Funding Report for August 2022

What happened last month in the alternative investment markets? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last year? We look at numbers reported to P2PMarketData in August 2022 and dive deeper into this month’s focus: summer slowdown in Peer-to-Peer lending.

About the monthly report

In the monthly funding report, we publish the funding amounts of online crowdfunding platforms. We track data from 69 participating platforms, operating in 23 markets and 9 different currencies. Please note that:

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms' publicly available loan books and statistic pages.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

We've welcomed a new platform into our database this month – Scramble (a direct marketplace lending platform based in Estonia, which offers business loans). You can check out the whole dataset at p2pmarketdata.com, and explore even more alternative investment platforms using the Platform Search Tool.

Key highlights: What happened last month in crowdfunding?

A slowdown in the crowdfunding market continues as funding volumes have decreased for the 3rd consecutive month. We recorded a total funding volume of €339m in August 2022 – a decrease of 7% compared to July 2022 (down from €365m). The total monthly funding volume in August 2022 was lower by €120m compared to the same time in 2021 and reached its lowest level over the last year.

Looking at funding across the main investment categories, most funding in August 2022 went to platforms offering consumer investments (€196m), followed by property (€86m), and business investments (€51m). Consumer lending increased by 12%, while business and property lending decreased by 46%, and 3%, compared to July 2022.

Platforms’ performance: How did the key players do in August 2022?

