Funding Report for February 2023

What happened last month in the alternative investment markets? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last year? We look at numbers reported to P2PMarketData in February 2023 and dive deeper into this month’s focus: A comparison of the two largest debt resale platforms - Mintos and PeerBerry.

About the monthly report

In the monthly funding report, we publish the funding amounts of online alternative investment platforms. We track data from 34 participating platforms, operating in 15 markets and 4 different currencies. Please note that:

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms' publicly available loan books and statistic pages.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track

You can check out the whole dataset at p2pmarketdata.com and explore even more alternative investment platforms using our Platform Search Tool.

Key highlights: What happened last month in alternative investing?

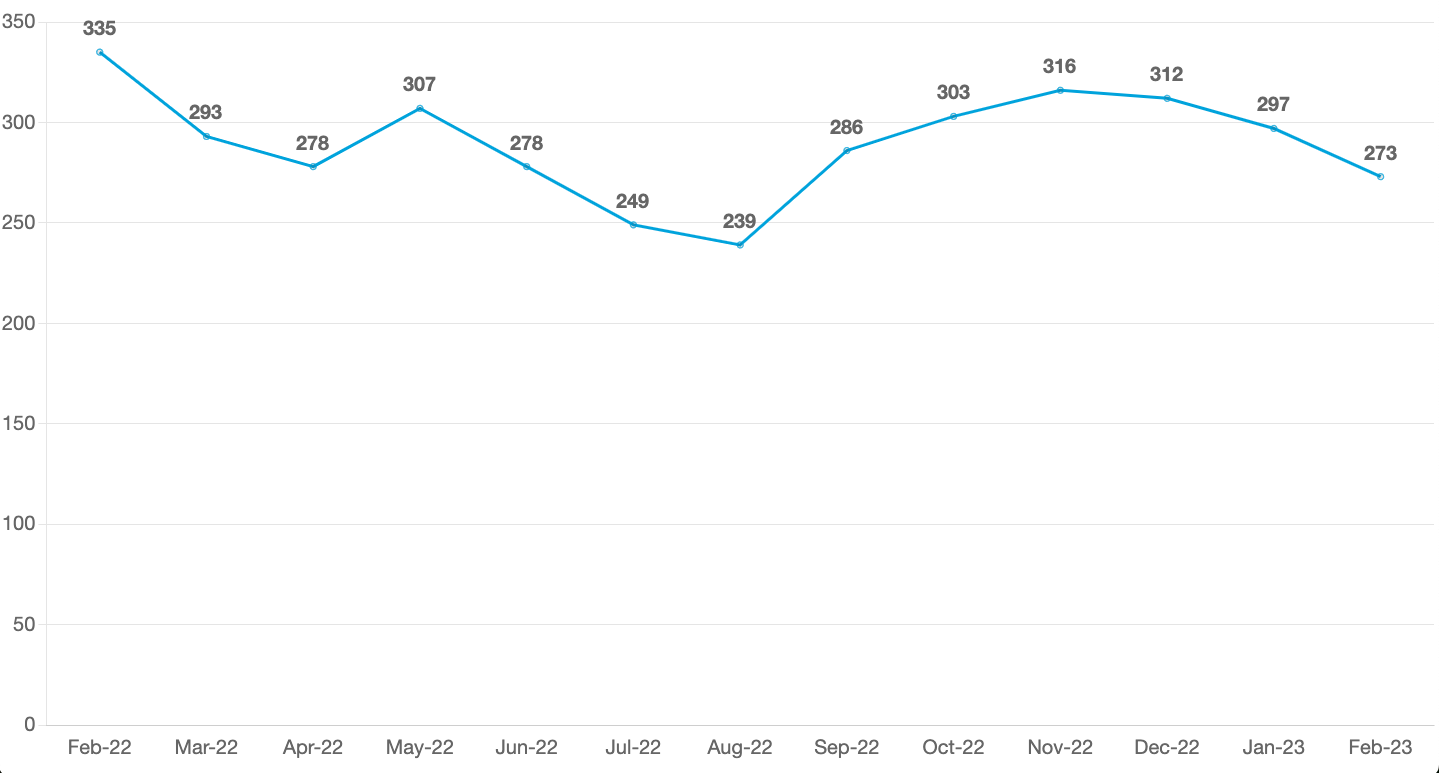

A slowdown in the alternative investment market continues as funding volumes have decreased for the third consecutive month. We recorded a total funding volume of €273m in February 2023 – a decrease of 7% compared to January 2023 (down from €295m). The total monthly funding volume in February 2023 was lower by €61m compared to the same time in 2022.

Looking at funding across the main investment categories, most funding in February 2023 went to platforms offering consumer investments (€184m), followed by business (€61m), and property investments (€28m). Business lending increased by 9%, while consumer lending, and property lending decreased by 7%, and 33% compared to January 2023.

Platforms’ performance: How did the key players do in February 2023?

Mintos funded the most loans in February 2023, followed by PeerBerry and Opyn. Overall, the five largest platforms accounted for 76% of the total funding volume recorded in our database, while the ten largest platforms funded 88% of the total volume. The largest players were most likely to be resale marketplace lending platforms (6 out of 10), come from Croatia (2 out of 10), and offer consumer investments (6 out of 10).

