How To Lend Your Crypto on Binance

When it comes to crypto lending, we’ve mentioned that the platforms fall into either the DeFi or CeFi categories. DeFi means decentralized finance, while CeFi means centralized (conventional, company-led) financial operations. Both are full of opportunities to lend at a profit, and I am going to discuss a CeFi opportunity with Binance today.

CeFi is like all the Euro-based p2p lending platforms you are used to and BlockFi in crypto, which we’ve reviewed here. With CeFi, the companies can help you when you are the lender, but they can also fail to help you when you want their help too.

What Are Bitcoin Exchanges?

Bitcoin exchanges are places where you can exchange Dollars, Euros, or Pounds for Bitcoin or other cryptocurrencies. Many are sophisticated and use great technology to make depositing fiat currency to buy crypto easily.

When you want to buy crypto so you can lend it, whether it’s through a DeFi app or a place like BlockFi, then you usually buy your crypto at an exchange.

When it comes to Bitcoin exchanges, the biggest one in the world by trading volume is Binance. Like other areas of finance, crypto benefits from scale, meaning there’s a good chance that larger exchanges like Binance or Coinbase are safer to use and have better pricing than smaller exchanges.

To give you a better idea of how big Binance is compared to a typical Euro p2p lending platform, the total lifetime loan volume of Mintos is currently 6.8 billion Euros making them the #1 platform by volume in Europe. In Bitcoin alone, and not the other 50 coins they support, Binance users traded $3.8 billion USD worth just in the last 24 hours.

The investment opportunity presented in this article is crypto lending on Binance. As a lender on Binance, you have a big company backing your loan and protecting your investment. It’s in their interest to protect your interest.

If Binance is so big and has so much trading volume, then why do they need your money, and what do they do with it?

Trading on Margin: The Lending Opportunity

Cryptocurrency attracts many aggressive traders due to how fast the prices can move. In these headers on top of the Binance screen, you can see there are ways to trade or use derivatives. And you can see from the wallet options down the left side in the screenshot below that there are many choices on the platform, including P2P trading, options, futures, margin, and pooling.

We are interested in Earn because we will lend our crypto to earn money – with the help of Binance.

In the trading world, margin means collateral on deposit at the exchange, so you can borrow to trade more. For example, with 5x leverage, someone can put down $10,000 and trade $50,000 worth in their account. The $10,000 is called margin. Futures traders, short traders (those who bet the market will fall), and some options traders need to borrow on margin so they can trade with leverage.

Let’s use Bitcoin as an example. With 5x leverage, someone can put down 0.2 BTC to trade 1 whole BTC. So, where does the other .8 BTC come from that enables them to trade with this leverage?

Us. It comes from us, and we get paid interest daily for the use of our crypto. We lend into a big liquidity pool that Binance uses to lend and monitor its borrowers for Margin trading.

The video below shows exactly where you find the Earn section of the website. It’s under the Finance header. Don’t adjust your volume, and your computer isn’t having issues. There’s no sound.

As you see in the video there are many different areas to visit on the Binance Earn page. Let’s start with Fixed Terms.

Fixed Terms on Binance Earn

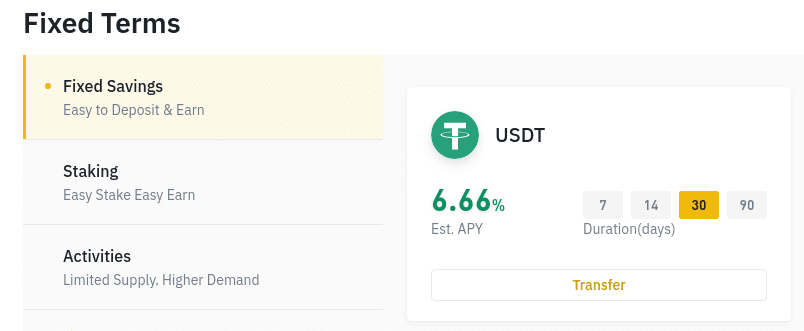

In Fixed Terms, the first thing you see is an APY interest rate for the two stablecoins in the video of USDT and BUSD. The 6.31% is annual but you see it’s for a 7-day duration. When we clicked on 14 and 30 days in the video, we saw the rates change to 6.48% and 6.66%, respectively. When Binance knows they have your coins to lend out for longer periods, it’s better for them, so they pay you more. Binance also offers staking and other options that are a little too complex for us at this point. Staking is a different investment option with different risks and rewards than lending.

Many of the other options on this page are beyond the scope of this article but let’s look at Flexible Terms now.

Flexible Terms on Binance Earn

In the Flexible Terms section, you see APY (Annual Percentage Yield) of 1.2% for BTC and 5.06% and 5.80% for the two stablecoins BUSD and USDT, more commonly known as Tether.

Binance is acting as the bank here. They are lending your .80 BTC out and paying you 1.2% annually. They are charging the borrower more than 1.2% and earning the spread for themselves. It’s exactly like a bank’s paying 1% interest on deposits and lending out at 4% to a borrower. Banks call that Net Interest Margin, and it’s the primary way they make money.

And this is good. Binance makes money, and we make money, so they protect our investment. When a trade goes against the trader like a coin rising against a short position, Binance liquidates automatically and returns your collateral to you to lend again. They manage this for you, so you don’t have to.

Just like a bank, Binance Earn is paying you to use your coins.

How to Lend on Binance

So now, what steps do we have to go through to make the loan from Binance Earn? Here are the mechanics of it.

Binance works through its many wallets, as we saw above. First, you put money into the Fiat & Spot Wallet by either depositing cash or crypto. Internal transfers from one wallet to another on Binance are free.

Lending Example #1

Under Fixed Terms, you see the Fixed Savings where it says Easy to Deposit and Earn.

So for 30 days, I can lend USDT for 6.66% – you start lending by clicking transfer. This is what we see next.

This is the screen you complete, and when you click on Transfer Confirmed, you are lending your USDT for 30 days, where you earn .5472 USDT per lot of 100 USDT.

Lending Example #2

Now we look at Flexible Terms. With flexible terms, you can lend without being locked in for too long. Using Tether (USDT) again, you can see that you can earn 5.83% annually by lending it out.

When we click on Transfer for USDT, this is what we get.

You see that for 7 days you earn .1589 USDT per $1000 USDT that you lend to get the 5.82% interest. Click Transfer Confirmed and you are off and running.

Between fixed and flexible options, you can lend for just a week or up to 3 months with the ability to reassess at any time. And to review, the idea of earning interest on Binance that is comparable or more than Euro p2p platforms is attractive for you for many reasons, including:

- Not limited to Euro only borrowers

- Not limited to collecting payment only in Euros

- Not subject to regional economic issues in Europe

- Limited or no verification requirements for those that value their privacy

- You are lending a different asset than government-issued currencies. You are working with digital assets.

- No selection of borrowers necessary. You lend into a pool, and Binance determines who borrows from it.

For any or all of these options, you are lending crypto with the help and support of a huge platform like Binance. Lending to help Binance in their margin operations can potentially increase your returns and lower your risks at the same time for your overall p2p lending portfolio.

Conclusion

Binance is one of the world’s biggest exchanges for exchanging fiat money for cryptocurrency. Besides exchanging, Binance and other exchanges encourage active trading and provide other services like Lending. It’s a great opportunity to use the strength of the exchange to lend and make money.

With Binance Earn, using your coin for active traders and protecting your investment allows you to deposit crypto just like at a bank and get paid in crypto by one of the biggest crypto exchanges in the world.