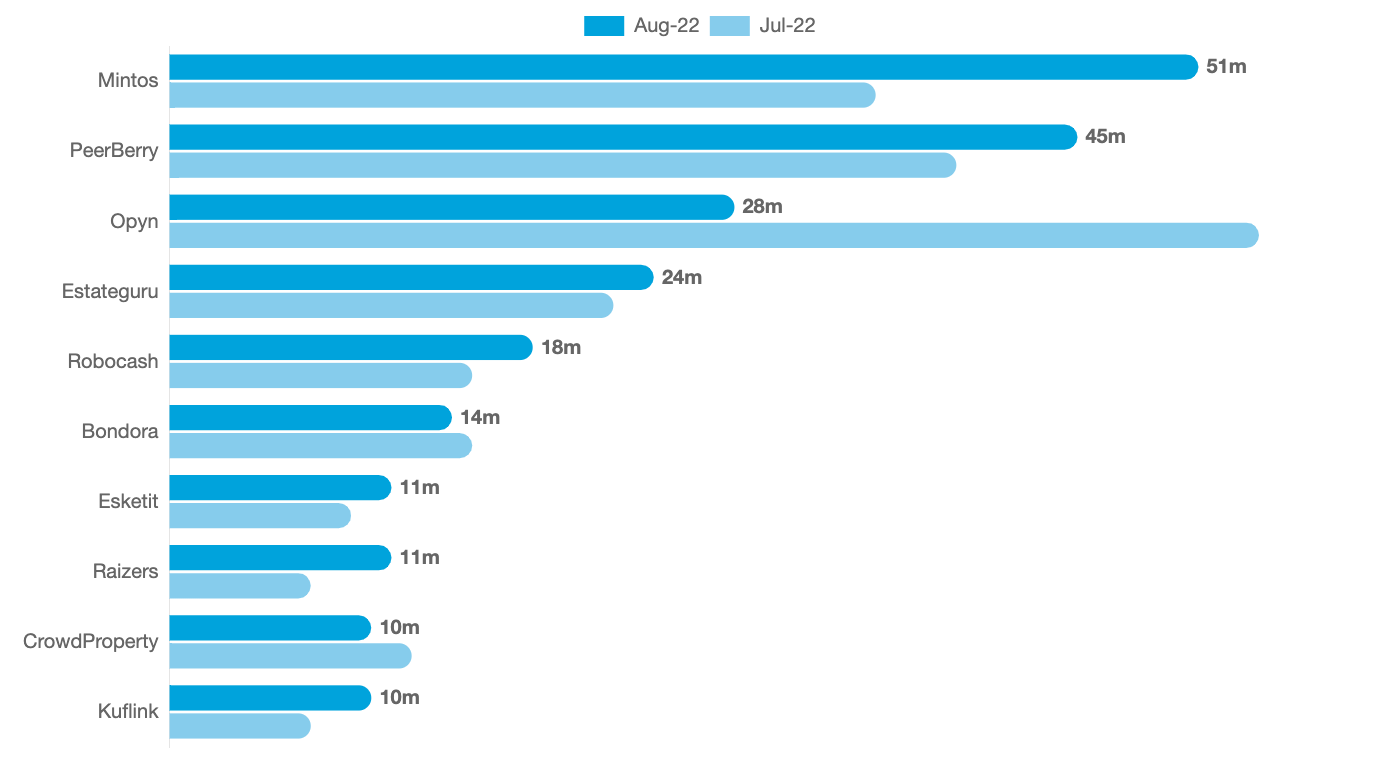

Mintos funded the most loans in August 2022, followed by PeerBerry and Opyn. Overall, the five largest platforms accounted for 49% of the total funding volume recorded in our database, while the ten largest platforms funded 65% of the total volume. The largest players were most likely to be direct marketplace lending platforms (6 out of 10) come from Croatia (2 out of 10) and offer consumer investments (5 out of 10).

Income Marketplace – a resale marketplace lending platform from Estonia, offering consumer investments, has been the fastest growing platform in the last year, followed by Esketit and Lender & Spender. The “rising stars” were most likely to be direct marketplace lending platforms (7 out of 10), come from the United Kingdom (3 out of 10) and offer consumer investments (4 out of 10).

Bulkestate, Ablrate and Mintos have performed the worst compared to the previous year. Overall, the declining or slow-growing platforms were most likely to be direct marketplace lending platforms (6 out of 10), come from Latvia (3 out of 10) and offer business investments (4 out of 10).

*We only take into account platforms with a total funding volume higher than €1 million.

Finally, we reported several noteworthy milestones reached last month:

- Opyn has reached over €1b of total funded loans to date.

- MyConstant has crossed the €200m total funding threshold.

- Lendahand has funded more than €100m worth of loans since its inception. Congrats!

Deep dive: Summer slowdown in P2P lending

Funding volumes have declined substantially since spring (from €477m in May to €339m in August). In this deep dive, we look at two angles of this slowdown: timing and sectoral differences.

First, seasonality is expected in the credit markets, and maybe even more so in P2P lending. Past years have generally shown declines, stagnation, or slowing growth in the summer months and strong rebounds in the fourth quarter. Bondora concluded in their analysis of June performance, “based on historic trends, the summer tends to be a time with fewer record-breaking moments and somewhat lower figures”.

This year is a bit different because funding volumes have decreased the whole year (seven out of eight months recorded declines), and the summer slump has been deeper than ever. Looking at the past four summers, only funding levels in August 2020 were lower than August 2022 – and that was the time of recovery after the Covid-induced retreat from P2P markets. This underperformance in 2022 can be attributed partly to the decline of Mintos, whose funding amount this month (€51m) was only roughly a quarter of its peak volume in October last year (€197m). However, even if we take Mintos out of the picture, the downward trend remains strong for the rest of the market.

Second, just as was the case last year (see the September 2021 report), the summer slowdown is driven mainly by declines in business lending. However, it's not all the same – last year, online SME business lending followed the general “summer lull” in business bank lending. This time, the European Central Bank noted an increasing demand for corporate loans in July, driven by working capital needs. Given the tightening credit standards in the banking system, this demand could be expected to trickle down to alternative finance options – but, so far, it hasn’t. At the same time, reports from both sides of the Atlantic emphasise the growing constraints on consumer credit (including mortgages), such as high uncertainty, less accommodative monetary policy, and slowing growth of house prices. In the US, some even warn about the shaky foundations of so-called "leveraged loans", which bring about unpleasant memories back from 2008. Again, against the general (this time unfavourable) trend in the broader economy, consumer and real estate P2P lending is doing all right – so far, at least.

We look forward to data flowing in from platforms in the fourth quarter of 2022 – will P2P lending bounce back by the end of the year as it tended to in the past?