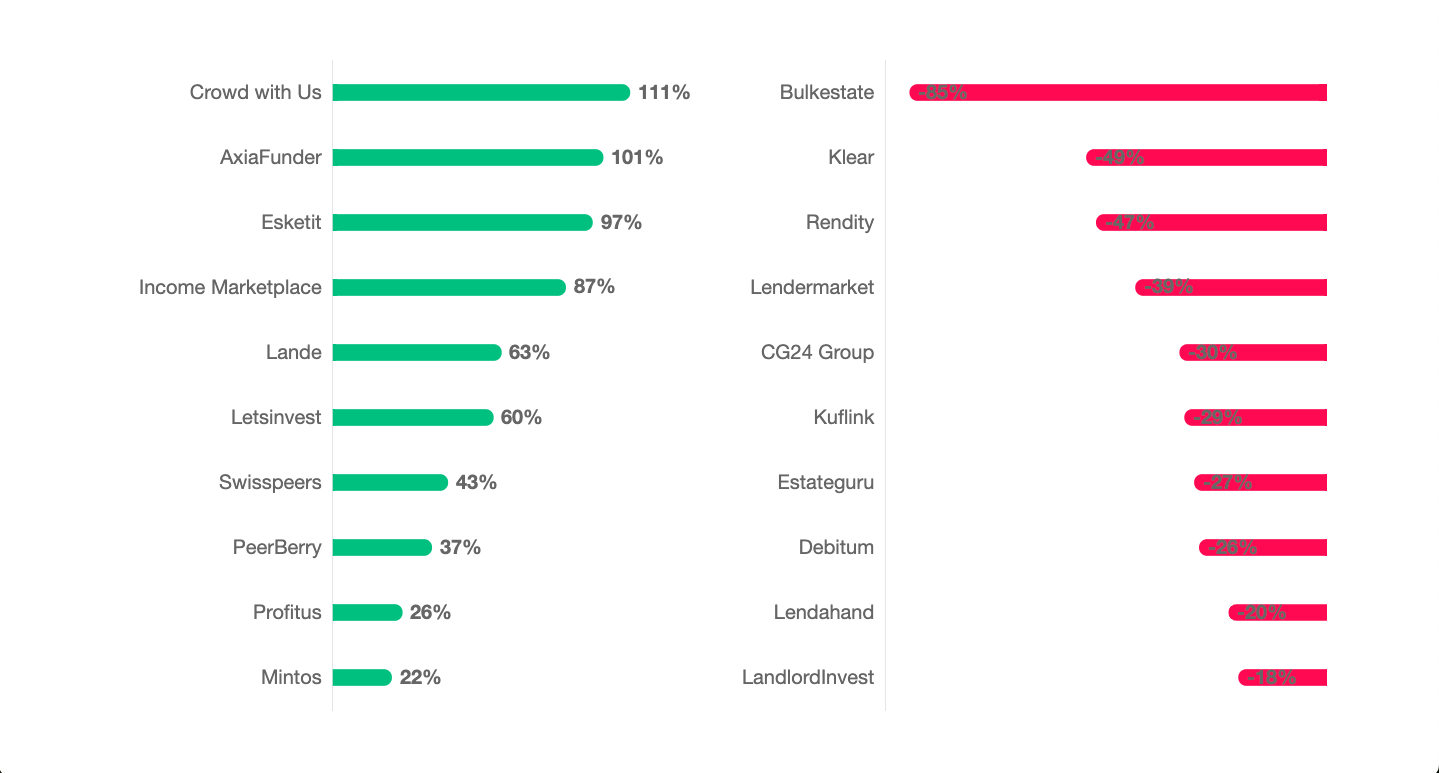

Crowd with Us – a direct marketplace lending platform from the United Kingdom, offering property investments, has been the fastest growing platform in the last year, followed by AxiaFunder and Esketit. The “rising stars” were most likely to be direct marketplace lending platforms (5 out of 10), come from the United Kingdom (2 out of 10), and offer consumer investments (4 out of 10).

Bulkestate, Klear, and Rendity have performed the worst compared to the previous year. Overall, the declining or slow-growing platforms were most likely to be direct marketplace lending platforms (8 out of 10), come from Estonia (2 out of 10), and offer property investments (7 out of 10).

*We only consider platforms with a total funding volume higher than €1 million.

Deep dive: Two largest EU resale platforms compared

Two years ago, Mintos was funding over three times PeerBerry’s amounts every month and was far beyond reach as the European debt investment leader. However, times have been tough ever since. Mintos accrued substantial losses during the turbulent 2020 and the early pandemic shock. Investor trust seems to have suffered – monthly funding volumes started dropping by the end of 2021 and kept decreasing for nine consecutive months to reach the bottom in July 2022. In late February and March 2022, the invasion of Ukraine and its impact on local loan originators added to the stress. In April 2022, we wrote about Opyn overtaking Mintos as the largest investment platform by monthly volumes.

