Funding Report for November 2022

What happened last month in the alternative investment markets? Which platforms are on the rise, and which ones are falling behind? How has the sector performed over the last year? We look at numbers reported to P2PMarketData in November 2022 and dive deeper into this month’s focus: A first peek into alternative investment projects.

About the monthly report

In the monthly alternative investment report, we publish the funding amounts of online alternative investment platforms, and now also deeper insights into the investment deals. We track data from 36 participating platforms, operating in 15 markets and 4 different currencies. Please note that:

- We convert all amounts to EUR for comparison reasons, using exchange rates from the last day of the month.

- None of the numbers cited is an estimation – the amounts are reported directly to us or pulled from the platforms' publicly available loan books and statistic pages.

- Historical funding volumes reported below may divert slightly from volumes calculated in previous reports due to exchange rate fluctuations and the changes in the pool of platforms we track.

You can check out the whole dataset at p2pmarketdata.com, and explore alternative investment deals using the Investment Search Tool. The number of partnering platforms participating in the monthly reports has recently decreased due to our new policies to ensure the data-sharing process is automated and follows high transparency standards, eventually leading to accurate and validated data.

Key highlights: What happened last month in alternative investing?

A small increase in the alternative investment market continues as funding volumes have increased for the third month. We recorded a total funding volume of €332m in November 2022 – an increase of 5% compared to October 2022 (up from €315m). The total monthly funding volume in November 2022 was lower by €75m compared to the same time in 2021.

Looking at funding across the main investment categories, most funding in November 2022 went to platforms offering consumer investments (€187m), followed by business (€82m), and property investments (€63m). Consumer lending, business lending, and property lending increased by 6%, 9%, and 1% compared to October 2022.

Platforms’ performance: How did the key players do in November 2022?

Opyn funded the most loans in November 2022, followed by Mintos and PeerBerry. Overall, the five largest platforms accounted for 73% of the total funding volume recorded in our database, while the ten largest platforms funded 87% of the total volume. The largest players were most likely to be resale marketplace lending platforms (7 out of 10), come from Croatia (2 out of 10), and offer consumer investments (7 out of 10).

