Monthly Funding Report: September 2021

What happened last month in peer-to-peer lending and real estate crowdfunding? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last 12 months? We look at numbers reported to P2P Market Data in September 2021 and dive deeper into this month’s focus: the recent declines in business funding volumes.

About the monthly report

In the monthly funding report, we publish the funding amounts of online crowdfunding platforms. We track data from 70 participating platforms, operating in 24 markets and 9 different currencies. Please note that:

- The statistics exclude some prominent platforms such as Lending Club, Funding Circle, and Prosper, which remain open only for institutional investors and do not share their data.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms’ publicly available loan books and statistic pages.

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

Key highlights: What happened in crowdfunding last month?

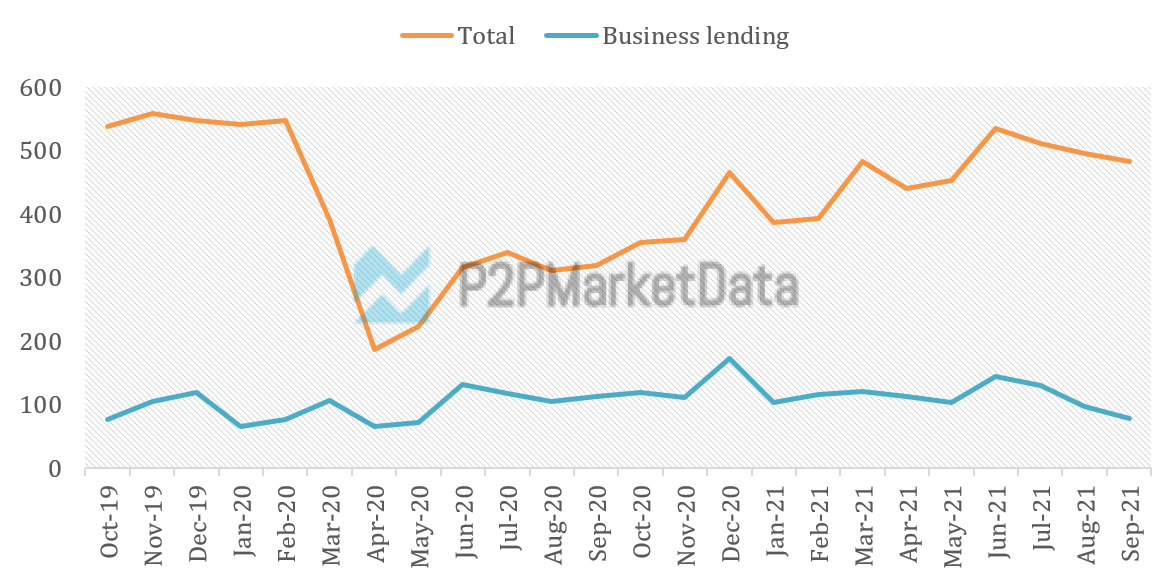

We recorded a total funding volume of €482.0m in September 2021 – a decrease of 3% compared to August 2021. Over the last 12 months, the whole sector has grown by 37%, at a 4% monthly growth rate on average.

Looking at funding across four main investment types, personal lending increased by 7%, business lending decreased by 19%, and marketplace and real estate lending recorded no change compared to August 2021.

Looking at the main currencies, funding denominated in CHF increased compared to August 2021 by 20%, while EUR and GBP funding decreased by 4% and 23%, respectively.

We reported several noteworthy milestones reached last month:

- Debitum Network – a Latvian business lending platform, and Lender & Spender – a Dutch personal lending platform, have both funded over €50m worth of loans,

- A US crypto lending platform – MyConstant, has crossed the €100m total funding barrier, and

- A Croatian marketplace lending platform – Robocash, has broken above the €300m mark.

Big player ranking

Mintos funded the most loans in September 2021, followed by PeerBerry and Opyn. Overall, the five largest platforms accounted for 57% of the total funding volume recorded in our database, while the ten largest platforms funded 72% of the total volume. The largest players were most likely to be marketplace lending platforms (4 out of 10) and come from Latvia (3 out of 10).

Rising star ranking

EvenFi – an Italian business lending platform, has been the fastest growing platform in the last 12 months, followed by Lendermarket and Opyn. The “rising stars” were most likely to be real estate lending platforms (5 out of 10) and come from Italy (3 out of 10).

Viventor, DoFinance, and Housers have grown at the slowest rate. Overall, the slowest-growing platforms were most likely to be marketplace lending platforms (4 out of 10) and come from Latvia (4 out of 10).

*We only take into account platforms with total funding volumes higher than €10 million.

The deep dive: Where is business marketplace lending going?

In the June report, we said that, in the long-term, business lending would most likely become the most prominent crowdfunding investment sector. Since then, we’ve seen a decrease in total funding volumes for three consecutive months… driven mainly by declines in business lending. What went wrong? Did anything?

Let’s look at the bigger picture first. When the pandemic first kicked in, crowdfunding volumes sharply dropped. But not for business lending – it grew and remained strong throughout the Covid crisis, as SMEs were borrowing to sustain their cashflows. This trend was even stronger in the bank lending sector – in the eurozone, corporate lending recorded a sharp increase at the start of the pandemic and remained high throughout. In the UK, a similar pattern emerged – in 2020, firms might have borrowed even four times more than the year before, partly thanks to government-backed lending schemes.

What should we expect after such a borrowing spree? The European Central Bank’s (ECB) mid-year bank lending survey (BLS) showed that banks expected an increase in firms’ demand for loans in the third quarter of 2021. When this didn’t materialise in the following months, some analysts blamed it on a “summer lull”. Although this might as well be the case, maybe eurozone bankers were too optimistic in the first place?

The EY ITEM Club Interim Bank Lending Forecast in the UK, around the same time, was predicting much slower business credit growth. The quicker-than-expected economic recovery, arguably, was making SMEs borrow less, not more. That’s because: (a) they didn’t need credit to stay afloat anymore, and (b) they emerged from the crisis with an already significant debt burden and needed to “repair their balance sheets” rather than borrow some more.

So, what’s next for business marketplace lending? The EY predicts that the slowdown in corporate lending will likely extend to 2022. But there is good news too. First, firms are expected to borrow less to merely keep their cash flow and take up more loans for investment purposes instead. Second, the increasing importance of business lending in the crowdfunding sector over the long term is still the most likely scenario. We will certainly be tracking and coming back to this topic in the future.