A lot has happened at Mintos since, though. It got licensed by the FCMA of Latvia (now Latvian national bank Latvijas Banka). It restructured its investment product and introduced ‘Notes’ that each carry an International Securities Identification Number (ISIN), provided by Nasdaq CSD SE’s regional central securities depository. The investment performance based on their recovery estimates has according to Mintos improved, too – average net returns on Mintos went initially from 11.1% in 2019 down to 2.4% in 2020, but then rebounded to 6.5% and 7.8% in 2021 and 2022. Funding volumes started a slow and steady recovery, and in January this year, Mintos got back to pole position as the largest European debt investment operator.

Mintos’ somewhat turbulent story of recent years is curiously compared to the one of PeerBerry – the second-biggest and, business model-wise – a quite similar platform. PeerBerry has been noting much more moderate but stable increases in funding volumes, closing the gap with the – until recently, seemingly unreachable front-runner. The war in Ukraine did hit it disproportionally, putting approx. €50 million worth of loans in Ukraine and Russia at risk. However, the volume dip was smaller and shorter than one might have expected, as PeerBerry quickly announced a repayment scheme for the affected investments. As soon as April 2022, investments picked up again.

The marketplace sector remains dynamic and, at times, volatile. It also still lacks the attention and scrutiny we might be used to in traditional financial markets. That’s why we at P2PMarketData have started offering Verification of Returns to platforms willing to integrate their in-depth performance statistics, so a 3rd party can monitor and report on either monthly or live performance metrics. By tracking the platform funding volumes (and recording a host of other data about both platforms and individual investments), we keep market participants informed and aware. If you have any suggestions on how we can do it even better, drop us a line!