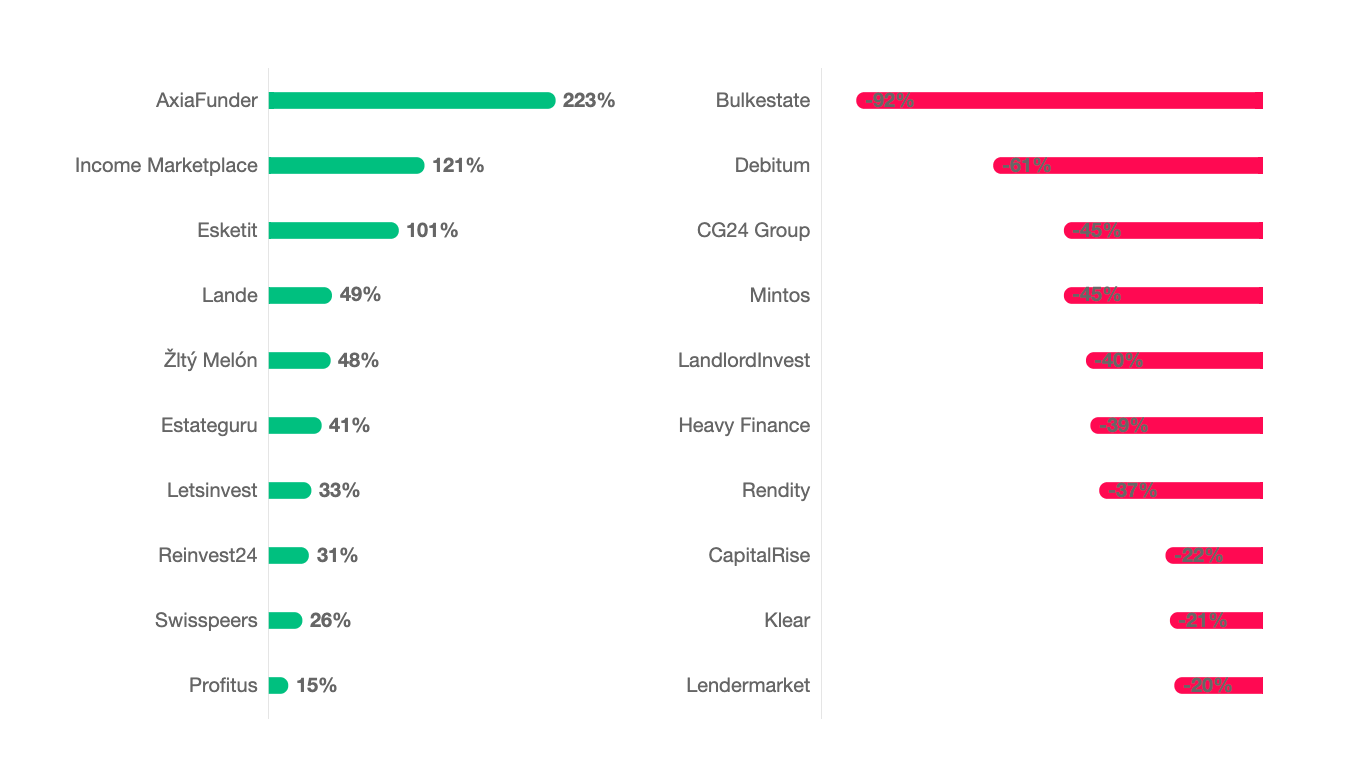

AxiaFunder – the litigation financing platform from the UK, has been the fastest-growing platform in the last year, followed by Income Marketplace and Esketit. The “rising stars” were most likely to be direct marketplace lending platforms (7 out of 10), come from Estonia (3 out of 10), and offer property investments (4 out of 10).

Bulkestate, Debitum, and CG24 Group have performed the worst compared to the previous year. Overall, the declining or slow-growing platforms were most likely to be direct marketplace lending platforms (7 out of 10), come from Latvia (2 out of 10), and offer property investments (5 out of 10).

*We only consider platforms with a total funding volume higher than €1 million.

Finally, we reported several noteworthy milestones reached last month:

- Letsinvest has funded more than €10m worth of loans since its inception.

- Estateguru has reached over €700m of total funded loans to date. Congrats!

Deep dive: A first peek into alternative investment projects

We have recently launched the Investment Search Tool, where you can browse funded, open, and upcoming investment deals in the alternative investment space. This month, we look closer at what deals have been available for investors.

You can browse through hundreds of deals open for investment, coming from eleven European platforms and ranging from real estate to resale lending to agricultural investments. You can filter the deals based on projected return, sector, country, and more. Once you find something interesting, you can overview the key summary information about each project at P2PMarketData and go directly to the platform’s project page for more details.

Besides open investments, we also store historical data about more than 7,000 funded deals worth over €1.2 billion. They include investments from nine European platforms (excluding two loan originator platforms, which fund LOs on a rolling basis) and 16 different countries. As we build the portfolio of platforms and projects, a more comprehensive and robust analysis will be possible to really grasp the state of the market and help investors make informed decisions. However, we can already share some first insights.

First, there’s a steady and increasing inflow of new deals every month. Generally, you can expect between 200 and 350 individual projects funded monthly, worth between €30 and €45 million. Additionally, there are 72 loan originators accessible through Mintos or Income Marketplace, which are open for finance on a rolling basis.

Second, although data for some categories still isn’t fully representative, we can already see interesting risk profiling of different investment segments. Agricultural and commercial real estate investments are at the higher risk/return end, while personal, residential real estate and business projects offer more moderate projected returns. In terms of project duration, unsurprisingly, invoice financing exhibits by far the shortest maturities.

P2PMarketData features the largest Alternative Investment Platform Inventory. As more platforms join to share their live data on investment deals with us, we will be able to offer more comprehensive resources to guide you through the alternative investment scene. Stay tuned for more market analyses and the P2PMarketData’s 2023 State-of-the-Market Report, coming soon!