The Monthly Funding Report February 2021

What happened last month in P2P finance and crowdfunding? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last 12 months? We take a look at numbers reported to P2PMarketData in February 2021 and dive deeper into this month’s special focus: platforms’ performance during the COVID downturn.

About the monthly report

In the Monthly Funding Report, we track the funding amounts of real estate crowdfunding, peer-to-peer & online marketplace lending platforms. Please note that:

- The report excludes some prominent platforms such as Lending Club, Funding Circle and Prosper. This is because Lending Club and Funding Circle have closed their P2P lending activities and remain open only for institutional and corporate investors, while Prosper only reports data quarterly.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms’ publicly available loan books and statistic pages.

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

We currently track data from 83 participating platforms, including originations operating in 26 markets and with 12 different currencies. In February 2021, we welcomed DoFinance to our database, which funded over €90,000 worth of loans just this month and more than €14 million since their launch in 2017. Fixura was removed from the report as they stopped providing publicly available historical funding volume statistics.

Key highlights: What happened in P2P finance last month?

We recorded a total funding volume of €527.5m in February 2021. This included:

- €339m funded in the main tracked currency – EUR;

- £139m (approx. €161) funded in GBP; and

- €27m financed in other currencies.

We also reported several noteworthy milestones reached last month:

- Swaper has funded over €200m since its launch;

- Raizers has broken above the €100m mark;

- Rendity has crossed the €50m total funding barrier; and

- The Swedish branch of Kameo has funded over 1 billion SEK worth of loans (more than €100 million).

In general, P2P finance and crowdfunding have continued a slow recovery from the sharp drop in spring 2020 (see Figure 1 below). Compared to the previous month, there has been a slight increase in total funding volume (up from €524m). Following the trend that we observed already in January, this increase has come predominantly from the UK (up from €155m to €161m) and other non-euro markets (up from €22m to €27m). The EUR market, on the other hand, has again declined (down from €347m).

Big player ranking

Table 1 below shows the 10 platforms that raised the most capital in February 2021. The top of the list has remained pretty much unchanged, with Mintos as an unchallenged leader, followed by the two leading UK platforms – Zopa and RateSetter. RoboCash joined the top 10 this month, pushing out Estate Guru.

It’s worth noting that even though the EUR market has been declining, 8 out of 10 top platforms still offer EUR-denominated investments.

Also, the 10 leading platforms account for as much as 75% of the total monthly volume we have recorded, while the top 5 account for over 60%. This suggests that despite the proliferation of P2P lending sites, the market remains relatively concentrated.

