Funding Report for May 2022

What happened last month in the crowdfunding and marketplace lending markets? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last year? We look at numbers reported to P2PMarketData in May 2022 and dive deeper into this month’s focus: comparing the alternative investment scenes in Europe and America.

About the monthly report

In the monthly funding report, we publish the funding amounts of online crowdfunding platforms. We track data from 74 participating platforms, operating in 23 markets and 9 different currencies. Please note that:

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms' publicly available loan books and statistic pages.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

- We've modified our methodology for calculating platforms' growth rates. We now calculate a semester (six-month) growth rate of monthly funding volumes (rather than a 12-month growth increment in the total funding volumes as previously).

Credit.fr has been excluded from this month's report as they failed to report funding data on time.

You can check out the whole dataset at p2pmarketdata.com, and explore alternative investment opportunities in the Campaign Search Tool.

Key highlights: What happened last month in crowdfunding?

After a period of decline, the market rebounded this month. We recorded a total funding volume of €506m in May 2022 – an increase of 10% compared to April 2022 (up from €460m).

Looking at the longer term, the sector has grown by 41% over the past year, at a 2.8% average monthly growth rate. The total monthly funding volume in May 2022 was higher by €66m compared to the same time in 2021.

Looking at funding across the main investment categories, most funding in May 2022 went to platforms offering consumer investments (€210m), followed by business (€179m), and property investments (€110m). Business lending and property lending increased by 23% and 31% respectively, while consumer lending decreased by 4%, compared to April 2022.

Platforms’ performance: How did the key players do in May 2022?

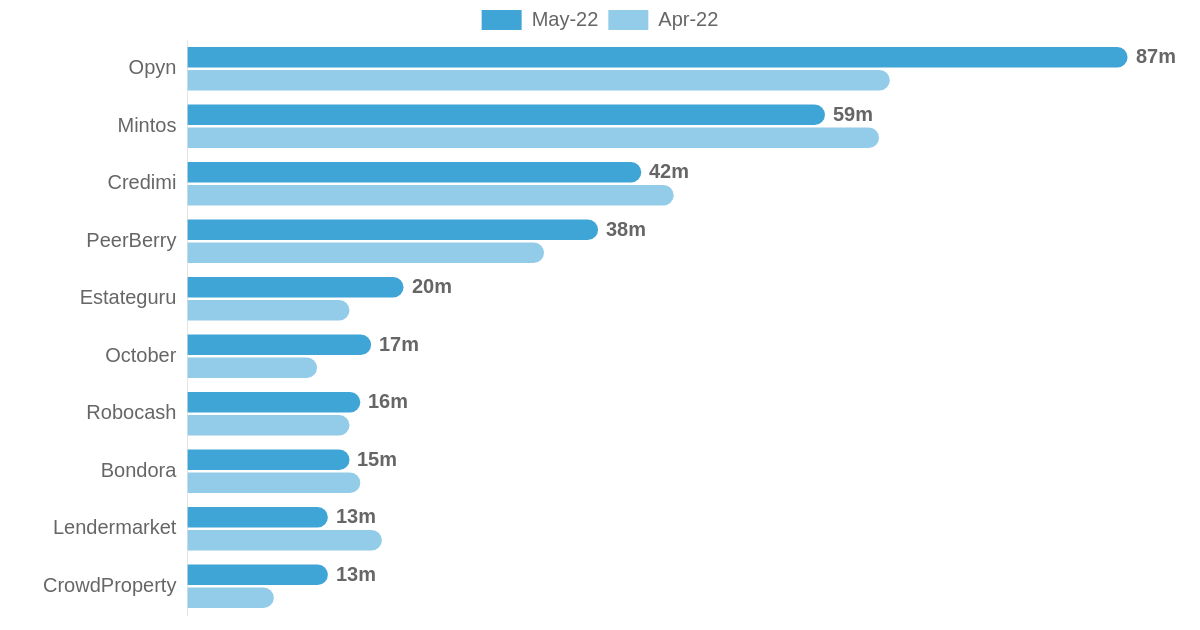

Opyn funded the most loans in May 2022, followed by Mintos and Credimi. Overall, the five largest platforms accounted for 49% of the total funding volume recorded in our database, while the ten largest platforms funded 64% of the total volume. The largest players were most likely to be direct marketplace lending platforms (6 out of 10) come from Italy (2 out of 10) and offer consumer investments (5 out of 10).

Flex Funding – a direct marketplace lending platform from Denmark, offering business investments, has been the fastest growing platform in the last six months, followed by Income Marketplace and Esketit. The “rising stars” were most likely to be direct marketplace lending platforms (7 out of 10), come from Denmark (2 out of 10), and offer property investments (4 out of 10).

Viventor, Ablrate and Lendwise have performed the worst compared to the previous six-month period. Overall, the declining or slow-growing platforms were most likely to be direct marketplace lending platforms (6 out of 10), come from the UK (4 out of 10), and offer consumer investments (4 out of 10).

*We only take into account platforms with a total funding volume higher than €1 million.

Finally, we reported several noteworthy milestones reached last month:

- Income Marketplace has funded more than €10m worth of loans since its inception.

- Esketit has crossed the €50m total funding threshold.

- Swisspeers has broken above the €100m mark.

- Swaper has funded more than €300m worth of loans since its inception.

- Bondora has crossed the €600m total funding threshold.

- Opyn has broken above the €800m mark.

- TWINO has reached over €1b of total funded loans to date. Congrats!

Deep dive: Alternative investments in Europe and America

In this monthly report, we celebrate P2PMarketData’s growing Platform Search Tool. With 800+ alternative investment platforms, we are currently the largest alternative investment database in the world (as far as we know). This gives us a great opportunity to analyse more data beyond the pool of our partner platforms. Here, we compare the two largest markets - Europe (432 platforms) and North America (195 platforms). And there are several notable differences!

First of all, Europe is P2P lending’s cradle. Two-thirds of all investment platforms are P2P lending sites, making it by far the most common investment model on the old continent. Other “traditional” crowdfunding platforms fill up the rest of the sector, including equity crowdfunding and donation and reward crowdfunding. Europe is also home to a large range of Resale Marketplace Lending platforms, which is not a common business model in North America.

In America, P2P lending is relatively less prevalent, likely because of less favourable legislation (virtually forbidden in its “pure” form). Instead, funds, fund marketplaces, online stockbrokers, and crypto and collectible trading platforms are much more common than in Europe.

The investment types are much closer in the two markets, although some nuances also emerge. Most notably, American platforms are more likely to focus on the crypto world than their European counterparts. European investors also have many more opportunities to invest in businesses via debt and equity.

The database continues to grow both in scope (more platforms) and depth (more detailed data about each), allowing us to draw more insightful analyses. Stay tuned for more comprehensive and in-depth insides in the future!