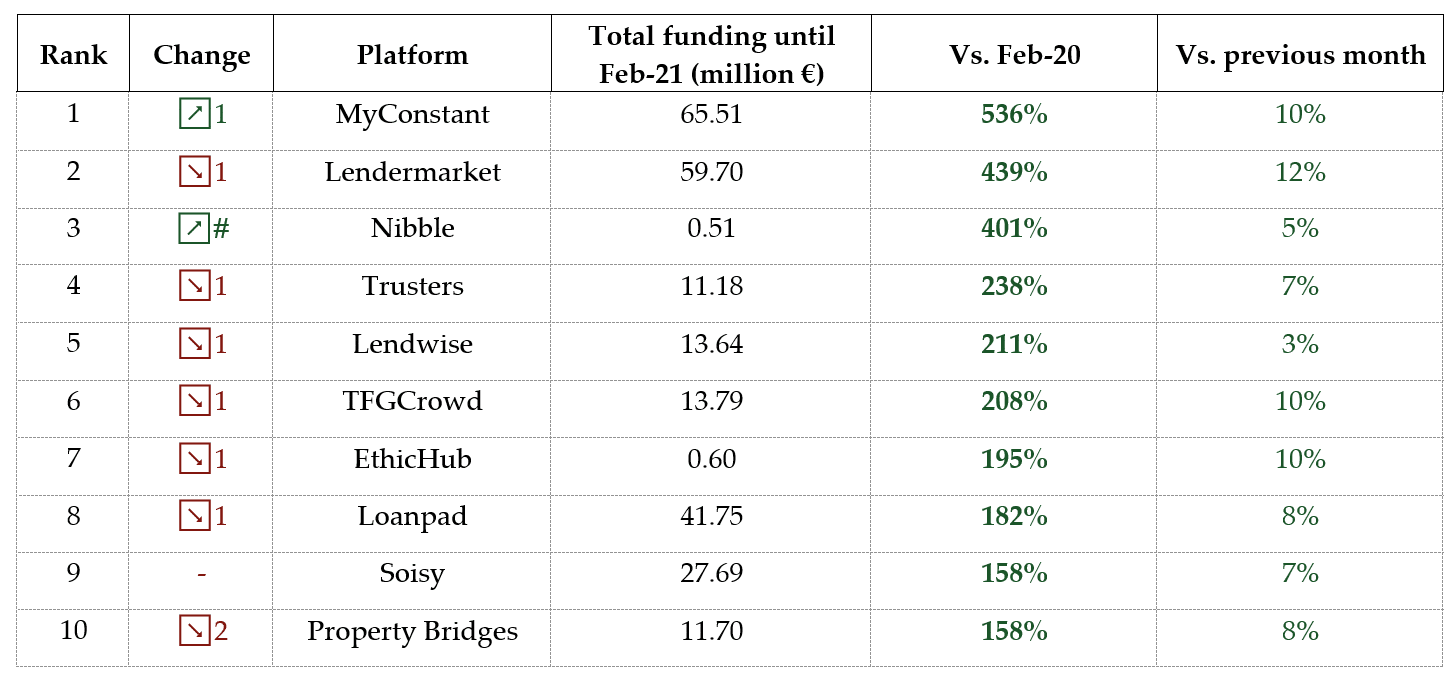

Rising star ranking

Table 2 shows 10 platforms that have grown the most over the past 12 months. MyConstant and Lendermarket remain the fastest-growing platforms. They have also managed to accumulate relatively large funding volumes – most of the platforms in this ranking tend to be just emerging start-ups. Nibble is one such new player – it ranked third this month, having been operating for 12 months – just enough to make it to the ranking.

Slow-mover ranking

Table 3 is the reverse of the rising star ranking as it gathers 10 platforms that have noted the slowest growth in the last year. There are three new platforms, compared to last month – DoFinance, Wisefund and Landlordinvest. Interestingly, although maybe unsurprisingly, the sluggish progress of all three seems to be down to serious troubles during the COVID crisis. DoFinance and Wisefund both faced more defaults than they were ready for and failed to honour their buyback guarantees, while Landlordinvest, although remained financially sound, was hit hard by the real estate market slump.

A deep dive: How have different platforms performed during COVID?

We’re now 12 months after the biggest downturn in the P2P lending history (see Figure 1 above). We know that the sector overall is recovering, albeit slowly. It’s also curious, though, to look at how particular platforms performed. The variances are quite significant, and we can never be sure about causality (there might be a myriad of reasons why some platforms thrive and others decline) but nevertheless, here are some hypotheses based on our data:

Big and well-established platforms fared better. Roughly half of all platforms funded a higher volume of loans this month than in February 2020, and the other half’s volumes declined. However, as many as 9 out of the 10 largest sites funded more loans than in February 2020 (see Table 1 above). Investors might simply have more trust in the big guys.

Platforms with low-risk, low-return investments noted some of the largest increases in funding year-over-year. Bergfuerst, Debitum Network, Fellow Finance, October, Raizers and Rendity are among the best performers, and all offer returns below 10% and relatively high investment protection and/or rigorous project selection. This makes sense – in times of uncertainty, capital typically shifts to safer assets.

Platforms that withdrew their investor protection schemes were hurt the most. DoFinance and Wisefund stand out in this month’s report – both sprung up the slow-mover ranking. They had a particularly hard time around the mid-2020 and had to withdraw their buyback guarantees. DoFinance even temporarily stopped accepting new clients and investments between May and November. As a consequence, investors swiftly pulled back from these platforms. DoFinance might be coming back, though – over €90,000 was invested on the platform in February – more than in the previous 9 months combined.

P2PMarketData is the world's largest discovery tool of online alternative investment websites. Discover alternative investment from all over the world in the Alternative Investment Search Tool.